What Analysts Are Saying About Marvell Tech Stock

Author: Benzinga Insights | September 25, 2025 03:02pm

Throughout the last three months, 17 analysts have evaluated Marvell Tech (NASDAQ: MRVL), offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

7 |

5 |

5 |

0 |

0 |

| Last 30D |

2 |

0 |

0 |

0 |

0 |

| 1M Ago |

5 |

5 |

3 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

0 |

0 |

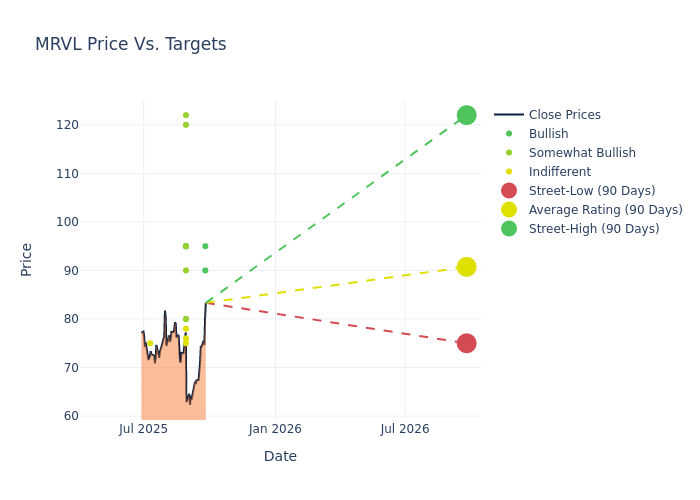

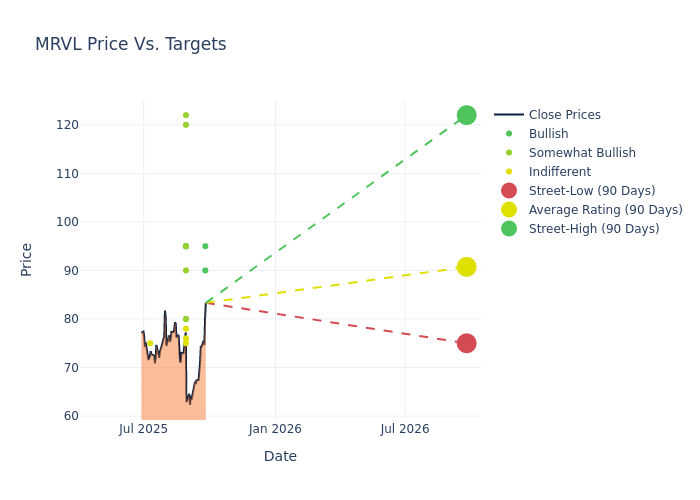

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $89.47, a high estimate of $122.00, and a low estimate of $75.00. A 5.51% drop is evident in the current average compared to the previous average price target of $94.69.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Marvell Tech among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| N. Quinn Bolton |

Needham |

Raises |

Buy |

$95.00 |

$80.00 |

| Ross Seymore |

Deutsche Bank |

Raises |

Buy |

$90.00 |

$80.00 |

| Harlan Sur |

JP Morgan |

Lowers |

Overweight |

$120.00 |

$130.00 |

| C.J. Muse |

Cantor Fitzgerald |

Maintains |

Neutral |

$75.00 |

$75.00 |

| Rick Schafer |

Oppenheimer |

Maintains |

Outperform |

$95.00 |

$95.00 |

| Timothy Arcuri |

UBS |

Lowers |

Buy |

$95.00 |

$110.00 |

| Joseph Moore |

Morgan Stanley |

Lowers |

Equal-Weight |

$76.00 |

$80.00 |

| Aaron Rakers |

Wells Fargo |

Lowers |

Overweight |

$90.00 |

$95.00 |

| Thomas O'Malley |

Barclays |

Maintains |

Overweight |

$80.00 |

$80.00 |

| Kevin Cassidy |

Rosenblatt |

Lowers |

Buy |

$95.00 |

$124.00 |

| Mark Lipacis |

Evercore ISI Group |

Lowers |

Outperform |

$122.00 |

$133.00 |

| Cody Acree |

Benchmark |

Maintains |

Buy |

$95.00 |

$95.00 |

| N. Quinn Bolton |

Needham |

Lowers |

Buy |

$80.00 |

$85.00 |

| Vivek Arya |

B of A Securities |

Lowers |

Neutral |

$78.00 |

$90.00 |

| Blayne Curtis |

Jefferies |

Lowers |

Buy |

$80.00 |

$90.00 |

| Joseph Moore |

Morgan Stanley |

Raises |

Equal-Weight |

$80.00 |

$73.00 |

| James Schneider |

Goldman Sachs |

Announces |

Neutral |

$75.00 |

- |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Marvell Tech. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Marvell Tech compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Marvell Tech's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Marvell Tech's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Marvell Tech analyst ratings.

Unveiling the Story Behind Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Breaking Down Marvell Tech's Financial Performance

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Over the 3M period, Marvell Tech showcased positive performance, achieving a revenue growth rate of 57.6% as of 31 July, 2025. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Marvell Tech's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.71% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Marvell Tech's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.46%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Marvell Tech's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.96%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Marvell Tech's debt-to-equity ratio stands notably higher than the industry average, reaching 0.36. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MRVL