Driving Performance Without CAR: Another Hedged Portfolio Outperforms, This Time Without The Skyrocketing Rental Car Company

Author: David Pinsen | November 15, 2021 04:39pm

Japanese gameshow contestant versus bear. Image via TMZ.

Not Just Luck

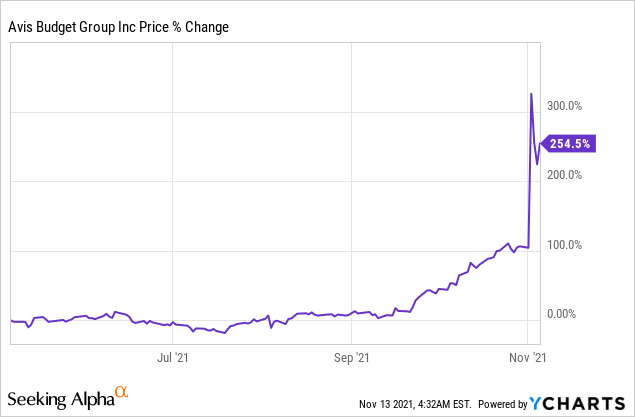

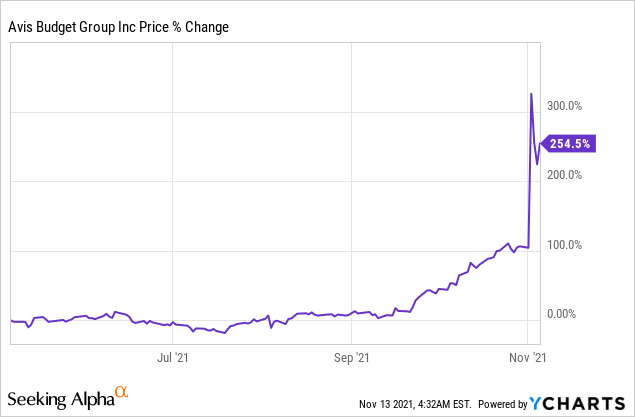

In a previous post (Aggressive Protection In Action), we posted the performance of the aggressive hedged portfolio our system created on May 6th (these portfolios last for six months, which is why we're writing about them now). As we noted there, the outperformance in that one was driven by a position in Avis Budget Group, Inc. (NASDAQ:CAR).

That raised the question of how our system would perform without it. Now we have the answer, with the conclusion of May 13th's aggressive portfolio: pretty well. Let's take a look. First, a quick recap of the May 6th portfolio and how it performed.

