Breaking Down Cleanspark: 12 Analysts Share Their Views

Author: Benzinga Insights | September 26, 2025 08:02am

Throughout the last three months, 12 analysts have evaluated Cleanspark (NASDAQ: CLSK), offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

7 |

4 |

1 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

4 |

4 |

0 |

0 |

0 |

| 3M Ago |

2 |

0 |

0 |

0 |

0 |

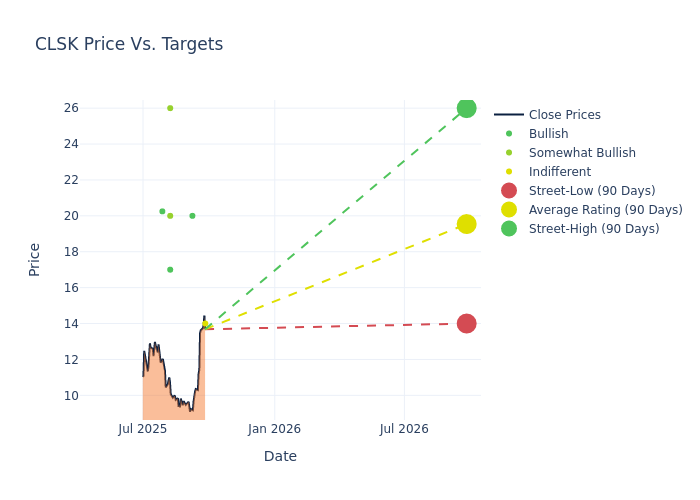

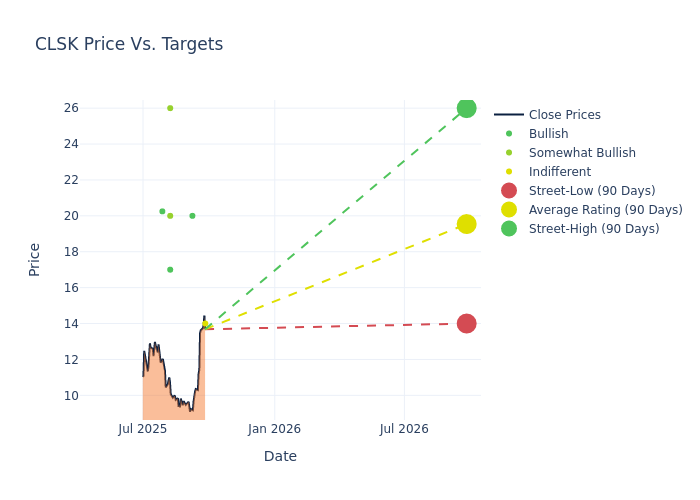

The 12-month price targets, analyzed by analysts, offer insights with an average target of $19.44, a high estimate of $26.00, and a low estimate of $14.00. This upward trend is evident, with the current average reflecting a 2.32% increase from the previous average price target of $19.00.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Cleanspark among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Reginald Smith |

JP Morgan |

Lowers |

Neutral |

$14.00 |

$15.00 |

| James McIlree |

Chardan Capital |

Maintains |

Buy |

$20.00 |

$20.00 |

| James McIlree |

Chardan Capital |

Maintains |

Buy |

$20.00 |

$20.00 |

| Paul Golding |

Macquarie |

Raises |

Outperform |

$20.00 |

$18.00 |

| Brett Knoblauch |

Cantor Fitzgerald |

Raises |

Overweight |

$26.00 |

$25.00 |

| Nick Giles |

B. Riley Securities |

Raises |

Buy |

$17.00 |

$16.00 |

| James McIlree |

Chardan Capital |

Maintains |

Buy |

$20.00 |

$20.00 |

| Jon Hickman |

Ladenburg Thalmann |

Announces |

Buy |

$20.25 |

- |

| Brett Knoblauch |

Cantor Fitzgerald |

Raises |

Overweight |

$25.00 |

$22.00 |

| Reginald Smith |

JP Morgan |

Raises |

Overweight |

$15.00 |

$14.00 |

| James McIlree |

Chardan Capital |

Maintains |

Buy |

$20.00 |

$20.00 |

| Nick Giles |

B. Riley Securities |

Announces |

Buy |

$16.00 |

- |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Cleanspark. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Cleanspark compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Cleanspark's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into Cleanspark's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Cleanspark analyst ratings.

All You Need to Know About Cleanspark

Cleanspark Inc is a bitcoin mining company. Through CleanSpark, Inc., and the Company's wholly owned subsidiaries, the company mines bitcoin. The company entered the bitcoin mining industry through its acquisition of ATL. Bitcoin mining is the sole reportable segment of the company.

Understanding the Numbers: Cleanspark's Finances

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Cleanspark displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 90.81%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Cleanspark's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 126.75% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 12.47%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Cleanspark's ROA excels beyond industry benchmarks, reaching 8.74%. This signifies efficient management of assets and strong financial health.

Debt Management: Cleanspark's debt-to-equity ratio is below the industry average. With a ratio of 0.38, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CLSK