Breaking Down Lam Research: 22 Analysts Share Their Views

Author: Benzinga Insights | October 13, 2025 03:01pm

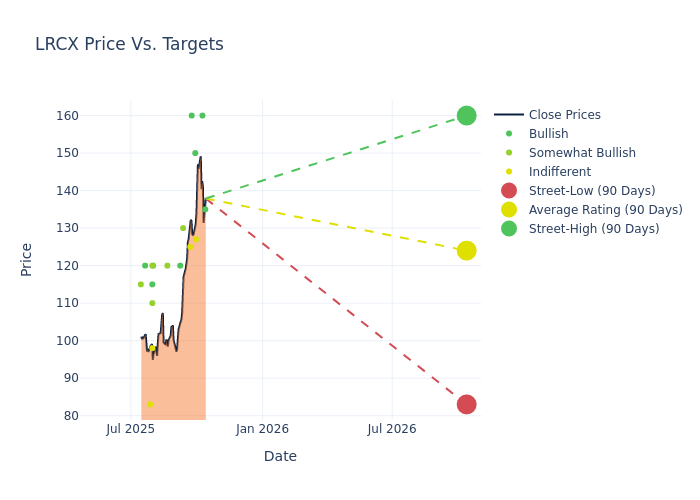

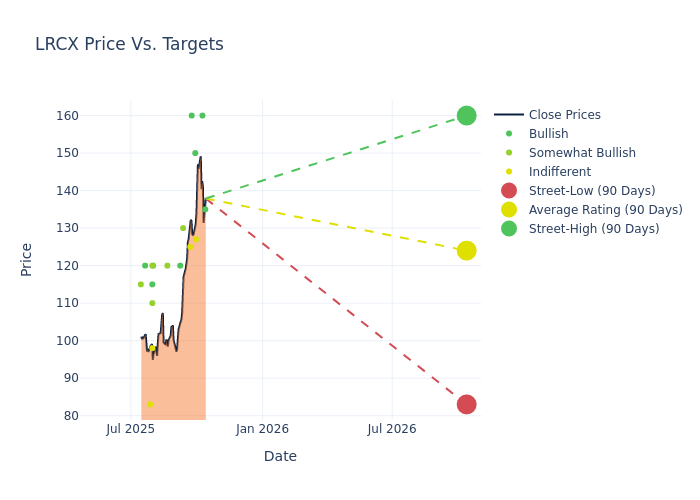

Providing a diverse range of perspectives from bullish to bearish, 22 analysts have published ratings on Lam Research (NASDAQ:LRCX) in the last three months.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

11 |

5 |

5 |

1 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

3 |

0 |

2 |

0 |

0 |

| 2M Ago |

1 |

2 |

0 |

1 |

0 |

| 3M Ago |

6 |

3 |

3 |

0 |

0 |

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $119.86, with a high estimate of $160.00 and a low estimate of $83.00. Surpassing the previous average price target of $103.86, the current average has increased by 15.41%.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of Lam Research by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Brian Chin |

Stifel |

Raises |

Buy |

$135.00 |

$115.00 |

| Toshiya Hari |

Goldman Sachs |

Raises |

Buy |

$160.00 |

$115.00 |

| Adithya Metuku |

HSBC |

Announces |

Hold |

$127.00 |

- |

| Melissa Weathers |

Deutsche Bank |

Raises |

Buy |

$150.00 |

$100.00 |

| Craig Ellis |

B. Riley Securities |

Raises |

Buy |

$160.00 |

$130.00 |

| Joseph Moore |

Morgan Stanley |

Raises |

Equal-Weight |

$125.00 |

$92.00 |

| Vijay Rakesh |

Mizuho |

Raises |

Outperform |

$130.00 |

$120.00 |

| Atif Malik |

Citigroup |

Raises |

Buy |

$120.00 |

$113.00 |

| Joseph Moore |

Morgan Stanley |

Lowers |

Underweight |

$92.00 |

$94.00 |

| C.J. Muse |

Cantor Fitzgerald |

Raises |

Overweight |

$120.00 |

$115.00 |

| Atif Malik |

Citigroup |

Raises |

Buy |

$113.00 |

$108.00 |

| Jim Kelleher |

Argus Research |

Raises |

Buy |

$120.00 |

$105.00 |

| Vijay Rakesh |

Mizuho |

Raises |

Outperform |

$120.00 |

$115.00 |

| Joseph Quatrochi |

Wells Fargo |

Raises |

Equal-Weight |

$98.00 |

$95.00 |

| Brian Chin |

Stifel |

Raises |

Buy |

$115.00 |

$110.00 |

| Joseph Moore |

Morgan Stanley |

Raises |

Equal-Weight |

$94.00 |

$87.00 |

| Srini Pajjuri |

Raymond James |

Raises |

Outperform |

$110.00 |

$90.00 |

| Ed Yang |

Oppenheimer |

Raises |

Outperform |

$120.00 |

$110.00 |

| Charles Shi |

Needham |

Raises |

Buy |

$115.00 |

$110.00 |

| Brian Chin |

Stifel |

Raises |

Buy |

$110.00 |

$92.00 |

| Tom O'Malley |

Barclays |

Raises |

Equal-Weight |

$83.00 |

$70.00 |

| Timothy Arcuri |

UBS |

Raises |

Buy |

$120.00 |

$95.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Lam Research. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Lam Research compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Lam Research's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Lam Research's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Lam Research analyst ratings.

Get to Know Lam Research Better

Lam Research is one of the largest semiconductor wafer fabrication equipment manufacturers in the world. It specializes in deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Lam Research's Economic Impact: An Analysis

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Lam Research displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 33.58%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Lam Research's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 33.26%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 17.76%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Lam Research's ROA stands out, surpassing industry averages. With an impressive ROA of 8.33%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a high debt-to-equity ratio of 0.45, Lam Research faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: LRCX