Where Hudson Pacific Properties Stands With Analysts

Author: Benzinga Insights | October 13, 2025 06:00pm

Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Hudson Pacific Properties (NYSE:HPP) in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

2 |

2 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

1 |

1 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

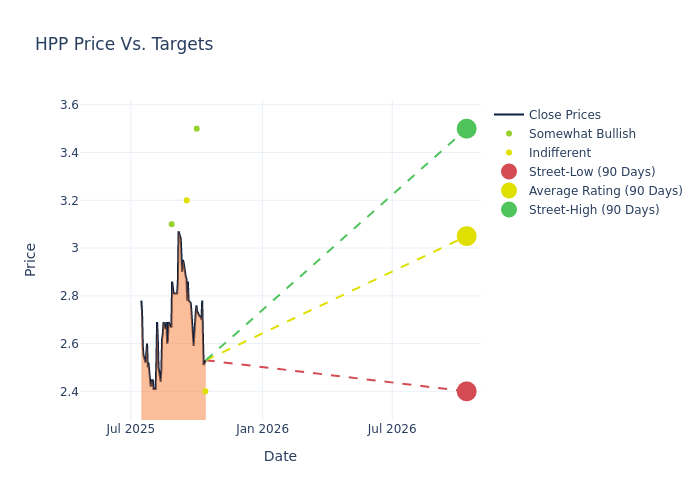

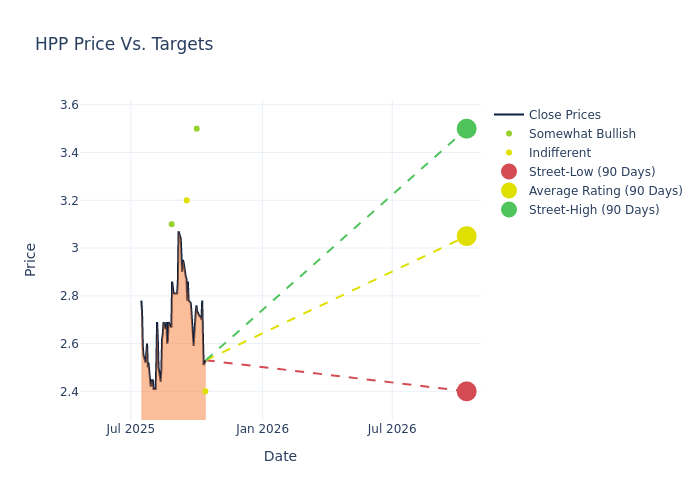

Insights from analysts' 12-month price targets are revealed, presenting an average target of $3.05, a high estimate of $3.50, and a low estimate of $2.40. This current average has increased by 5.17% from the previous average price target of $2.90.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Hudson Pacific Properties. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Joe Dickstein |

Jefferies |

Lowers |

Hold |

$2.40 |

$2.50 |

| Richard Anderson |

Cantor Fitzgerald |

Announces |

Overweight |

$3.50 |

- |

| Caitlin Burrows |

Goldman Sachs |

Raises |

Neutral |

$3.20 |

$2.80 |

| Blaine Heck |

Wells Fargo |

Lowers |

Overweight |

$3.10 |

$3.40 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Hudson Pacific Properties. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Hudson Pacific Properties compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Hudson Pacific Properties's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of Hudson Pacific Properties's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Hudson Pacific Properties analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Hudson Pacific Properties

Hudson Pacific Properties Inc is a real estate investment trust that acquires, operates, and owns office buildings and media and entertainment properties, such as sound stages, on America's West Coast. The company focuses on developed, urban markets in Northern California, Southern California, and the Pacific Northwest. In terms of total square footage, the vast majority of Hudson Pacific's real estate portfolio is composed of office properties located in the Greater Seattle, San Francisco, and Los Angeles areas. The company operates in two reportable segments; office properties & related operations; and studio properties & related operations. The majority of revenue is derived from the office properties & related operations segment.

Hudson Pacific Properties: Delving into Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Hudson Pacific Properties's revenue growth over a period of 3M has faced challenges. As of 30 June, 2025, the company experienced a revenue decline of approximately -12.84%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: Hudson Pacific Properties's net margin is impressive, surpassing industry averages. With a net margin of -43.76%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Hudson Pacific Properties's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -3.14%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Hudson Pacific Properties's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of -1.03%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 1.4, Hudson Pacific Properties adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: HPP