NVIDIA's Options: A Look at What the Big Money is Thinking

Author: Benzinga Insights | May 09, 2024 09:47am

Investors with a lot of money to spend have taken a bearish stance on NVIDIA (NASDAQ:NVDA).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NVDA, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 174 uncommon options trades for NVIDIA.

This isn't normal.

The overall sentiment of these big-money traders is split between 35% bullish and 47%, bearish.

Out of all of the special options we uncovered, 67 are puts, for a total amount of $3,607,618, and 107 are calls, for a total amount of $8,191,209.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $695.0 to $1030.0 for NVIDIA over the recent three months.

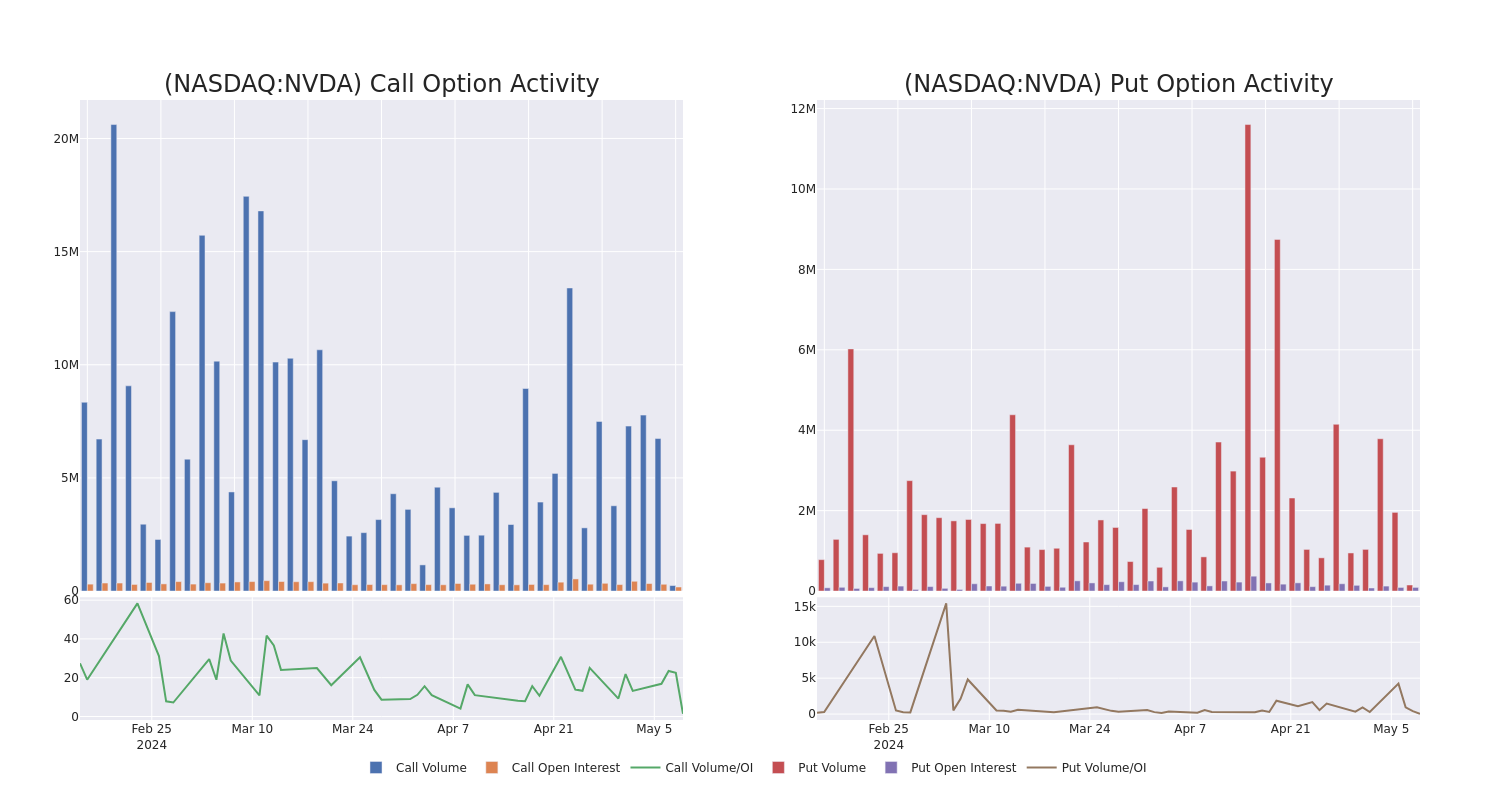

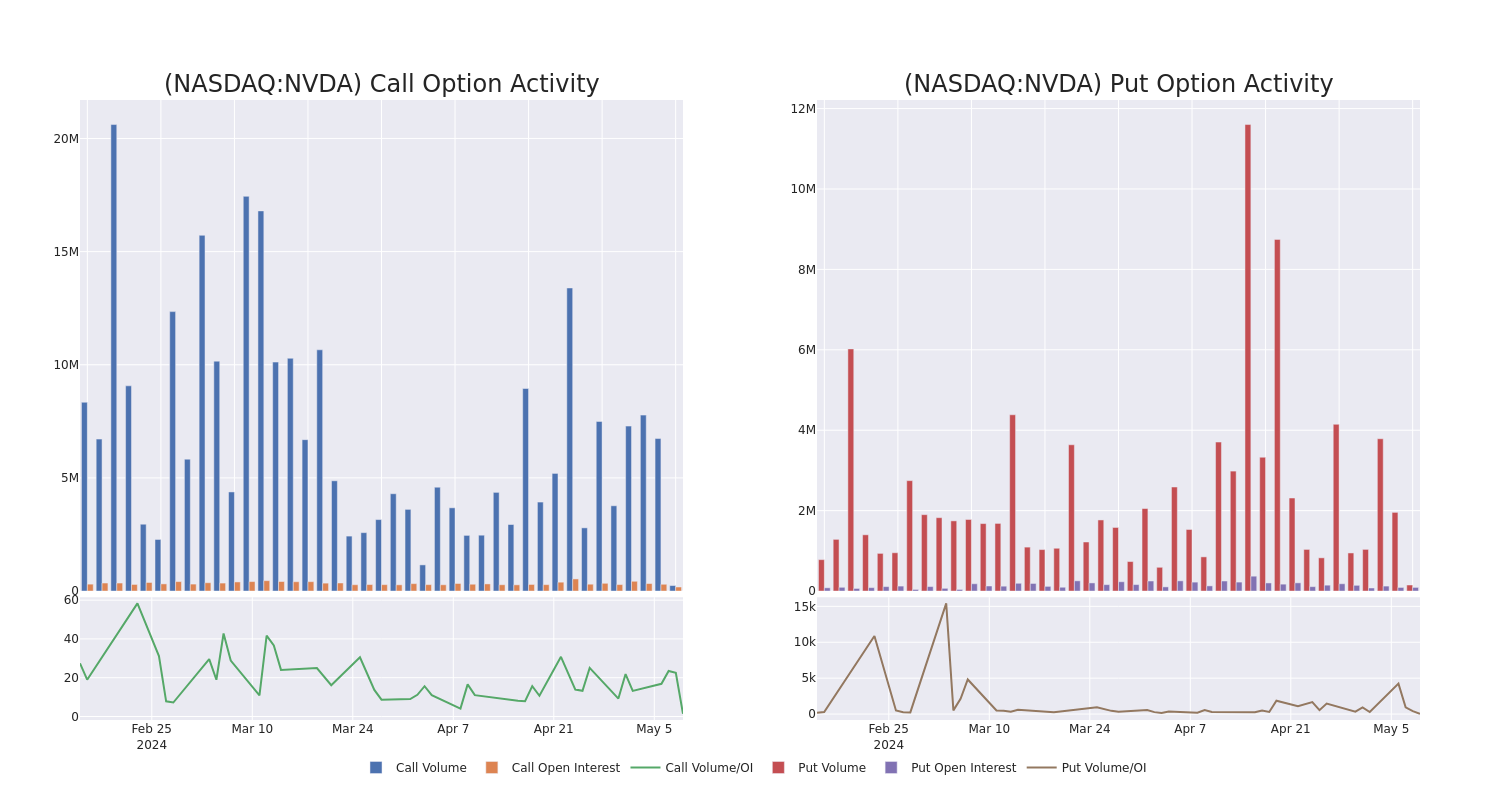

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for NVIDIA options trades today is 5482.82 with a total volume of 377,635.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for NVIDIA's big money trades within a strike price range of $695.0 to $1030.0 over the last 30 days.

NVIDIA Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| NVDA |

PUT |

SWEEP |

BEARISH |

05/17/24 |

$10.45 |

$10.35 |

$10.45 |

$850.00 |

$244.9K |

7.2K |

1.1K |

| NVDA |

CALL |

SWEEP |

BULLISH |

05/10/24 |

$13.9 |

$13.6 |

$13.8 |

$890.00 |

$138.0K |

3.7K |

3.6K |

| NVDA |

PUT |

SWEEP |

NEUTRAL |

05/10/24 |

$12.95 |

$12.85 |

$12.85 |

$890.00 |

$125.4K |

4.7K |

5.0K |

| NVDA |

PUT |

TRADE |

BEARISH |

05/17/24 |

$31.0 |

$30.95 |

$31.0 |

$900.00 |

