RPM International Earnings Preview

Author: Benzinga Insights | September 30, 2025 10:00am

RPM International (NYSE:RPM) will release its quarterly earnings report on Wednesday, 2025-10-01. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate RPM International to report an earnings per share (EPS) of $1.88.

RPM International bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

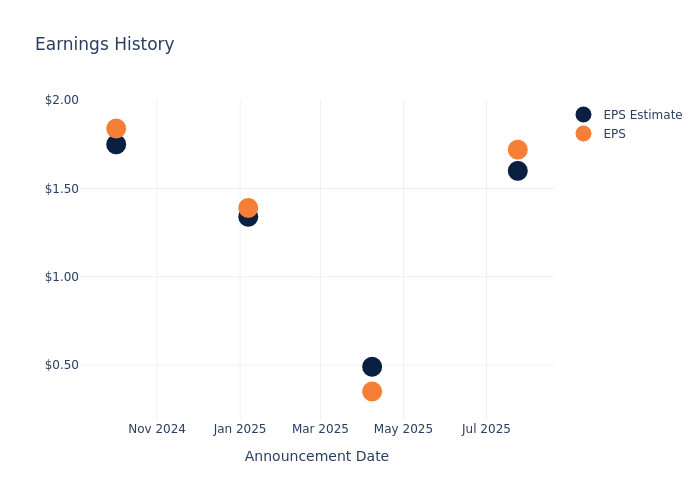

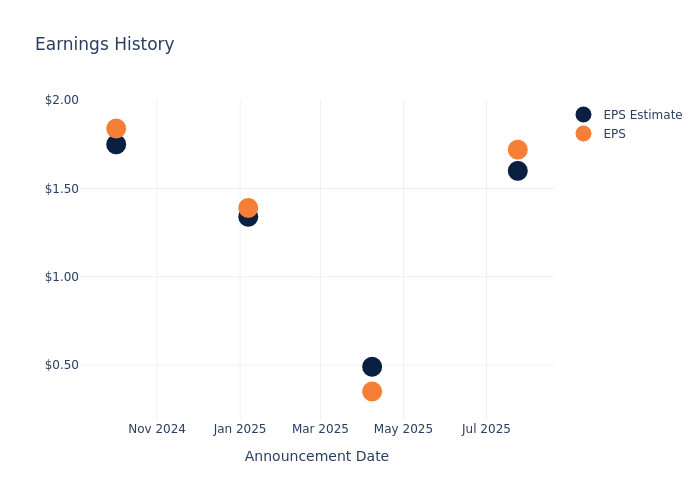

Past Earnings Performance

The company's EPS beat by $0.12 in the last quarter, leading to a 0.11% increase in the share price on the following day.

Here's a look at RPM International's past performance and the resulting price change:

| Quarter |

Q4 2025 |

Q3 2025 |

Q2 2025 |

Q1 2025 |

| EPS Estimate |

1.60 |

0.49 |

1.34 |

1.75 |

| EPS Actual |

1.72 |

0.35 |

1.39 |

1.84 |

| Price Change % |

0.00% |

9.00% |

1.00% |

-0.00% |

Tracking RPM International's Stock Performance

Shares of RPM International were trading at $117.03 as of September 29. Over the last 52-week period, shares are down 8.43%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Insights on RPM International

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding RPM International.

A total of 8 analyst ratings have been received for RPM International, with the consensus rating being Neutral. The average one-year price target stands at $132.5, suggesting a potential 13.22% upside.

Analyzing Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Intl Flavors & Fragrances, Albemarle and Eastman Chemical, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Intl Flavors & Fragrances, with an average 1-year price target of $87.4, suggesting a potential 25.32% downside.

- Analysts currently favor an Neutral trajectory for Albemarle, with an average 1-year price target of $71.8, suggesting a potential 38.65% downside.

- Analysts currently favor an Outperform trajectory for Eastman Chemical, with an average 1-year price target of $78.89, suggesting a potential 32.59% downside.

Snapshot: Peer Analysis

Within the peer analysis summary, vital metrics for Intl Flavors & Fragrances, Albemarle and Eastman Chemical are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| RPM International |

Neutral |

3.68% |

$881.77M |

8.09% |

| Intl Flavors & Fragrances |

Outperform |

-4.33% |

$1.03B |

4.44% |

| Albemarle |

Neutral |

-7.02% |

$196.88M |

-0.24% |

| Eastman Chemical |

Outperform |

-3.22% |

$506M |

2.39% |

Key Takeaway:

RPM International ranks in the middle among its peers for revenue growth, with a positive growth rate. It ranks at the top for gross profit, indicating strong profitability. However, its return on equity is below average compared to its peers.

Discovering RPM International: A Closer Look

RPM International Inc manufactures and sells a variety of paints, coatings, and adhesives. The firm organizes itself into four segments based on product type. The construction products group sells coatings, roofing, insulation, and other products to distributors, contractors, and end consumers globally. The performance coatings group produces coatings that are used in construction and industrial applications like floorings and corrosion control. The consumer group sells paint, finishes, and similar products to individual consumers through hardware and craft stores. The specialty products group sells a line of products ranging from niche applications of the other groups to marine finishes, to edible food colorings. The majority of revenue is from the construction products and North America.

Unraveling the Financial Story of RPM International

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Over the 3 months period, RPM International showcased positive performance, achieving a revenue growth rate of 3.68% as of 31 May, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Materials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: RPM International's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.8% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): RPM International's ROE stands out, surpassing industry averages. With an impressive ROE of 8.09%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): RPM International's ROA stands out, surpassing industry averages. With an impressive ROA of 3.12%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: RPM International's debt-to-equity ratio is below the industry average at 1.03, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for RPM International visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: RPM