Jack Ma Backed Ant Group's Alipay+ Broadens Payment Reach Across Continents: How It's Shaping Global Commerce?

Author: Anusuya Lahiri | May 06, 2024 08:32am

Alibaba Group Holding Limited (NYSE:BABA) fintech affiliate Ant Group is enhancing its global presence through its digital platform, Alipay+, aiming to unify mobile payment apps worldwide.

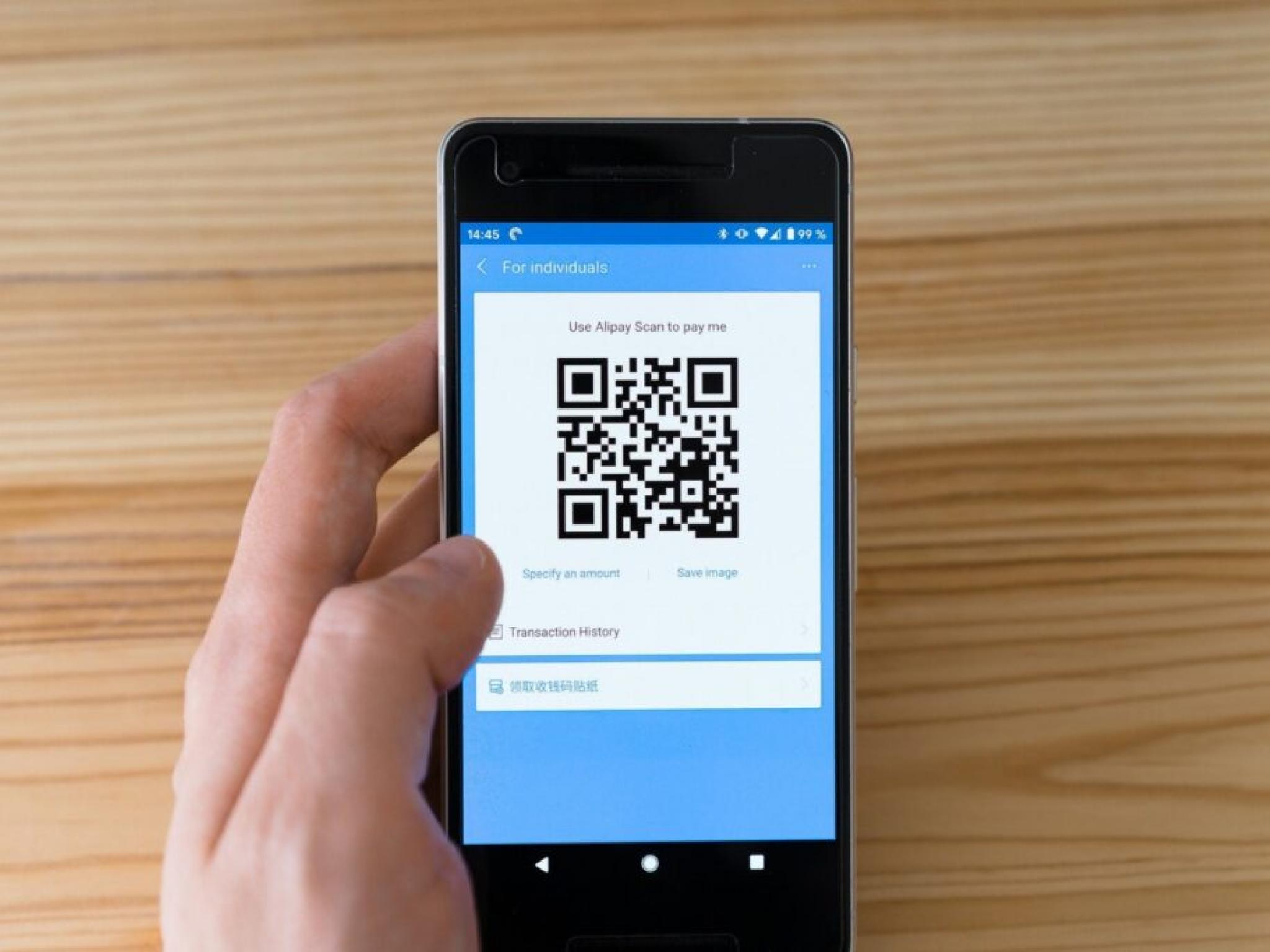

Ant International, the group’s global division, launched Alipay+ in 2020. It allows users to make payments with apps from their home countries via Alipay’s QR code network and local partners abroad.

Douglas Feagin, Senior VP at Ant Group, emphasized that travelers prefer using their trusted home-country e-wallets instead of unfamiliar foreign apps, CNBC reports.

With this in mind, Alipay+ connects 88 million merchants across 57 countries and regions to over 1.5 billion consumer accounts from 25+ e-wallets and banking apps. They partner with digital payment services like Singapore’s SGQR and South Korea’s ZeroPay.

Ant’s early global strategy, focused on Southeast Asia, saw investments in Singapore’s 2C2P and South Korea’s Kakao Pay, which now facilitate their international growth.

The company also expanded into emerging markets like Sri Lanka and Cambodia. It established European partnerships, such as with Italy’s Tinaba and Nexi, and in the Middle East through Dubai Duty Free.

They are focused on large tourism markets like Japan, Thailand, and Singapore while targeting European, Latin American, and Middle Eastern regions to continue growing their merchant coverage.

Prior reports indicated Mastercard Inc (NYSE:MA) enhancing its cross-border remittance capabilities by joining forces with Alipay. This partnership builds on their existing relationship and allows users to transfer and receive money to their digital wallets nearly instantly.

Meanwhile analysts remained positive over Alibaba’s positioning as a key China e-commerce player as it looks to pivot toward building on robust growth in cross-border volumes, and driving revenues in the public cloud market. Analysts consider Alibaba an attractive turnaround story and await more recovery in China for a rebound.

Alibaba stock lost over 2% in the last 12 months. Investors can gain exposure to the stock via Invesco Golden Dragon China ETF (NASDAQ:PGJ) and Tidal Trust II CoreValues Alpha Greater China Growth ETF (NYSE:CGRO).

Price Action: BABA shares closed lower by 3.88% at $70.78 on Thursday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Wikimedia Commons

Posted In: BABA CGRO MA PGJ