Our May 6th Aggressive Portfolio

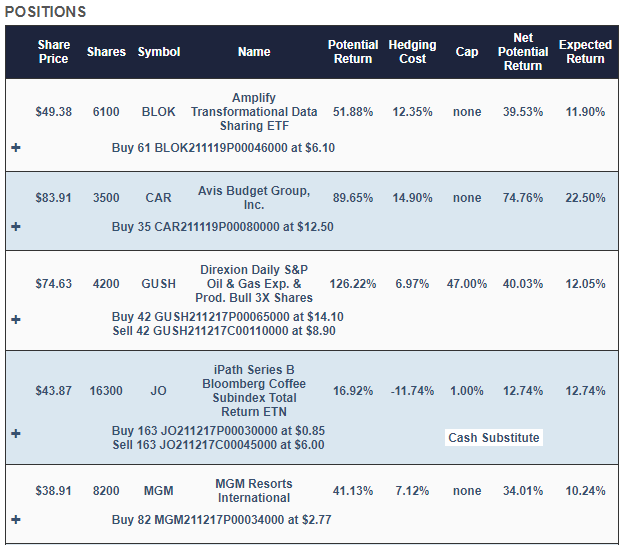

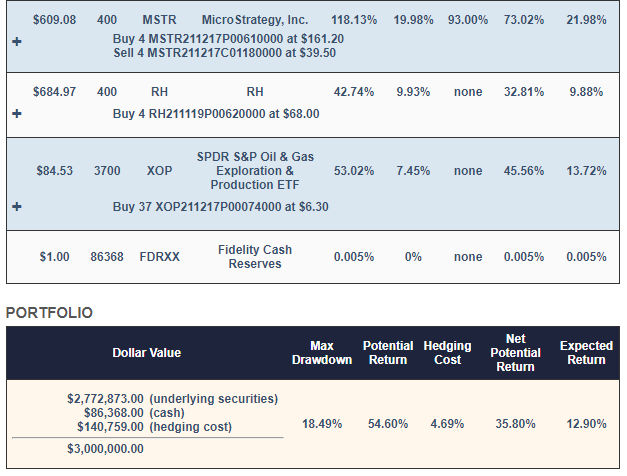

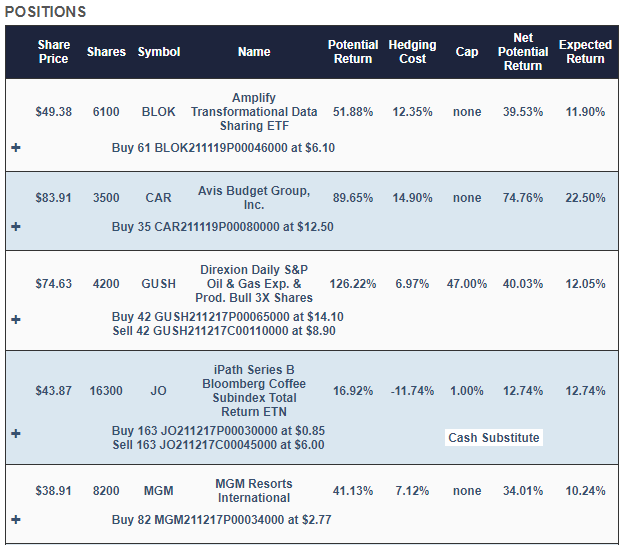

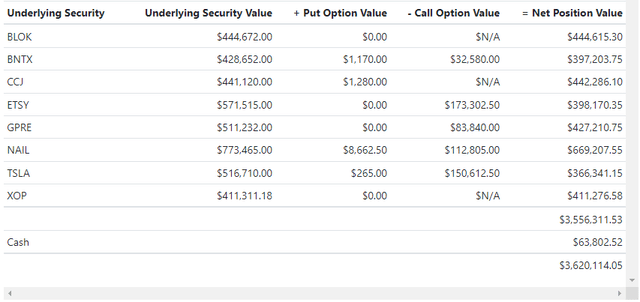

This is the portfolio our site created for an investor looking to maximize his return while limiting his risk to a decline of no more than 20% over the next six months, in a worst case scenario.

Screen captures via Portfolio Armor on 5/6/2021.

How The May 6th Portfolio Performed

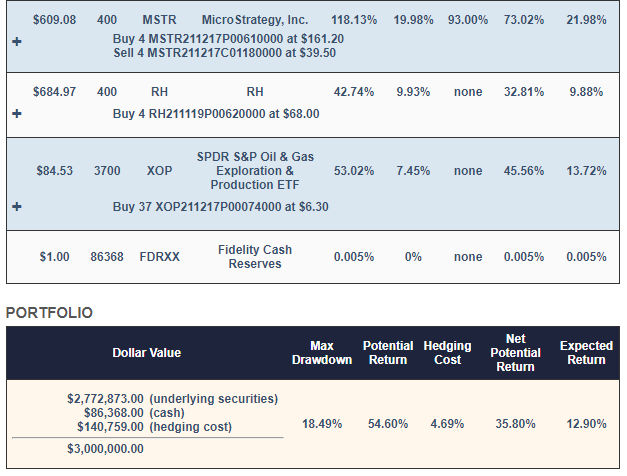

It was up 35.12% over the next six months, versus 12.54% for the SPDR S&P 500 Trust ETF (NYSE:SPY).

