Shopify Options Trading: A Deep Dive into Market Sentiment

Author: Benzinga Insights | April 24, 2024 11:45am

Deep-pocketed investors have adopted a bearish approach towards Shopify (NYSE:SHOP), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SHOP usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Shopify. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 60% bearish. Among these notable options, 2 are puts, totaling $81,800, and 8 are calls, amounting to $611,974.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $69.0 to $80.0 for Shopify during the past quarter.

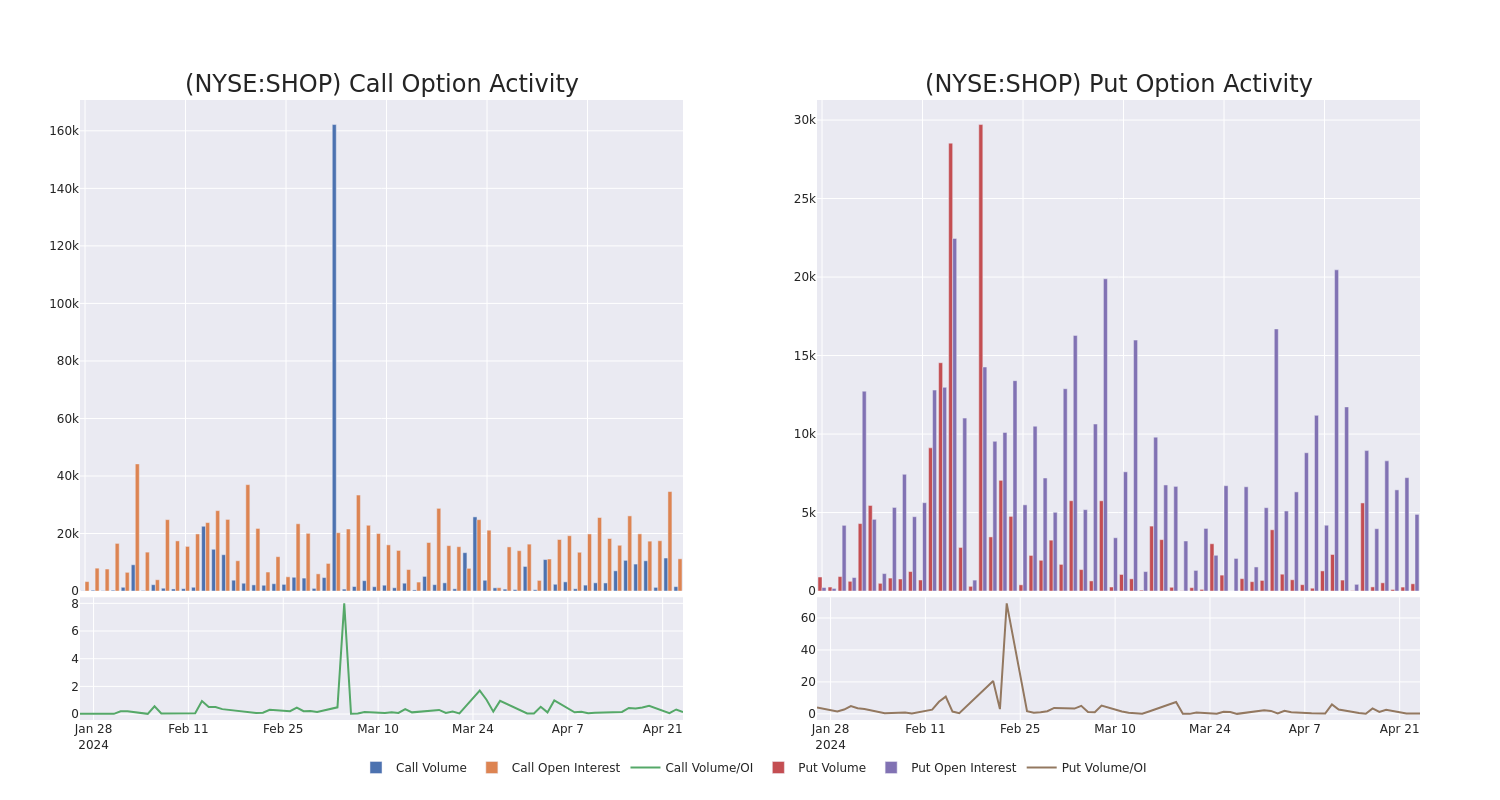

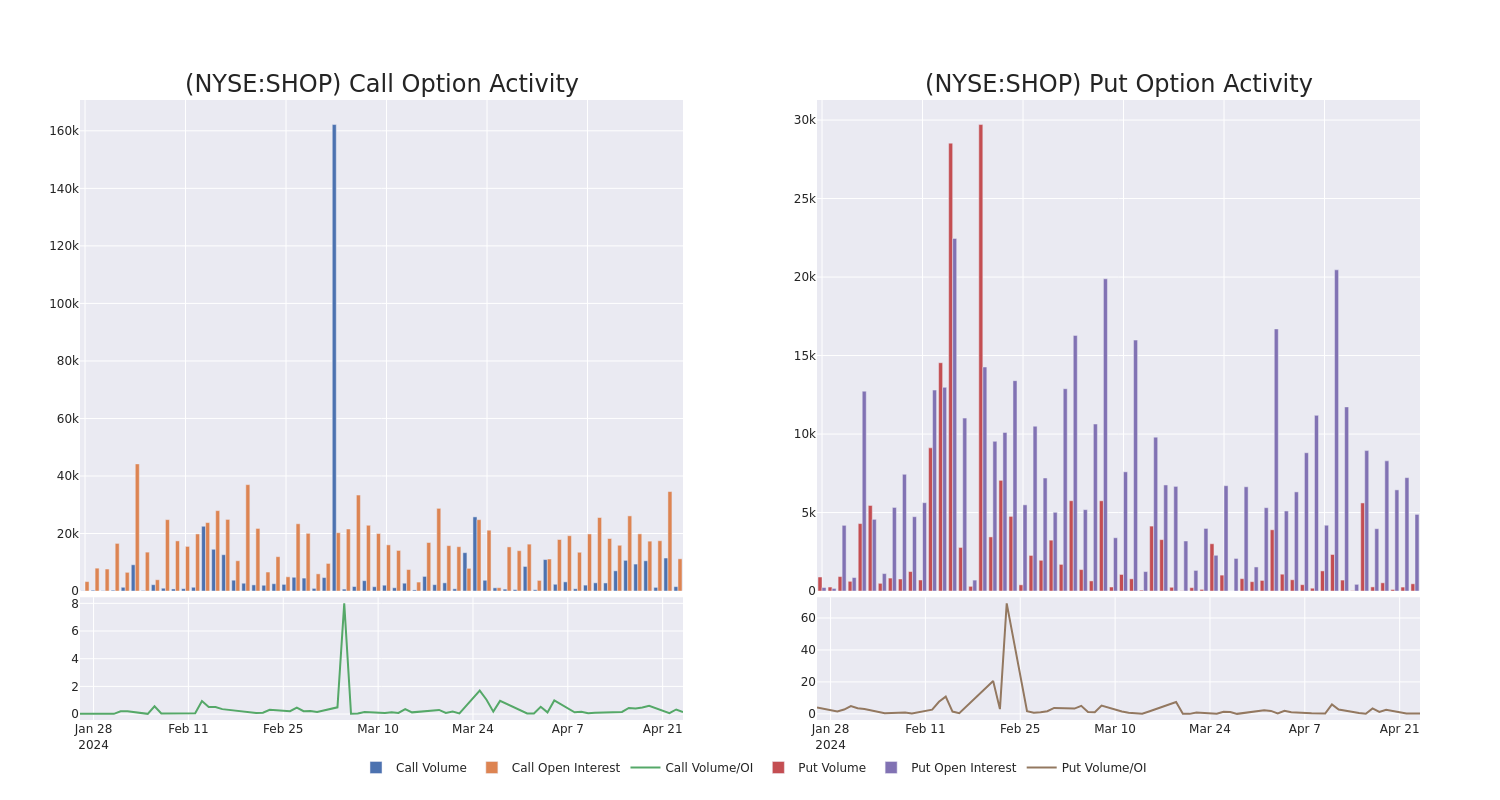

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Shopify options trades today is 2681.33 with a total volume of 1,994.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Shopify's big money trades within a strike price range of $69.0 to $80.0 over the last 30 days.

Shopify Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SHOP |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$7.4 |

$7.35 |

$7.35 |

$75.00 |

$140.4K |

1.3K |

0 |

| SHOP |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$2.28 |

$2.2 |

$2.2 |

$80.00 |

$110.0K |

5.7K |

56 |

| SHOP |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$7.1 |

$7.0 |

$7.0 |

$75.00 |

$105.0K |

1.3K |

519 |

| SHOP |

CALL |

TRADE |

BULLISH |

07/19/24 |

$7.2 |

$7.15 |

$7.2 |

$75.00 |

$72.0K |

1.3K |

269 |

| SHOP |

CALL |

SWEEP |

BULLISH |

05/10/24 |

$6.6 |

$6.45 |

$6.6 |

$69.00 |

$65.9K |

38 |

100 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Where Is Shopify Standing Right Now?

- Trading volume stands at 2,076,687, with SHOP's price down by -2.36%, positioned at $72.26.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 14 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Shopify, Benzinga Pro gives you real-time options trades alerts.

Posted In: SHOP