Analyst Expectations For Host Hotels & Resorts's Future

Author: Benzinga Insights | September 22, 2025 02:01pm

In the preceding three months, 6 analysts have released ratings for Host Hotels & Resorts (NASDAQ:HST), presenting a wide array of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

3 |

2 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

1 |

1 |

0 |

0 |

| 2M Ago |

1 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

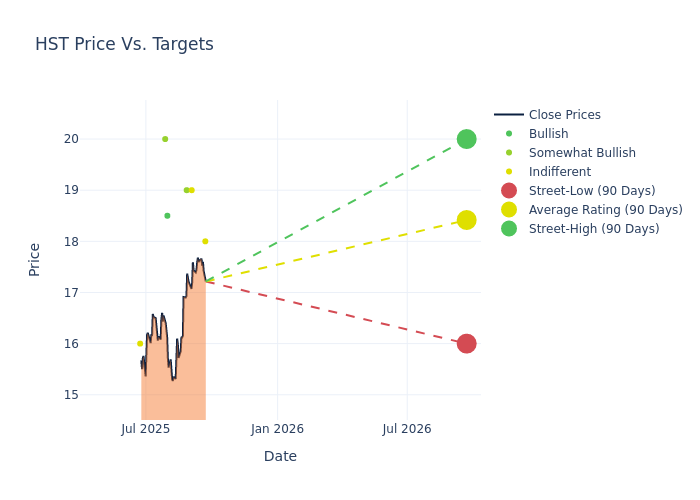

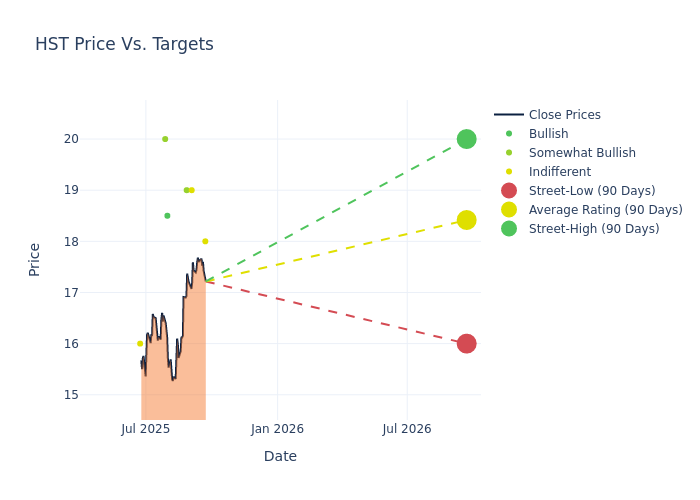

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $18.75, a high estimate of $20.00, and a low estimate of $18.00. Surpassing the previous average price target of $17.33, the current average has increased by 8.19%.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Host Hotels & Resorts. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Robin Farley |

UBS |

Raises |

Neutral |

$18.00 |

$17.00 |

| Patrick Scholes |

Truist Securities |

Raises |

Hold |

$19.00 |

$17.00 |

| James Feldman |

Wells Fargo |

Raises |

Overweight |

$19.00 |

$18.00 |

| Simon Yarmak |

Stifel |

Raises |

Buy |

$18.50 |

$17.00 |

| Duane Pfennigwerth |

Evercore ISI Group |

Raises |

Outperform |

$20.00 |

$19.00 |

| James Feldman |

Wells Fargo |

Raises |

Overweight |

$18.00 |

$16.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Host Hotels & Resorts. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Host Hotels & Resorts compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Host Hotels & Resorts's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Host Hotels & Resorts's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Host Hotels & Resorts analyst ratings.

All You Need to Know About Host Hotels & Resorts

Host Hotels & Resorts owns 81 predominantly urban and resort upper-upscale and luxury hotel properties representing over 43,000 rooms, mainly in the United States. Host recently sold off the company's interests in a joint venture owning a portfolio of hotels throughout Europe and also sold other joint ventures that owned properties in Asia and the United States. The majority of Host's portfolio operates under the Marriott and Starwood brands.

Host Hotels & Resorts's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Over the 3M period, Host Hotels & Resorts showcased positive performance, achieving a revenue growth rate of 8.19% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Host Hotels & Resorts's net margin is impressive, surpassing industry averages. With a net margin of 13.93%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Host Hotels & Resorts's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.33% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Host Hotels & Resorts's ROA stands out, surpassing industry averages. With an impressive ROA of 1.71%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Host Hotels & Resorts's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.85.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: HST