Our CAR-less May 13th Portfolio

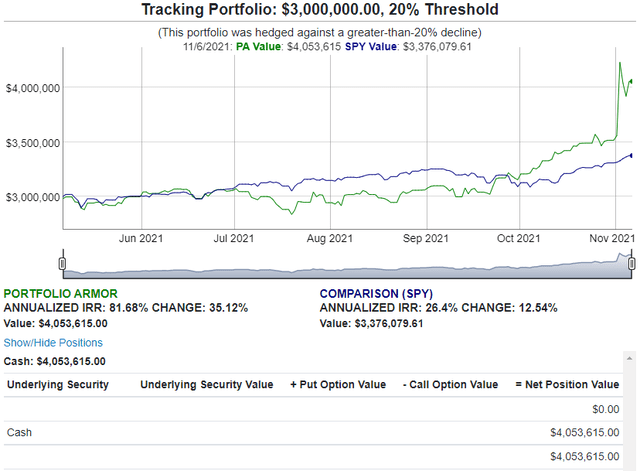

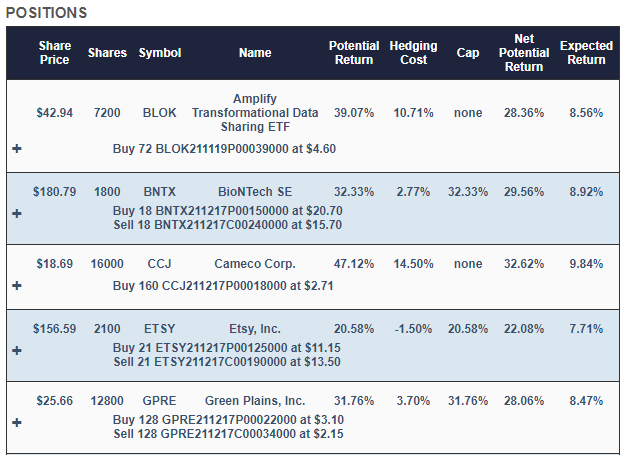

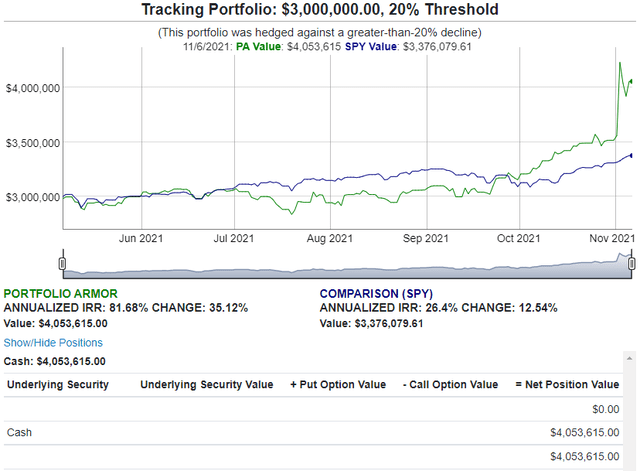

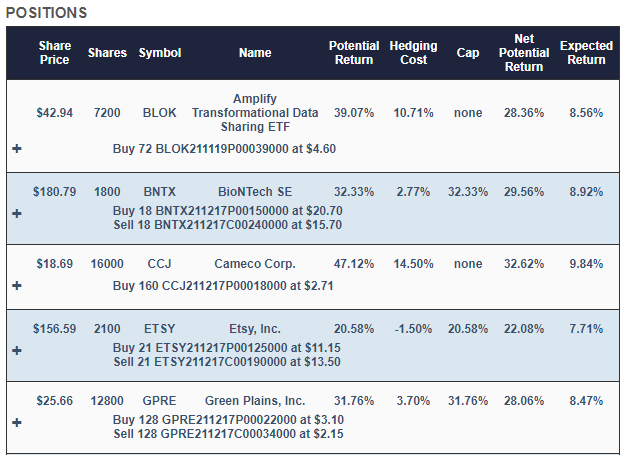

This was our portfolio hedged against a >20% decline created on May 13th.

Screen captures via Portfolio Armor on 5/13/2021.

The Net Potential Return in the portfolio-level summary above was our system's estimate of a best-case return for this portfolio; the Expected Return was its estimate of a more likely return, taking into account historic actual performance versus our potential return estimates.

Our May 13th portfolio had two securities in common with our May 6th portfolio, the Amplify Transformational Data Sharing ETF (NYSE:BLOK) and the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE:XOP). It did have Tesla, Inc. (NASDAQ:TSLA) in it, but Tesla was hedged with a collar limiting its upside to 29% over the time frame of the hedge.

