What Analysts Are Saying About California Resources Stock

Author: Benzinga Insights | August 20, 2025 02:01pm

In the last three months, 8 analysts have published ratings on California Resources (NYSE:CRC), offering a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

4 |

1 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

1 |

1 |

0 |

0 |

0 |

| 2M Ago |

1 |

2 |

1 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

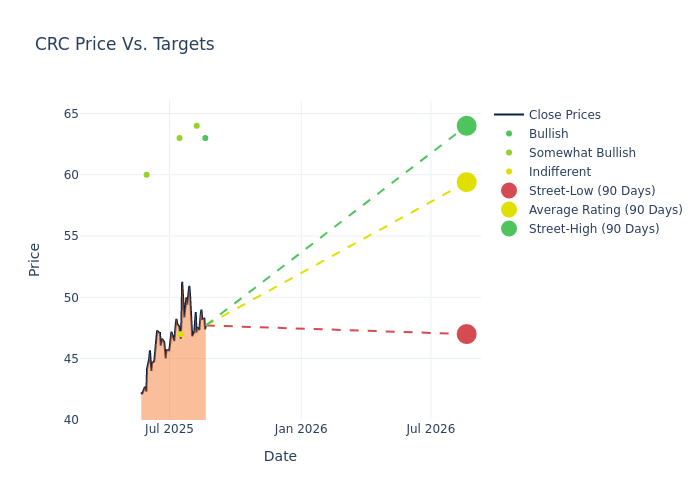

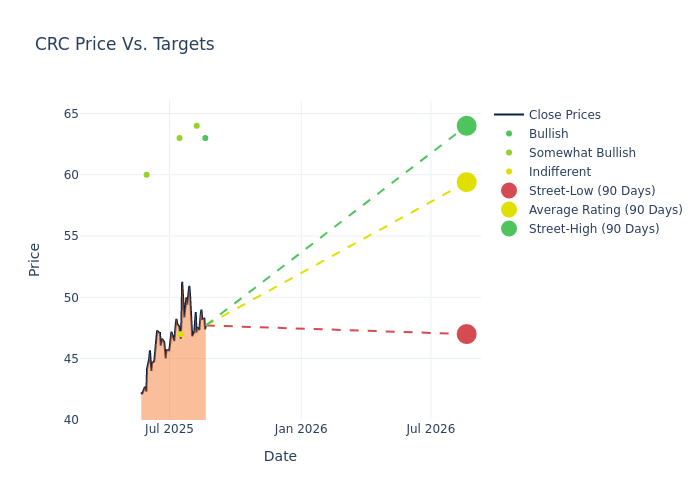

The 12-month price targets, analyzed by analysts, offer insights with an average target of $59.62, a high estimate of $64.00, and a low estimate of $47.00. Observing a 7.19% increase, the current average has risen from the previous average price target of $55.62.

Analyzing Analyst Ratings: A Detailed Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive California Resources. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Josh Silverstein |

UBS |

Raises |

Buy |

$63.00 |

$61.00 |

| Josh Silverstein |

UBS |

Raises |

Buy |

$61.00 |

$58.00 |

| Nitin Kumar |

Mizuho |

Raises |

Outperform |

$64.00 |

$61.00 |

| Scott Gruber |

Citigroup |

Raises |

Neutral |

$47.00 |

$44.00 |

| Zach Parham |

JP Morgan |

Raises |

Overweight |

$63.00 |

$60.00 |

| Nitin Kumar |

Mizuho |

Raises |

Outperform |

$61.00 |

$60.00 |

| Josh Silverstein |

UBS |

Raises |

Buy |

$58.00 |

$51.00 |

| Betty Jiang |

Barclays |

Raises |

Overweight |

$60.00 |

$50.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to California Resources. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of California Resources compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for California Resources's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into California Resources's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on California Resources analyst ratings.

About California Resources

California Resources Corp is an independent oil and natural gas exploration and production company operating properties exclusively within California. It provides affordable and reliable energy in a safe and responsible manner, to support and enhance the quality of life of Californians and the local communities in which the company operates. It has some of the lowest carbon intensity production in the United States and is focused on maximizing the value of its land, mineral, and technical resources for decarbonization by developing carbon capture and storage (CCS) and other emissions-reducing projects.

California Resources's Economic Impact: An Analysis

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: California Resources displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 63.53%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 21.08%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.97%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.54%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.32, California Resources adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CRC