Breaking Down Centene: 20 Analysts Share Their Views

Author: Benzinga Insights | October 07, 2025 04:01pm

In the preceding three months, 20 analysts have released ratings for Centene (NYSE:CNC), presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

3 |

13 |

1 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

1 |

2 |

0 |

0 |

| 3M Ago |

2 |

2 |

9 |

1 |

0 |

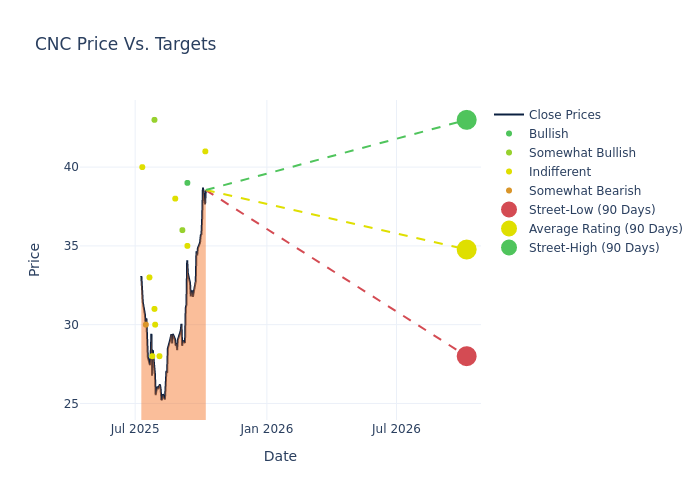

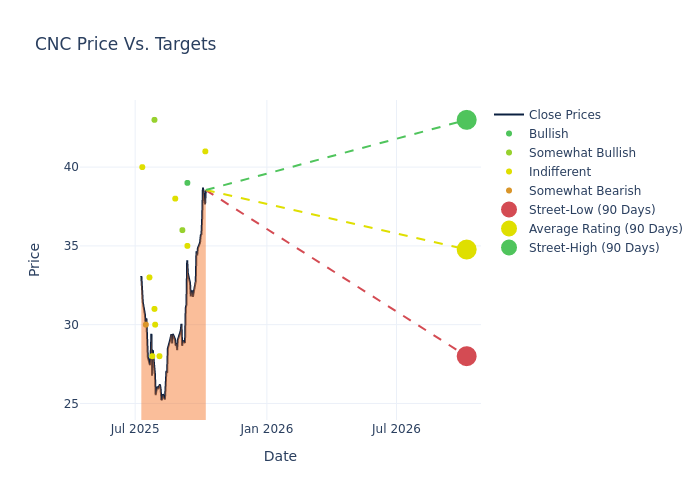

In the assessment of 12-month price targets, analysts unveil insights for Centene, presenting an average target of $35.7, a high estimate of $51.00, and a low estimate of $28.00. Experiencing a 33.89% decline, the current average is now lower than the previous average price target of $54.00.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Centene. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Stephen Baxter |

Wells Fargo |

Raises |

Equal-Weight |

$41.00 |

$30.00 |

| Ryan MacDonald |

Truist Securities |

Raises |

Buy |

$39.00 |

$35.00 |

| Andrew Mok |

Barclays |

Raises |

Equal-Weight |

$35.00 |

$33.00 |

| Lance Wilkes |

Bernstein |

Lowers |

Outperform |

$36.00 |

$40.00 |

| Andrew Mok |

Barclays |

Lowers |

Equal-Weight |

$33.00 |

$45.00 |

| Sarah James |

Cantor Fitzgerald |

Maintains |

Neutral |

$38.00 |

$38.00 |

| Ricky Goldwasser |

Morgan Stanley |

Lowers |

Equal-Weight |

$28.00 |

$33.00 |

| John Stansel |

JP Morgan |

Lowers |

Neutral |

$30.00 |

$48.00 |

| A.J. Rice |

UBS |

Lowers |

Neutral |

$31.00 |

$45.00 |

| Ryan MacDonald |

Truist Securities |

Lowers |

Buy |

$35.00 |

$42.00 |

| Michael Wiederhorn |

Oppenheimer |

Lowers |

Outperform |

$43.00 |

$51.00 |

| Sarah James |

Cantor Fitzgerald |

Lowers |

Neutral |

$38.00 |

$65.00 |

| Michael Ha |

Baird |

Lowers |

Neutral |

$28.00 |

$68.00 |

| Stephen Baxter |

Wells Fargo |

Lowers |

Equal-Weight |

$30.00 |

$72.00 |

| Ryan Langston |

TD Cowen |

Lowers |

Hold |

$33.00 |

$73.00 |

| Ryan MacDonald |

Truist Securities |

Lowers |

Buy |

$42.00 |

$84.00 |

| Kevin Fischbeck |

B of A Securities |

Lowers |

Underperform |

$30.00 |

$52.00 |

| Michael Wiederhorn |

Oppenheimer |

Lowers |

Outperform |

$51.00 |

$85.00 |

| Ann Hynes |

Mizuho |

Lowers |

Neutral |

$40.00 |

$71.00 |

| Ricky Goldwasser |

Morgan Stanley |

Lowers |

Equal-Weight |

$33.00 |

$70.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Centene. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Centene compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Centene's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Centene's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Centene analyst ratings.

Delving into Centene's Background

Centene is a managed care organization that focuses on government-sponsored healthcare plans, including Medicaid, Medicare, and the individual exchanges. Centene served 22 million medical members as of December 2024, mostly in Medicaid (about 60% of membership), the individual exchanges (about 20%), and Medicare (about 5%). The company also has a military contract and provides Medicare Part D pharmaceutical plans.

Centene: A Financial Overview

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Centene's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 22.36% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Centene's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -0.52%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Centene's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -0.91%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Centene's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -0.29%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Centene's debt-to-equity ratio is below the industry average. With a ratio of 0.64, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CNC