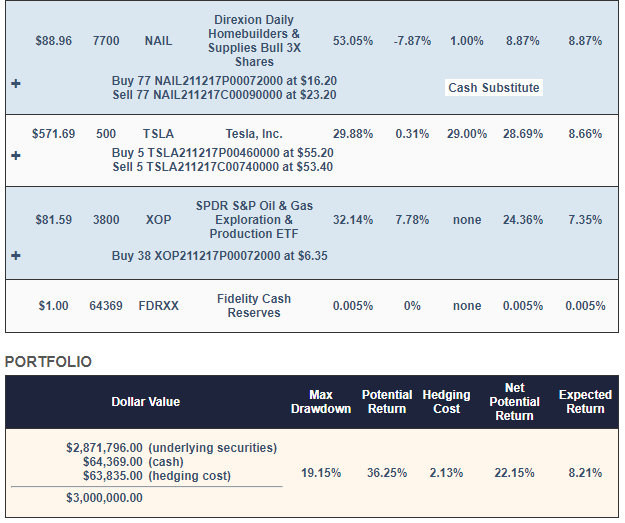

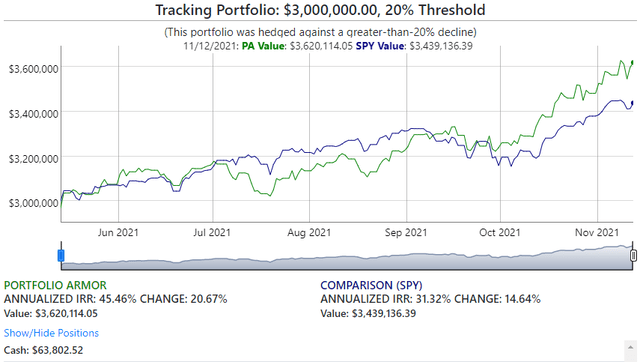

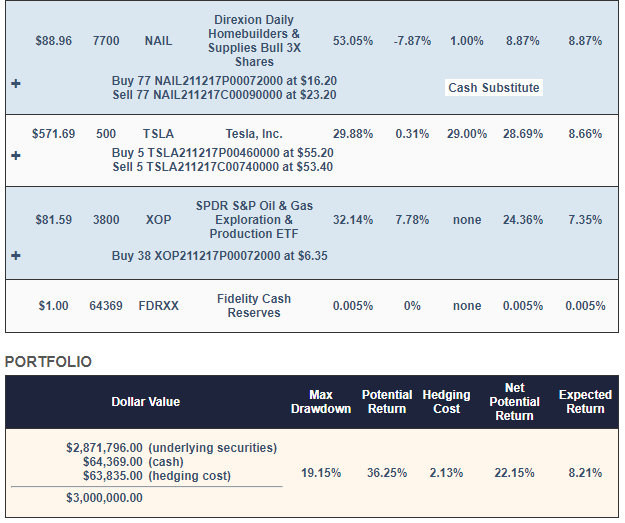

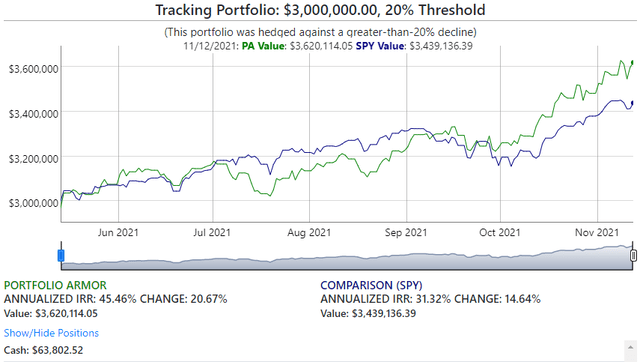

Performance Of Our May 13th Portfolio

Our May 13th portfolio was up 20.67%, versus 14.64% for SPY over the same time period.

You Can Do Well In Up Markets While Hedged

The key is having an effective method for selecting securities and hedges. Having one uncapped position hit it out of the park like CAR did in our May 6th portfolio certainly helps, but isn't necessary to deliver solid performance.

Posted In: BLOK CAR SPY TSLA XOP