Bullish On China-Based Internet Stocks? This ETF Offers 3X Leverage

Author: Melanie Schaffer | June 30, 2022 04:56pm

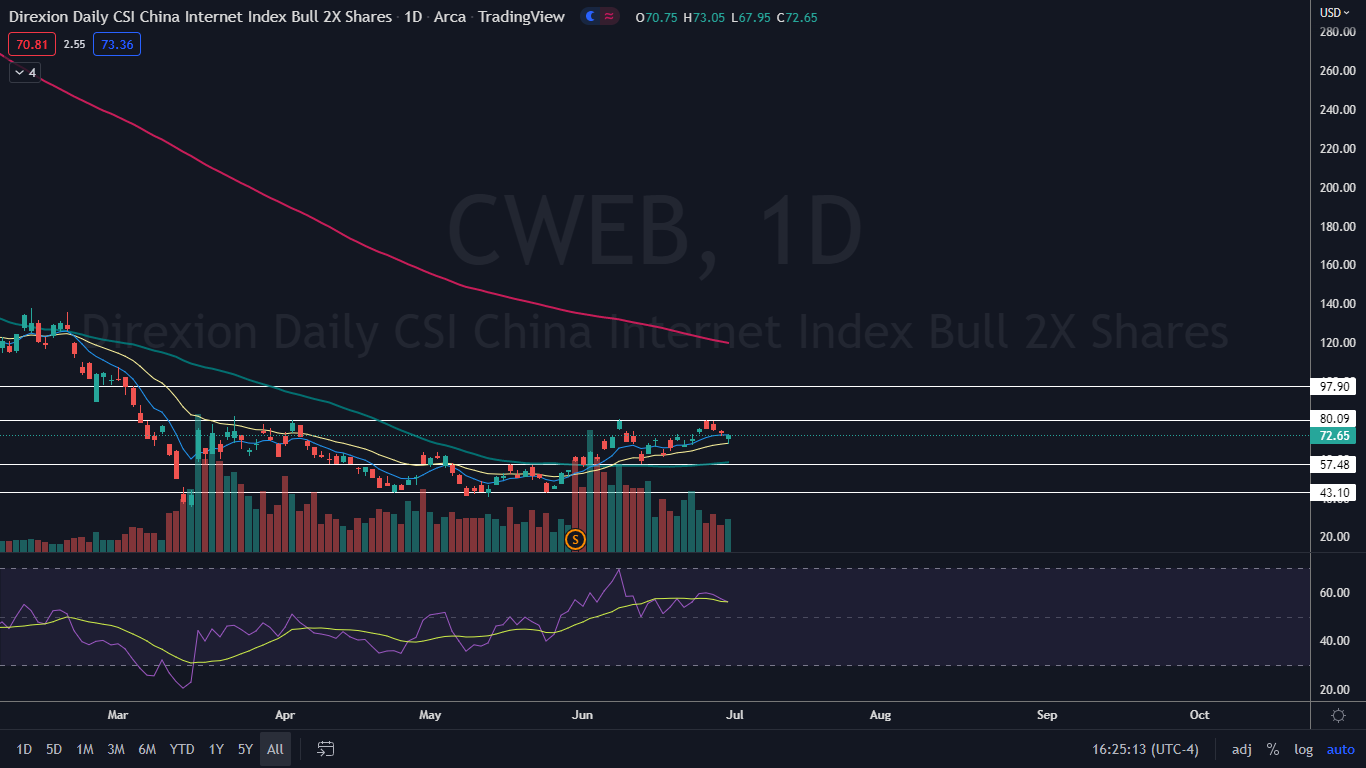

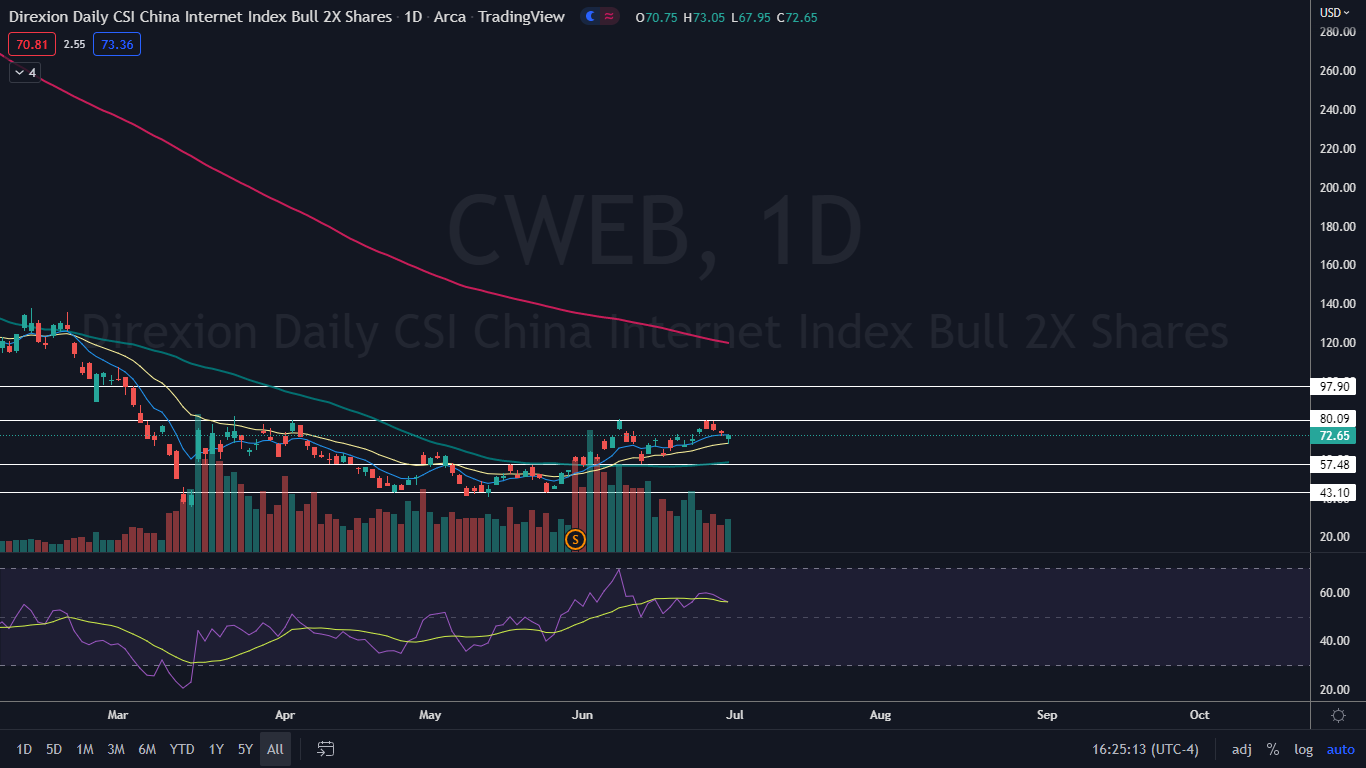

Direxion Daily CSI China Internet Index Bull 2x Shares (NYSE:CWEB) closed down 1.62% on Thursday in consolidation. Consolidation can be determined by looking at volume on a security, which in this case was lower than average.

CWEB reversed into an uptrend on May 25 and has been gradually grinding higher since that date.

The ETF is a double leveraged fund that offers 2x daily exposure to companies whose primary business falls within the internet or internet-related sectors. The ETF tracks a number of China-based Internet companies through its four holdings, with the KraneShares CSI China Internet ETF and the U.S. dollar making up 82.44% of its weighted holdings.

The other two funds making up the remainder of CWEB’s weightings are the Goldman Sachs Trust Financial Square Treasury Instruments Fund Institutional, weighted at 10.48%, and Dreyfus Government Cash Management Funds Institutional, with a 7.08% weighting.

It should be noted that leveraged ETFs are meant to be used as a trading vehicle as opposed to a long-term investment by experienced traders. Leveraged ETFs should never be used by an investor with a buy and hold strategy or those who have low risk appetites.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The CWEB Chart: CWEB formed the most recent higher high of its downtrend on June 27 at $80.09 and the most recent confirmed higher low was printed at the $66.07 mark on June 22.

On Thursday, CWEB printed a hammer candlestick on the daily chart, which could indicate the next higher low is in and the ETF will trade higher on Friday as it continues in its uptrend.

- The declining share price on Thursday took place on lower-than-average volume, which indicates consolidation. Bullish traders want to see lower prices on lower-than-average volume and higher prices on higher-than-average volume, which indicates the bull are in control.

- CWEB is trading slightly below the eight-day exponential moving average (EMA) but with the eight-day EMA trending above the 21-day, which indicates indecision. Bullish traders will want to see CWEB regain the eight-day EMA over the coming days to avoid the indicator crossing below the 21-day.

- CWEB has resistance above at $80.09 and $97.90 and support below at $57.48 and $43.10.

See Also: Alibaba And Other Chinese Stocks Go Jittery As China Tightens Rules On Overseas Data Transfer

See Also: Alibaba And Other Chinese Stocks Go Jittery As China Tightens Rules On Overseas Data Transfer

Photo via Shutterstock.

Posted In: CWEB

See Also:

See Also: