Insights into BrainsWay's Upcoming Earnings

Author: Benzinga Insights | November 10, 2025 10:03am

BrainsWay (NASDAQ:BWAY) is gearing up to announce its quarterly earnings on Tuesday, 2025-11-11. Here's a quick overview of what investors should know before the release.

Analysts are estimating that BrainsWay will report an earnings per share (EPS) of $0.07.

Investors in BrainsWay are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Performance in Previous Earnings

In the previous earnings release, the company missed EPS by $0.00, leading to a 1.02% increase in the share price the following trading session.

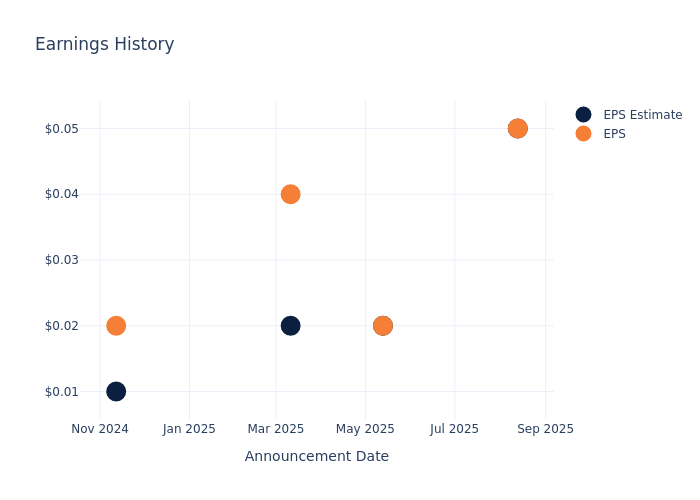

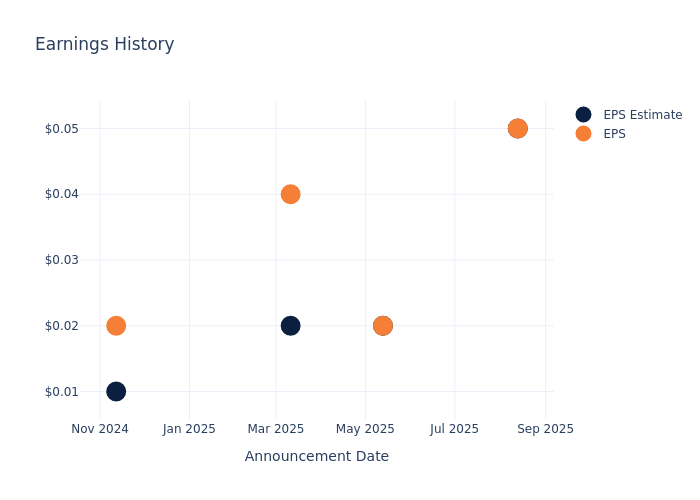

Here's a look at BrainsWay's past performance and the resulting price change:

| Quarter |

Q2 2025 |

Q1 2025 |

Q4 2024 |

Q3 2024 |

| EPS Estimate |

0.05 |

0.02 |

0.02 |

0.01 |

| EPS Actual |

0.05 |

0.02 |

0.04 |

0.02 |

| Price Change % |

1.00 |

5.00 |

7.00 |

-7.00 |

BrainsWay Share Price Analysis

Shares of BrainsWay were trading at $15.59 as of November 07. Over the last 52-week period, shares are up 67.99%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on BrainsWay

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding BrainsWay.

The consensus rating for BrainsWay is Buy, derived from 3 analyst ratings. An average one-year price target of $17.67 implies a potential 13.34% upside.

Peer Ratings Overview

The below comparison of the analyst ratings and average 1-year price targets of Sight Sciences, Delcath Systems and Treace Medical Concepts, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Sight Sciences, with an average 1-year price target of $5.12, suggesting a potential 67.16% downside.

- Analysts currently favor an Buy trajectory for Delcath Systems, with an average 1-year price target of $23.0, suggesting a potential 47.53% upside.

- Analysts currently favor an Neutral trajectory for Treace Medical Concepts, with an average 1-year price target of $6.46, suggesting a potential 58.56% downside.

Insights: Peer Analysis

The peer analysis summary presents essential metrics for Sight Sciences, Delcath Systems and Treace Medical Concepts, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| BrainsWay |

Buy |

26.26% |

$9.50M |

3.07% |

| Sight Sciences |

Neutral |

-8.45% |

$16.59M |

-16.18% |

| Delcath Systems |

Buy |

83.60% |

$17.94M |

0.76% |

| Treace Medical Concepts |

Neutral |

11.37% |

$39.71M |

-17.44% |

Key Takeaway:

In terms of consensus rating, BrainsWay is rated as 'Buy', which is positive. BrainsWay's revenue growth is at 26.26%, placing it at the top among peers. The company's gross profit of $9.50M is lower than some peers. However, BrainsWay's return on equity of 3.07% is higher than some peers, indicating a moderate performance overall.

Unveiling the Story Behind BrainsWay

BrainsWay Ltd is engaged in advanced noninvasive neurostimulation treatments for mental health disorders. The company is advancing neuroscience with its proprietary Deep Transcranial Magnetic Stimulation (Deep TMS) platform technology to improve health and transform lives. Current indications include depressive disorder (including reduction of anxiety symptoms, commonly referred to as anxious depression), obsessive-compulsive disorder, and smoking addiction. Additional clinical trials of Deep TMS in various psychiatric, neurological, and addiction disorders are underway. The company derives revenues from the lease and sale of Deep TMS systems.

Key Indicators: BrainsWay's Financial Health

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining BrainsWay's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 26.26% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: BrainsWay's net margin excels beyond industry benchmarks, reaching 16.05%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): BrainsWay's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.07%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): BrainsWay's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.91% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: BrainsWay's debt-to-equity ratio is below the industry average at 0.09, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for BrainsWay visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BWAY