Turning Slightly Bearish: A Bearish ETF Hits Our Top Ten Names. How To Handle Market Inflection Points.

Author: David Pinsen | January 28, 2022 12:46pm

Janko Ferlic/Pexels.

A Bearish ETF Hits Our Top Ten

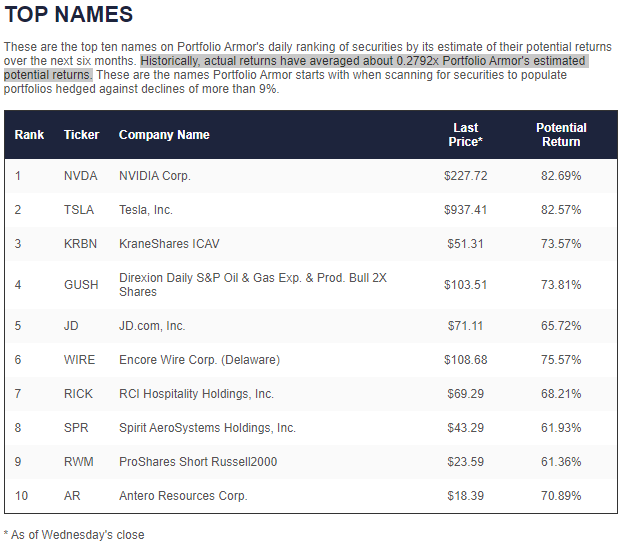

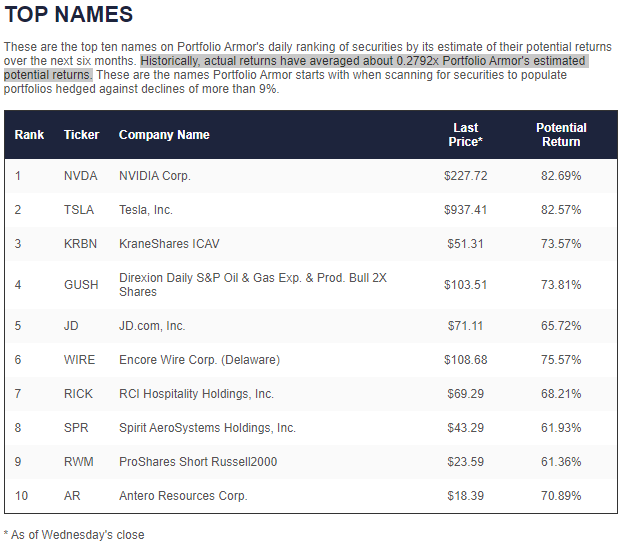

On our previous post, Bear With Us, we mentioned that our system's universe of securities includes inverse and bearish ETFs, and that, depending on market conditions, those might appear among our top names (and in our hedged portfolios) at some point. That point ended up being Wednesday, as you can see below.

Screen capture via Portfolio Armor on 1/26/2022.

The ProShares Short Russell 2000 (NYSE:RWM), an inverse ETF of the Russell 2000 small cap index, appeared in our top ten alongside some familiar long names such as Nvidia, Inc. (NASDAQ:NVDA), Tesla, Inc. (NASDAQ:TSLA), and the Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2x Shares ETF (NYSE:GUSH).

Dealing With Inflection Points

Our top names are selected with six-month time horizons in mind, and six months is how long our hedged portfolios last. It's possible that over the next six months large cap names like Tesla will post positive performance while small caps suffer, but it seems more likely that if our bearish ETF RWM does well over the next six months, most of the stocks in our top names from Wednesday will be down. It's also possible that in a month or two, our top names will be all bullish names again, or even all bearish ETFs. We are in an inflection point, and there are two ways to hedge our bets about it.

The first way is simply to hedge. Each of our top ten names was selected in part because it was cost effective to hedge, and in hedged portfolios created by our site, each position is hedged. That way, if you have a position in RWM, and small caps rebound and go on a tear, your downside will be strictly limited.

The second way to hedge our bets is to split your money into more than one tranche, as we mentioned in our previous post. You could put half of the money you're looking to invest in a hedged portfolio now, and then put the other half in a hedged portfolio created in March or April, when the market direction looks clearer.

Posted In: GUSH NVDA RWM TSLA