Shopify Unusual Options Activity For May 03

Author: Benzinga Insights | May 03, 2024 01:46pm

Financial giants have made a conspicuous bullish move on Shopify. Our analysis of options history for Shopify (NYSE:SHOP) revealed 34 unusual trades.

Delving into the details, we found 61% of traders were bullish, while 11% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $265,699, and 26 were calls, valued at $1,173,819.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $90.0 for Shopify over the last 3 months.

Volume & Open Interest Development

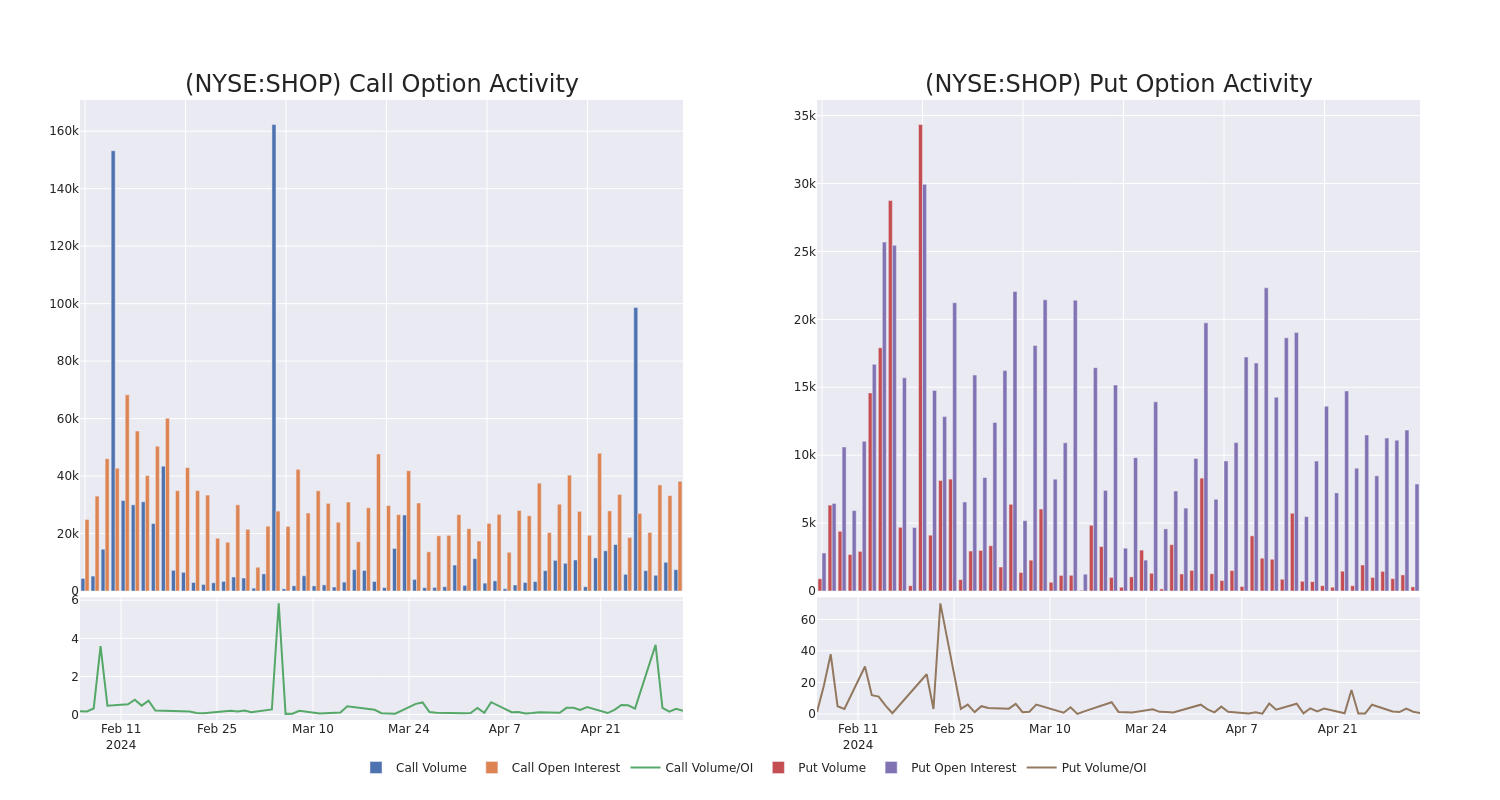

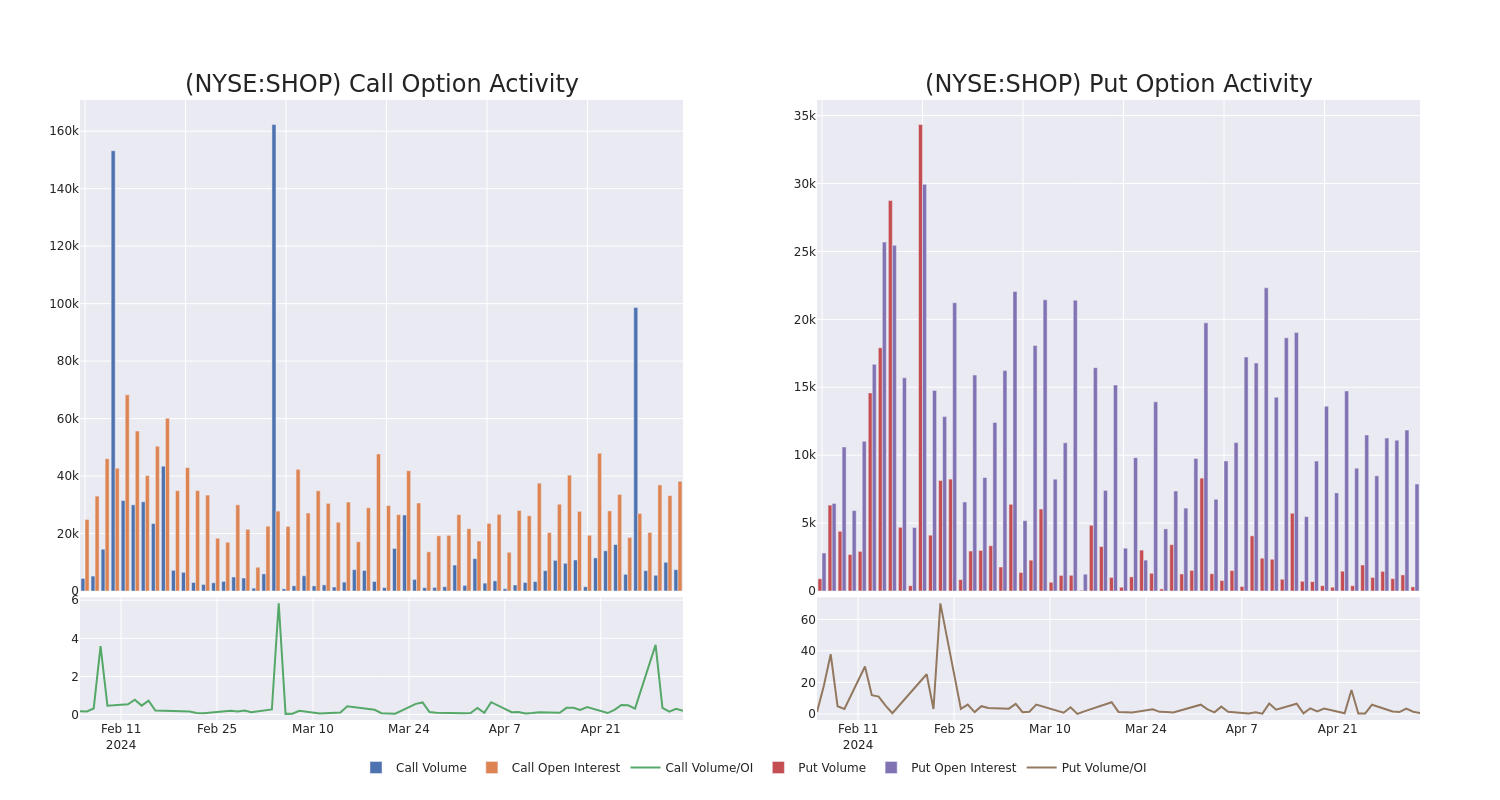

In today's trading context, the average open interest for options of Shopify stands at 1770.65, with a total volume reaching 7,749.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Shopify, situated within the strike price corridor from $50.0 to $90.0, throughout the last 30 days.

Shopify Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| SHOP |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$1.46 |

$1.37 |

$1.37 |

$85.00 |

$123.5K |

5.3K |

385 |

| SHOP |

CALL |

SWEEP |

BEARISH |

07/19/24 |

$6.85 |

$6.8 |

$6.8 |

$75.00 |

$102.0K |

1.7K |

692 |

| SHOP |

CALL |

SWEEP |

BULLISH |

01/17/25 |

$7.6 |

$7.45 |

$7.59 |

$90.00 |

$79.7K |

4.5K |

307 |

| SHOP |

CALL |

TRADE |

NEUTRAL |

05/17/24 |

$2.74 |

$2.61 |

$2.68 |

$80.00 |

$67.0K |

5.4K |

287 |

| SHOP |

CALL |

TRADE |

NEUTRAL |

01/17/25 |

$7.7 |

$7.5 |

$7.61 |

$90.00 |

$64.6K |

4.5K |

222 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

Following our analysis of the options activities associated with Shopify, we pivot to a closer look at the company's own performance.

Shopify's Current Market Status

- With a volume of 4,863,368, the price of SHOP is up 2.85% at $74.05.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 5 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Shopify options trades with real-time alerts from Benzinga Pro.

Posted In: SHOP