What Analysts Are Saying About Fiserv Stock

Author: Benzinga Insights | October 13, 2025 06:01pm

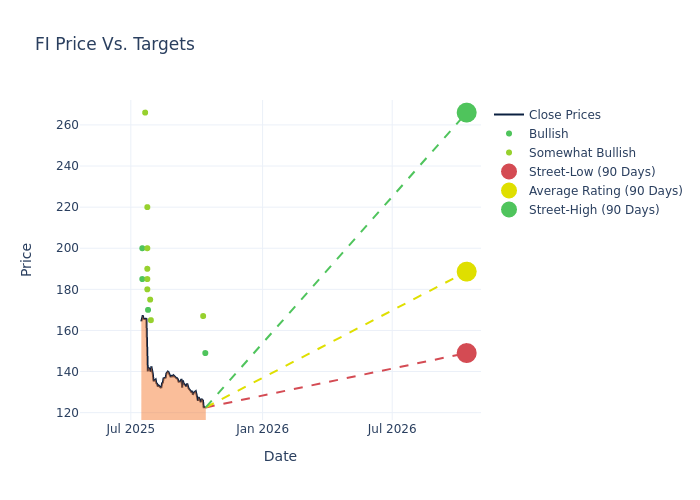

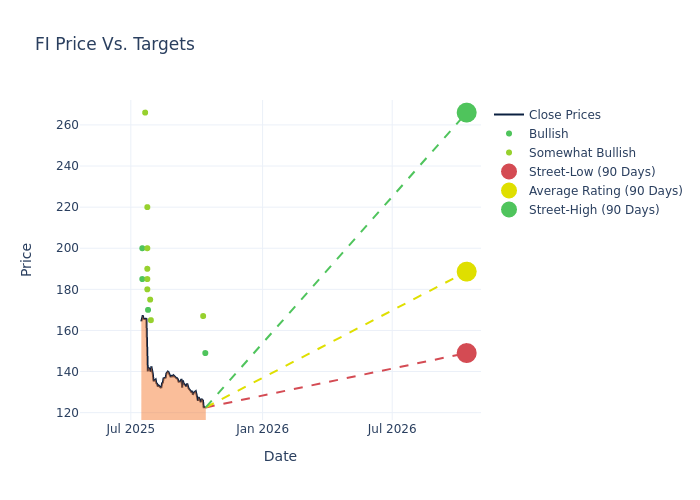

13 analysts have shared their evaluations of Fiserv (NYSE:FI) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

4 |

9 |

0 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

0 |

1 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

3 |

8 |

0 |

0 |

0 |

Analysts have set 12-month price targets for Fiserv, revealing an average target of $188.62, a high estimate of $266.00, and a low estimate of $149.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 13.77%.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Fiserv among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Will Nance |

Goldman Sachs |

Lowers |

Buy |

$149.00 |

$192.00 |

| John Davis |

Raymond James |

Lowers |

Outperform |

$167.00 |

$170.00 |

| Dan Dolev |

Mizuho |

Lowers |

Outperform |

$165.00 |

$194.00 |

| Ramsey El-Assal |

Barclays |

Lowers |

Overweight |

$175.00 |

$230.00 |

| Timothy Chiodo |

UBS |

Lowers |

Buy |

$170.00 |

$225.00 |

| Tien-Tsin Huang |

JP Morgan |

Lowers |

Overweight |

$190.00 |

$210.00 |

| Charles Nabhan |

Stephens & Co. |

Lowers |

Overweight |

$180.00 |

$240.00 |

| James Friedman |

Susquehanna |

Lowers |

Positive |

$220.00 |

$240.00 |

| Alex Markgraff |

Keybanc |

Lowers |

Overweight |

$200.00 |

$250.00 |

| David Koning |

Baird |

Lowers |

Outperform |

$185.00 |

$225.00 |

| Ole Slorer |

Morgan Stanley |

Lowers |

Overweight |

$266.00 |

$268.00 |

| Bryan Keane |

Deutsche Bank |

Announces |

Buy |

$200.00 |

- |

| Matthew Coad |

Truist Securities |

Raises |

Buy |

$185.00 |

$181.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Fiserv. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Fiserv compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Fiserv's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Fiserv's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Fiserv analyst ratings.

Unveiling the Story Behind Fiserv

Fiserv is a leading provider of core processing and complementary services, such as electronic funds transfer, payment processing, and loan processing, for US banks and credit unions, with a focus on small and midsize banks. Through the merger with First Data in 2019, Fiserv also provides payment processing services for merchants. About 10% of the company's revenue is generated internationally.

Financial Insights: Fiserv

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Fiserv's revenue growth over a period of 3M has been noteworthy. As of 30 June, 2025, the company achieved a revenue growth rate of approximately 8.01%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Fiserv's net margin excels beyond industry benchmarks, reaching 18.6%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Fiserv's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 4.02%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Fiserv's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 1.27%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 1.18.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: FI