A Prisoner Exchange With Iran Could Impact The Oil Sector: Here's How

Author: Natan Ponieman | September 18, 2023 05:23pm

The U.S. and Iran completed a prisoner swap that could anticipate improving relations between the two nations.

The deal, which freed 10 people — five Iranians and five Americans — also unlocked $6 billion in oil funds that the U.S. was holding from the Middle-Eastern nation.

Positive U.S.-Iran relations emerged during the post-war years but quickly deteriorated after the Iranian Revolution, which overthrew the last royal dynasty in 1979 and established the current Islamic Republic of Iran. By 1980 the two countries had ceased formal diplomatic relations.

The decades that followed were conflict-filled as the U.S. launched a long campaign of military intervention in the Middle East. The last decade was marked by U.S.-led pressure to limit Iran's nuclear weapons program through economic embargoes and sanctions which pressed heavily on the oil industry.

Iran's nuclear program: Iran is currently not known to possess any nuclear weapons but is publicly aiming for their development. The construction of uranium enrichment facilities beginning in the early 2000s has been a consistent cause of concern for the West.

Since 2015, the U.S. has been involved in efforts to oversee the dismantlement of Iran's nuclear weapons program through an initiative led by President Barack Obama, which leveraged lifting some sanctions in exchange for the deal. President Donald Trump pulled the U.S. from the agreement in 2018 leading Iran to boost its uranium enrichment program and launching the two countries into new military tensions.

Iran's involvement in the Ukraine war has also raised concern for NATO powers as the country quickly became one of Russia's closest allies after Moscow was cut off from the West.

Dozens of Russia-controlled, Iran-made fighter drones were spotted on the Ukrainian front. According to Foreign Policy, the two countries are deepening ties for mutual benefit and could become powerful allies in overcoming many of the sanctions imposed by the West.

Read Also: Lindsey Graham Blasts US-Iran Prisoner Release Deal That Will Unfreeze $6B In Frozen Funds: ‘Dollars Will Now Flow To The Ayatollah’

Prisoner release and oil money: In this context, the diplomatic success story of a prisoner swap could mean an opening up of new talks between the U.S. and Iran.

"As we welcome home our fellow citizens, I once more remind all Americans of the serious risks of traveling to Iran. American passport holders should not travel there," said President Joe Biden in a speech following the prisoners' release.

Adding to the prisoners, the U.S. agreed to unfreeze $6 billion in Iran's name which was held in South Korea. The money came from the purchase of Iranian oil by the Asian country in 2018, which became stuck after Trump increased sanctions on Iran in 2019, The Washington Post reported. Republican lawmakers recently expressed discontent with unfreezing the funds.

Iran won't be allowed to use the capital for sanctioned goods, which include weapons, and its expenditure will be overseen by the U.S. government to make sure it’s used to purchase resources like food or medicine.

Impact on the oil industry: As part of a long list of U.S. sanctions that have accumulated since 1979, U.S.-based companies are barred from investing in Iran's oil industry.

In 2019, former Secretary of State Mike Pompeo announced that the U.S. would begin imposing sanctions on Chinese companies importing Iranian oil. Iran maintains close commercial ties with China, which remains its largest trading partner over the last decade with bilateral trade amounting to $15.8 billion in 2022.

Tensions between the U.S. and China have been on the rise in recent years over issues concerning the sovereignty of Taiwan, conflicting geopolitical influence and the domination of key technological sectors including AI and semiconductors.

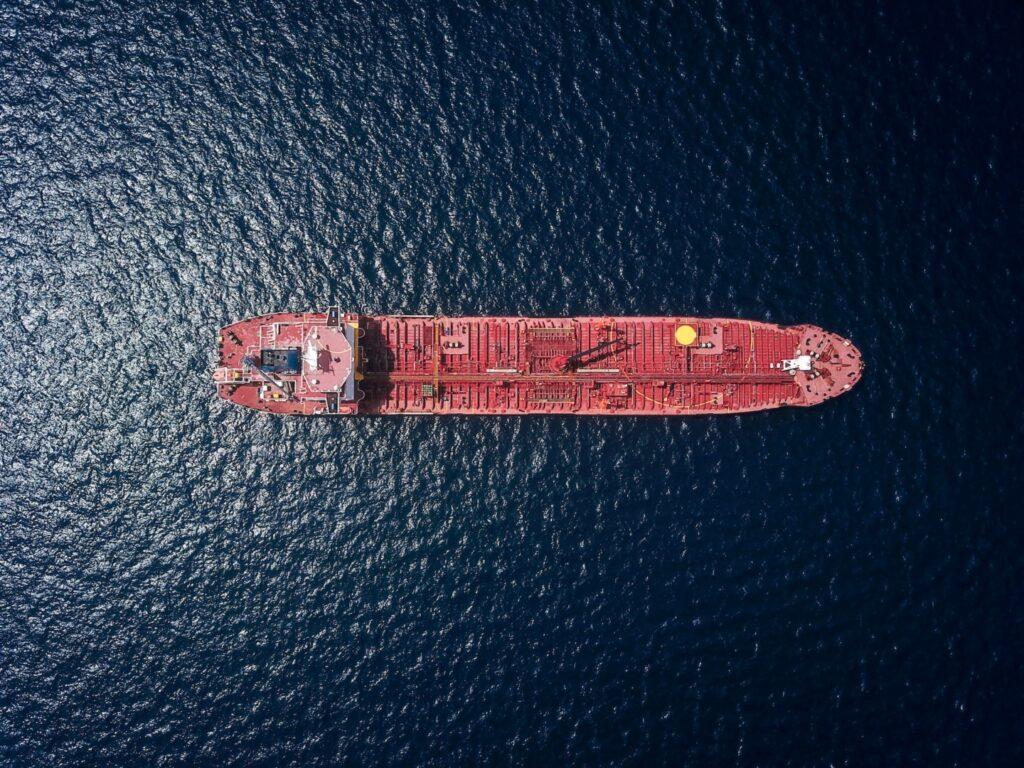

Earlier this month, the U.S. seized 1 million barrels of crude oil from a Greek tanker owned by a company that was declared guilty of smuggling sanctioned Iranian oil.

During his presidential campaign, Biden vowed to renew the lost nuclear deal with Iran. While talks have been slow, renewing the deal would naturally involve stepping back on several of the sanctions imposed by the Trump administration.

Releasing sanctions on Iranian oil could impact the energy industry by pumping more oil into the system. Iran is an OPEC member and the 14th largest oil exporter by official numbers, though it’s believed the country exports a lot more oil through unofficial means.

In 2021, Iran accounted for 24% of oil reserves in the Middle East and 12% in the world, according to the U.S. Energy Information Administration.

If U.S.-Iran talks improve and the countries return to talks of a new nuclear deal, the U.S. would remove sanctions, potentially impacting oil and energy ETFs. These include:

- iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO)

- ProShares Ultra Bloomberg Crude Oil (NYSE:UCO)

- Invesco DB Oil Fund (NYSE:DBO)

- iShares US Oil Equipment & Services ETF (NYSE:IEZ)

Read Next: Dire Consequences’ For Billions: OPEC Blasts IEA’s Fossil Fuel Demand Forecast, Warns Of ‘Energy Chaos’ On Unprecedented Scale — 3 Top Oil Stocks From Wall Street

\Photo: Unsplash

Posted In: DBO IEO IEZ UCO