Global Outlook: Not Good

Author: Chris Dier-Scalise | September 26, 2019 08:44am

Life for the bulls was rough in August. Major averages bounded from one end of a trading range to the other on a seemingly daily basis, sectors fell in and out of favorability in mere moments, and a now persistently inverted yield-curve is underpinning endless speculation of a recession.

But don’t despair. That good news is that while U.S. markets struggle with their identity crises, international markets are showing clearer conviction. The bad news is that conviction is largely bearish.

We can get a sense of how short-term bears are positioning themselves via the surging performance of Direxion’s suite of international leveraged bear ETFs.

Direxion Daily MSCI Developed Markets Bear 3X Shares

Source: Yahoo Finance, Data as of Sept 25, 3019

Source: Yahoo Finance, Data as of Sept 25, 3019

Gaining roughly 11% over July and August only to fall and bounce slightly into September, the Direxion Daily MSCI Developed Markets Bear 3X Shares (NYSE:DPK) has wavered on continued signs of a global economic slowdown, most of which are emanating from Europe. The persistent question of Brexit and the prospect of an impending economic shock from a no-deal exit from the European Union remains a major concern for the multinational banks and corporations doing business in the country. At the same time, weak economic data coming from Germany, one of the E.U’s wealthiest member-states, has raised even more alarm from investors in the continent.

Aside from general anxiety, DPK was truly helped by the poor performance of multinational oil and gas concerns Royal Dutch Shell plc ADR Class A (NYSE: RDS-A) and BP plc (NYSE:BP). Other laggards bolstering DPK include British bank HSBC Holdings plc (NYSE:HSBC) and German software company SAP SE (NYSE:SAP).

Direxion Daily MSCI Emerging Markets Bear 3X Shares

Source: Yahoo Finance, Data as of Sept 25, 3019

Source: Yahoo Finance, Data as of Sept 25, 3019

Trade tensions have also dimmed the outlook on emerging markets, as shown in the Direxion Daily MSCI Emerging Markets Bear 3X Shares (NYSE:EDZ), which is up about 8% over the past three months. However, EDZ saw a larger move back in August thanks largely to its exposure to China and other East Asian nations impacted by the trade war, though the aforementioned recessionary fears among developed economies has lowered growth expectations globally.

China tech stalwart Alibaba Group Holding Ltd ADR (NYSE:BABA) is a good example of the impact of both these concerns. While Alibaba has continued the trend of solid quarterly earnings, the stock is down roughly 17% from its 2019 high, both due to trade war woes as well as the general volatility of the U.S. equity markets. Other tech companies in developing nations like Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM), down 3%, and South African internet firm Naspers Limited (OTC:NPSNY), down 12%, are feeling similar headwinds to their near-term growth prospects.

Direxion Daily Russia Bull and Bear 3X Shares

Source: Yahoo Finance, Data as of Sept 25, 3019

Aside from China, Russia has been among the most persistently bearish international markets in 2019 thanks largely to the country's reliance on oil exports. The bearish energy markets have helped the Direxion Daily Russia Bull and Bear 3X Shares (NYSE:RUSS) rise by 12% in August before falling again and bouncing in September by about 4%.

The volatile pattern is a clear reflection of the fund’s sector exposure, with 40% of the ETF devoted to energy companies like Lukoil (OTC:LUKOY), down almost 10% since July, and Gazprom PAO (OTC:OGZPY), down 10% down almost 3% in that span.

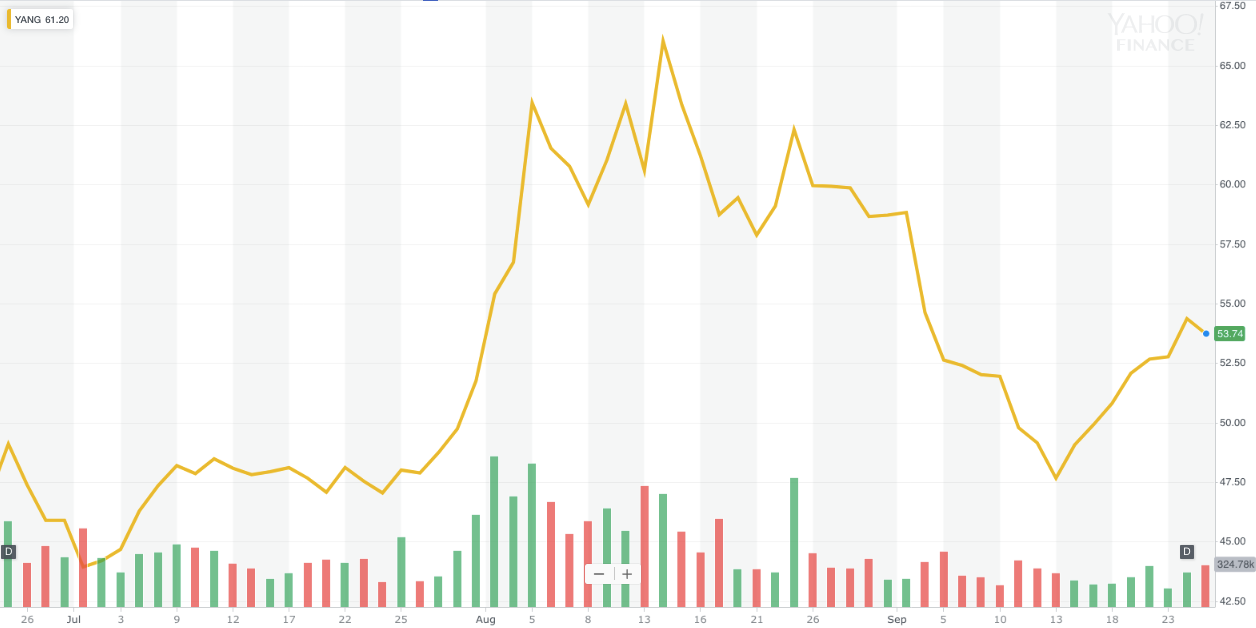

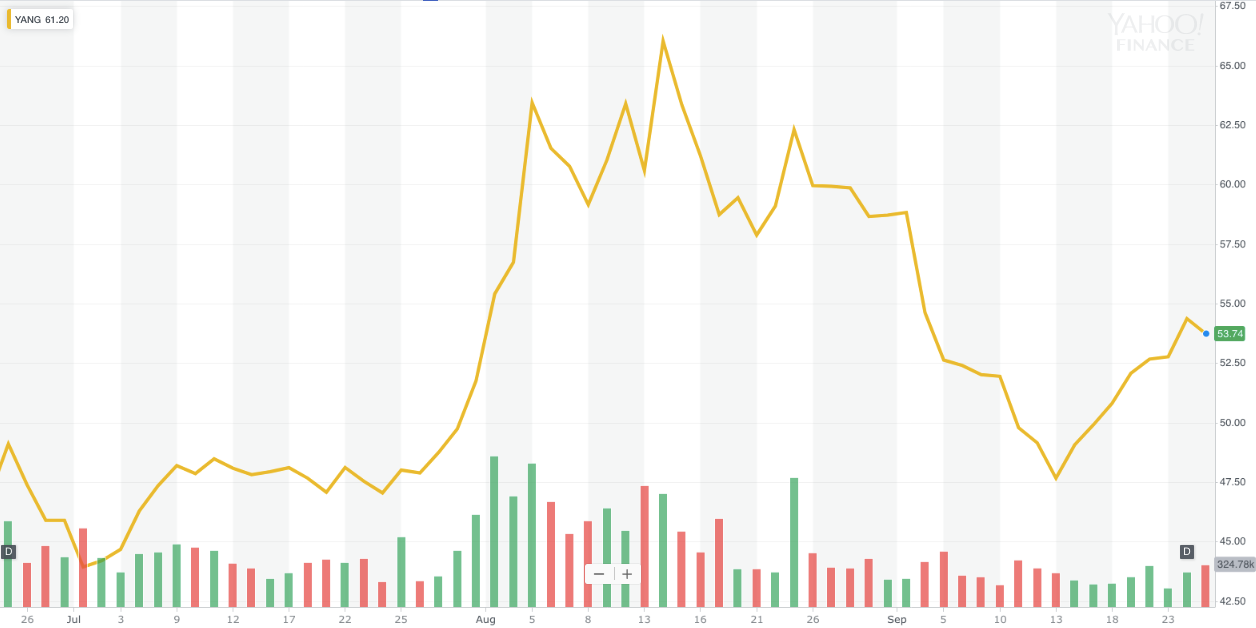

Direxion Daily FTSE China Bear 3X Shares

Source: Yahoo Finance, Data as of Sept 25, 3019

Source: Yahoo Finance, Data as of Sept 25, 3019

Up 14%over the past 3 months is, unsurprisingly, the Direxion Daily FTSE China Bear 3X Shares (NYSE:YANG). Despite the U.S.-China trade war already being more than a year old, YANG has actually spent much of 2019 in the red, though it’s recently hit a new six-month high back in August on new tariff threats and rekindled trade fears.

Investors have recently punished large Chinese tech firms like Tencent Holdings ADR (OTC:TCEHY) and Baidu Inc. (NASDAQ:BIDU) while the nation’s “Big Four” financial companies—The Bank of China (OTC:BACHF), The China Construction Bank (OTC:CICHY), Industrial Commercial Bank of China (OTC:IDCBY) and The Agricultural Bank of China (OTC:ACGBF)—struggle to find investors as the nation’s currency continues to tumble in the midst of the trade war.

Direxion is a content partner of Benzinga

Posted In: ACGBF BABA BACHF BIDU BP CICHY DPK EDZ HSBC IDCBY LUKOY NPSNY OGZPY RDS-A RUSS SAP TCEHY TSM YANG