Expert Outlook: Intel Through The Eyes Of 12 Analysts

Author: Benzinga Insights | October 08, 2025 09:01am

During the last three months, 12 analysts shared their evaluations of Intel (NASDAQ:INTC), revealing diverse outlooks from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

0 |

7 |

2 |

2 |

| Last 30D |

0 |

0 |

0 |

1 |

0 |

| 1M Ago |

1 |

0 |

4 |

0 |

1 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

3 |

1 |

1 |

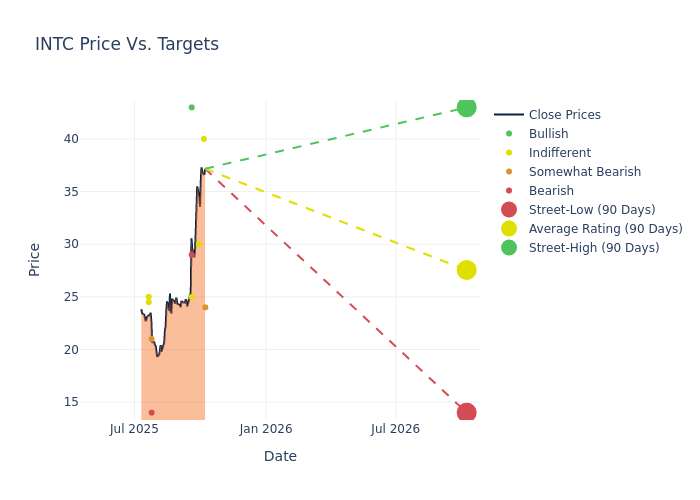

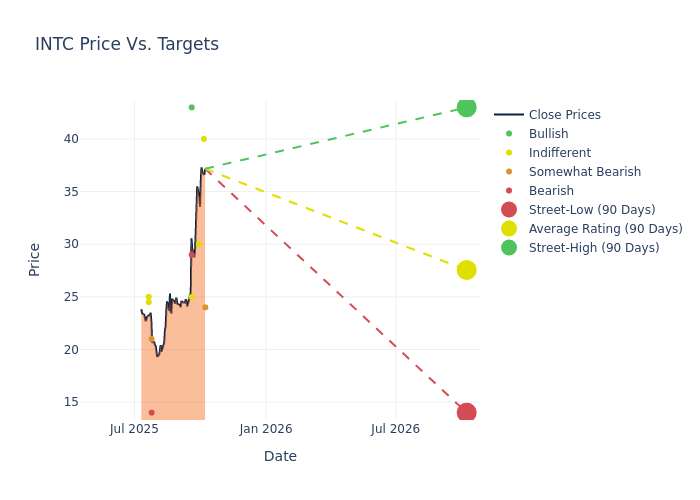

The 12-month price targets, analyzed by analysts, offer insights with an average target of $27.96, a high estimate of $43.00, and a low estimate of $14.00. This current average reflects an increase of 25.27% from the previous average price target of $22.32.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Intel's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Frank Lee |

HSBC |

Raises |

Reduce |

$24.00 |

$21.25 |

| Timothy Arcuri |

UBS |

Raises |

Neutral |

$40.00 |

$35.00 |

| Ross Seymore |

Deutsche Bank |

Raises |

Hold |

$30.00 |

$23.00 |

| Timothy Arcuri |

UBS |

Raises |

Neutral |

$35.00 |

$25.00 |

| Tom O'Malley |

Barclays |

Raises |

Equal-Weight |

$25.00 |

$19.00 |

| Christopher Danely |

Citigroup |

Raises |

Sell |

$29.00 |

$24.00 |

| Cody Acree |

Benchmark |

Announces |

Buy |

$43.00 |

- |

| Harlan Sur |

JP Morgan |

Raises |

Underweight |

$21.00 |

$20.00 |

| Kevin Cassidy |

Rosenblatt |

Maintains |

Sell |

$14.00 |

$14.00 |

| Gary Mobley |

Loop Capital |

Announces |

Hold |

$25.00 |

- |

| Ruben Roy |

Stifel |

Raises |

Hold |

$24.50 |

$21.00 |

| Timothy Arcuri |

UBS |

Raises |

Neutral |

$25.00 |

$21.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Intel. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Intel compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Intel's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Intel's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Intel analyst ratings.

About Intel

Intel is a leading digital chipmaker, focused on the design and manufacturing of microprocessors for the global personal computer and data center markets. Intel pioneered the x86 architecture for microprocessors and was the prime proponent of Moore's law for advances in semiconductor manufacturing. Intel remains the market share leader in central processing units in both the PC and server end markets. Intel has also been expanding into new adjacencies, such as communications infrastructure, automotive, and the Internet of Things. Further, Intel expects to leverage its chip manufacturing capabilities into an outsourced foundry model where it constructs chips for others.

Understanding the Numbers: Intel's Finances

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3M period, Intel showcased positive performance, achieving a revenue growth rate of 0.2% as of 30 June, 2025. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Intel's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -22.69% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Intel's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -2.95%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Intel's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -1.52%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Intel's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.52, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: INTC