What Analysts Are Saying About Somnigroup International Stock

Author: Benzinga Insights | October 13, 2025 06:01pm

Throughout the last three months, 7 analysts have evaluated Somnigroup International (NYSE:SGI), offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

4 |

1 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

2 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

2 |

2 |

0 |

0 |

0 |

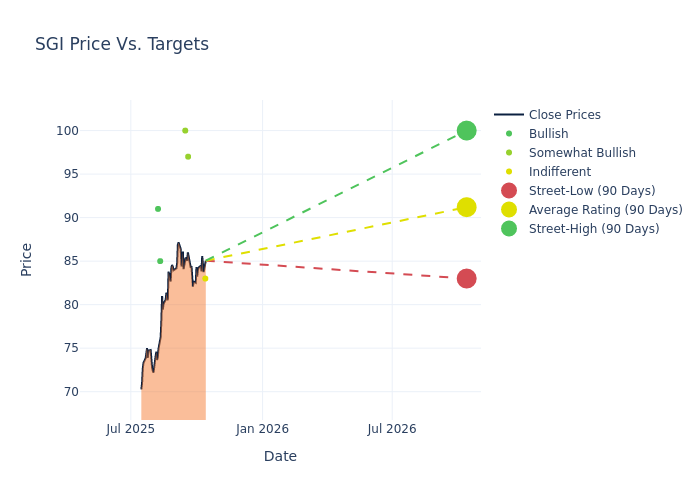

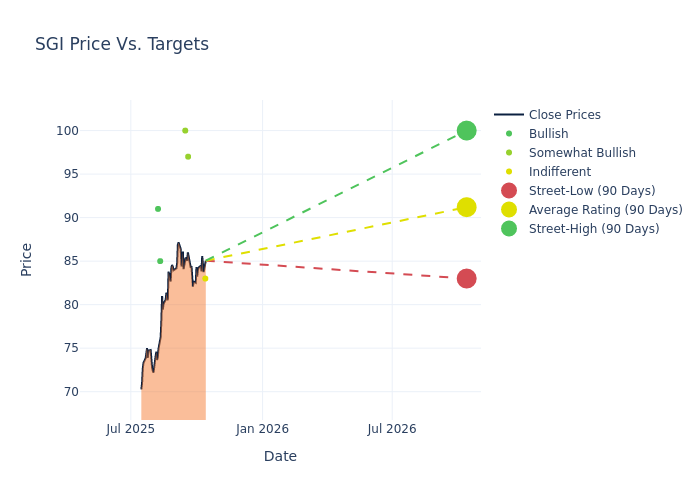

Insights from analysts' 12-month price targets are revealed, presenting an average target of $89.43, a high estimate of $100.00, and a low estimate of $80.00. This current average has increased by 12.79% from the previous average price target of $79.29.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Somnigroup International's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Susan Maklari |

Goldman Sachs |

Raises |

Neutral |

$83.00 |

$75.00 |

| Bradley Thomas |

Keybanc |

Raises |

Overweight |

$97.00 |

$90.00 |

| Peter Keith |

Piper Sandler |

Raises |

Overweight |

$100.00 |

$80.00 |

| Keith Hughes |

Truist Securities |

Raises |

Buy |

$85.00 |

$75.00 |

| Dan Silverstein |

UBS |

Raises |

Buy |

$91.00 |

$84.00 |

| Peter Keith |

Piper Sandler |

Raises |

Overweight |

$80.00 |

$77.00 |

| Bradley Thomas |

Keybanc |

Raises |

Overweight |

$90.00 |

$74.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Somnigroup International. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Somnigroup International compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Somnigroup International's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Somnigroup International's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Somnigroup International analyst ratings.

Delving into Somnigroup International's Background

Somnigroup International Inc is a bedding company, dedicated to improving people's lives through good sleep. With superior capabilities in design, manufacturing, distribution and retail, It delivers breakthrough sleep solutions and serves the evolving needs of consumers in more than 100 countries world-wide through its fully-owned businesses, Tempur Sealy, Mattress Firm and Dreams. The company's portfolio includes the brand such as Tempur-Pedic, Sealy and Stearns & Foster, and its Multinational omnichannel platform enables the company to meet consumers wherever shop, offering a personal connection and innovation to provide a retail experience and tailored solutions.

Key Indicators: Somnigroup International's Financial Health

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Somnigroup International displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 52.46%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 5.26%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Somnigroup International's ROE stands out, surpassing industry averages. With an impressive ROE of 3.55%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.87%, the company showcases effective utilization of assets.

Debt Management: Somnigroup International's debt-to-equity ratio stands notably higher than the industry average, reaching 2.41. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

What Are Analyst Ratings?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SGI