$124.0K |

5.5K |

1.3K |

| NVDA |

CALL |

SWEEP |

BEARISH |

05/17/24 |

$22.75 |

$22.5 |

$22.5 |

$900.00 |

$121.5K |

14.9K |

2.1K |

About NVIDIA

Nvidia is a leading developer of graphics processing units. Traditionally, GPUs were used to enhance the experience on computing platforms, most notably in gaming applications on PCs. GPU use cases have since emerged as important semiconductors used in artificial intelligence. Nvidia not only offers AI GPUs, but also a software platform, Cuda, used for AI model development and training. Nvidia is also expanding its data center networking solutions, helping to tie GPUs together to handle complex workloads.

NVIDIA's Current Market Status

- Trading volume stands at 1,372,535, with NVDA's price up by 0.36%, positioned at $907.42.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 13 days.

Expert Opinions on NVIDIA

4 market experts have recently issued ratings for this stock, with a consensus target price of $1127.5.

- Consistent in their evaluation, an analyst from Raymond James keeps a Strong Buy rating on NVIDIA with a target price of $1100.

- Consistent in their evaluation, an analyst from UBS keeps a Buy rating on NVIDIA with a target price of $1150.

- An analyst from Evercore ISI Group has revised its rating downward to Outperform, adjusting the price target to $1160.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Buy rating for NVIDIA, targeting a price of $1100.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for NVIDIA, Benzinga Pro gives you real-time options trades alerts.

Posted In: NVDA