Decoding Citigroup's Options Activity: What's the Big Picture?

Author: Benzinga Insights | November 13, 2025 02:01pm

Deep-pocketed investors have adopted a bearish approach towards Citigroup (NYSE:C), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in C usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 27 extraordinary options activities for Citigroup. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 22% leaning bullish and 59% bearish. Among these notable options, 6 are puts, totaling $467,924, and 21 are calls, amounting to $4,343,756.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $130.0 for Citigroup during the past quarter.

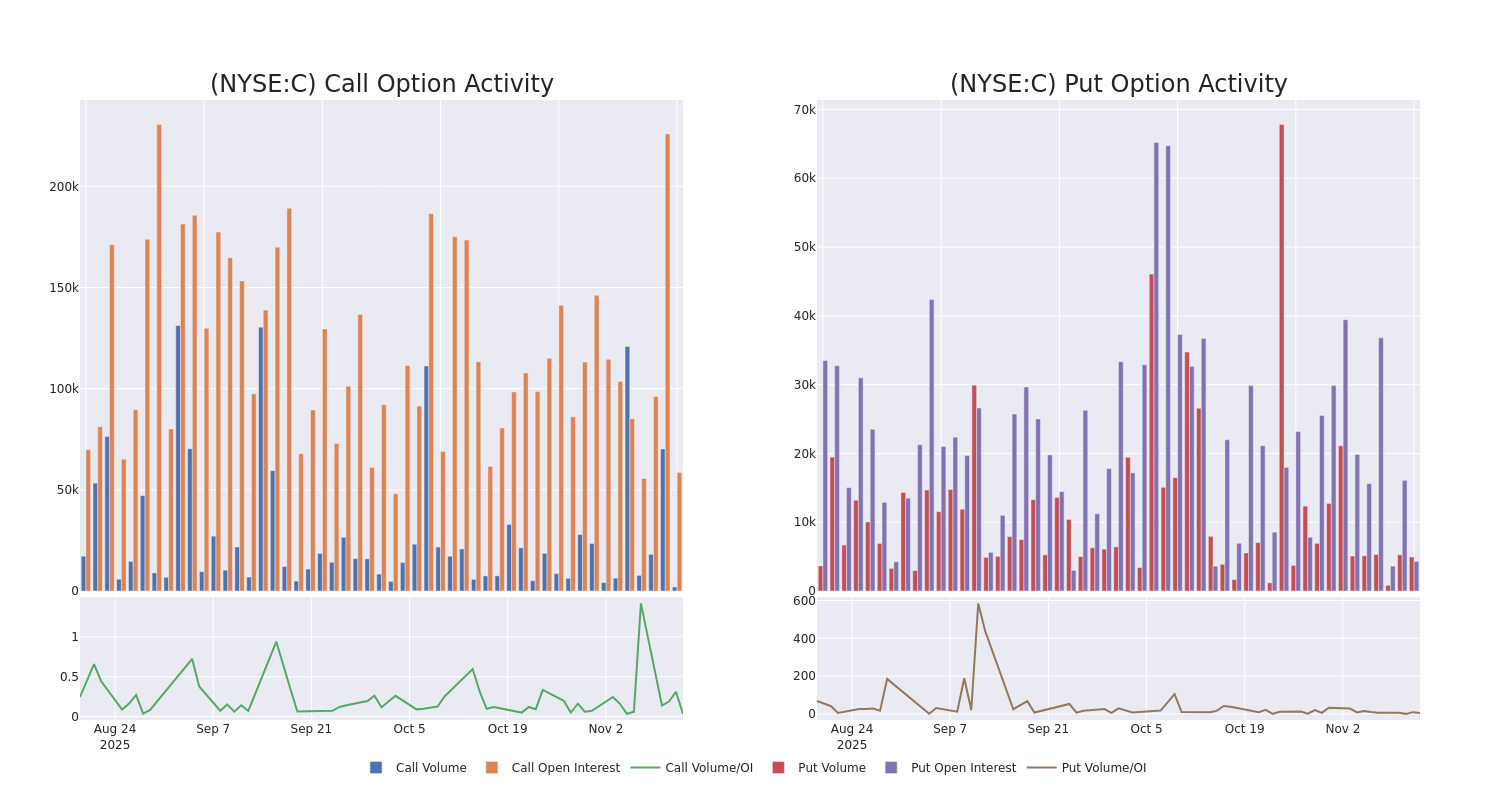

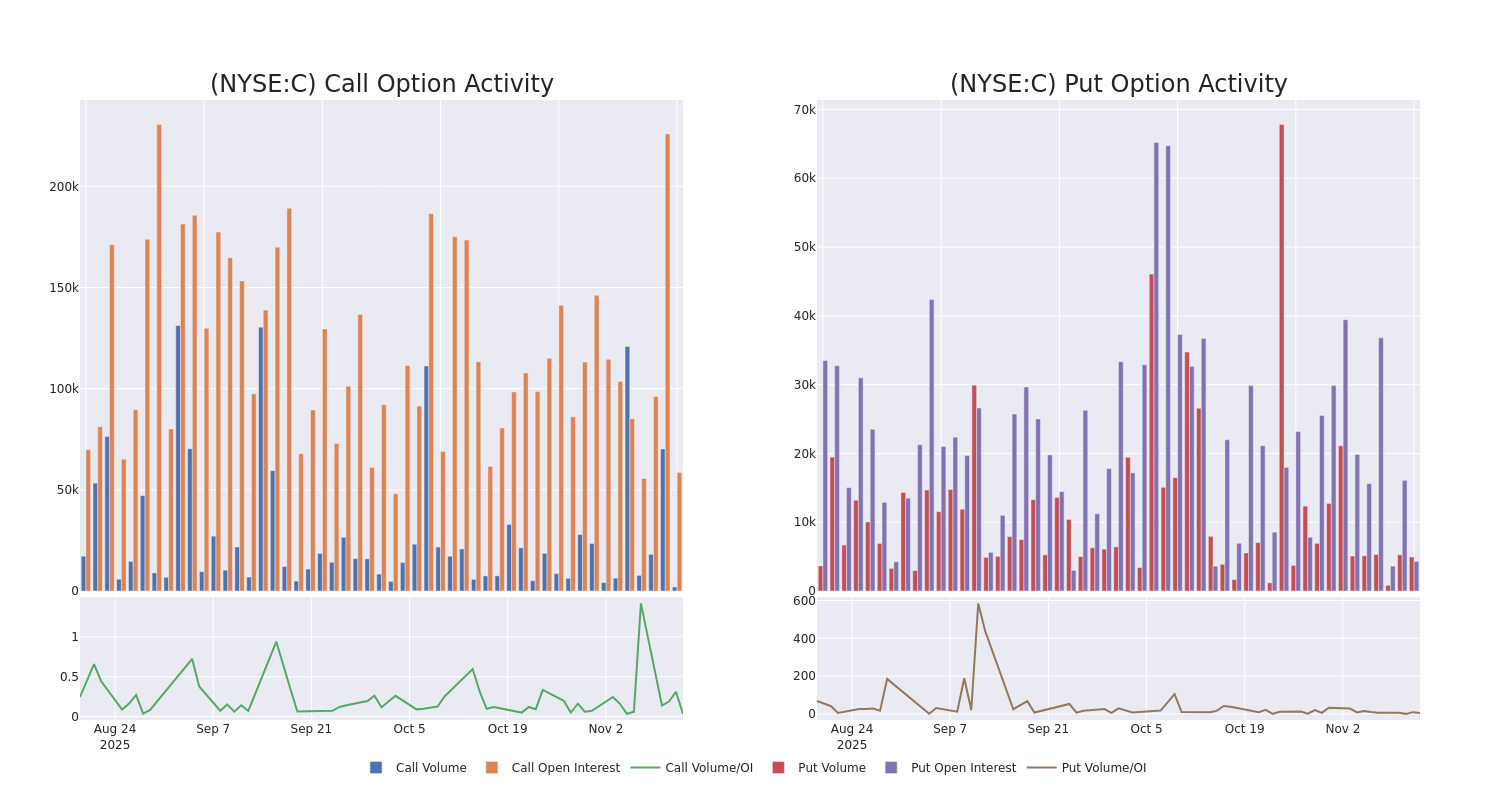

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Citigroup options trades today is 3146.1 with a total volume of 6,969.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Citigroup's big money trades within a strike price range of $60.0 to $130.0 over the last 30 days.

Citigroup Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| C |

CALL |

SWEEP |

BEARISH |

06/17/27 |

$15.3 |

$14.05 |

$14.12 |

$110.00 |

$2.1M |

2.7K |

1 |

| C |

CALL |

TRADE |

BULLISH |

06/17/27 |

$7.7 |

$7.4 |

$7.7 |

$130.00 |

$770.0K |

2.1K |

0 |

| C |

CALL |

SWEEP |

BEARISH |

01/21/28 |

$25.8 |

$25.65 |

$25.8 |

$90.00 |

$269.4K |

1.2K |

105 |

| C |

CALL |

SWEEP |

BEARISH |

06/17/27 |

$28.2 |

$25.3 |

$25.3 |

$85.00 |

$242.8K |

716 |

96 |

| C |

CALL |

TRADE |

BULLISH |

01/21/28 |

$39.0 |

$39.0 |

$39.0 |

$70.00 |

$175.5K |

115 |

75 |

About Citigroup

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup's operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank's primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

Having examined the options trading patterns of Citigroup, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Citigroup Standing Right Now?

- Currently trading with a volume of 5,534,101, the C's price is down by -0.51%, now at $102.35.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 62 days.

Professional Analyst Ratings for Citigroup

In the last month, 5 experts released ratings on this stock with an average target price of $119.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from TD Cowen persists with their Hold rating on Citigroup, maintaining a target price of $110.

* Maintaining their stance, an analyst from B of A Securities continues to hold a Buy rating for Citigroup, targeting a price of $120.

* An analyst from Keefe, Bruyette & Woods persists with their Outperform rating on Citigroup, maintaining a target price of $118.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Citigroup with a target price of $134.

* Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Citigroup with a target price of $115.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Citigroup options trades with real-time alerts from Benzinga Pro.

Posted In: C