Taiwan Semiconductor's Options Frenzy: What You Need to Know

Author: Benzinga Insights | May 09, 2024 10:17am

High-rolling investors have positioned themselves bullish on Taiwan Semiconductor (NYSE:TSM), and it's important for retail traders to take note.

\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in TSM often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 16 options trades for Taiwan Semiconductor. This is not a typical pattern.

The sentiment among these major traders is split, with 43% bullish and 31% bearish. Among all the options we identified, there was one put, amounting to $75,200, and 15 calls, totaling $1,198,319.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $155.0 for Taiwan Semiconductor over the last 3 months.

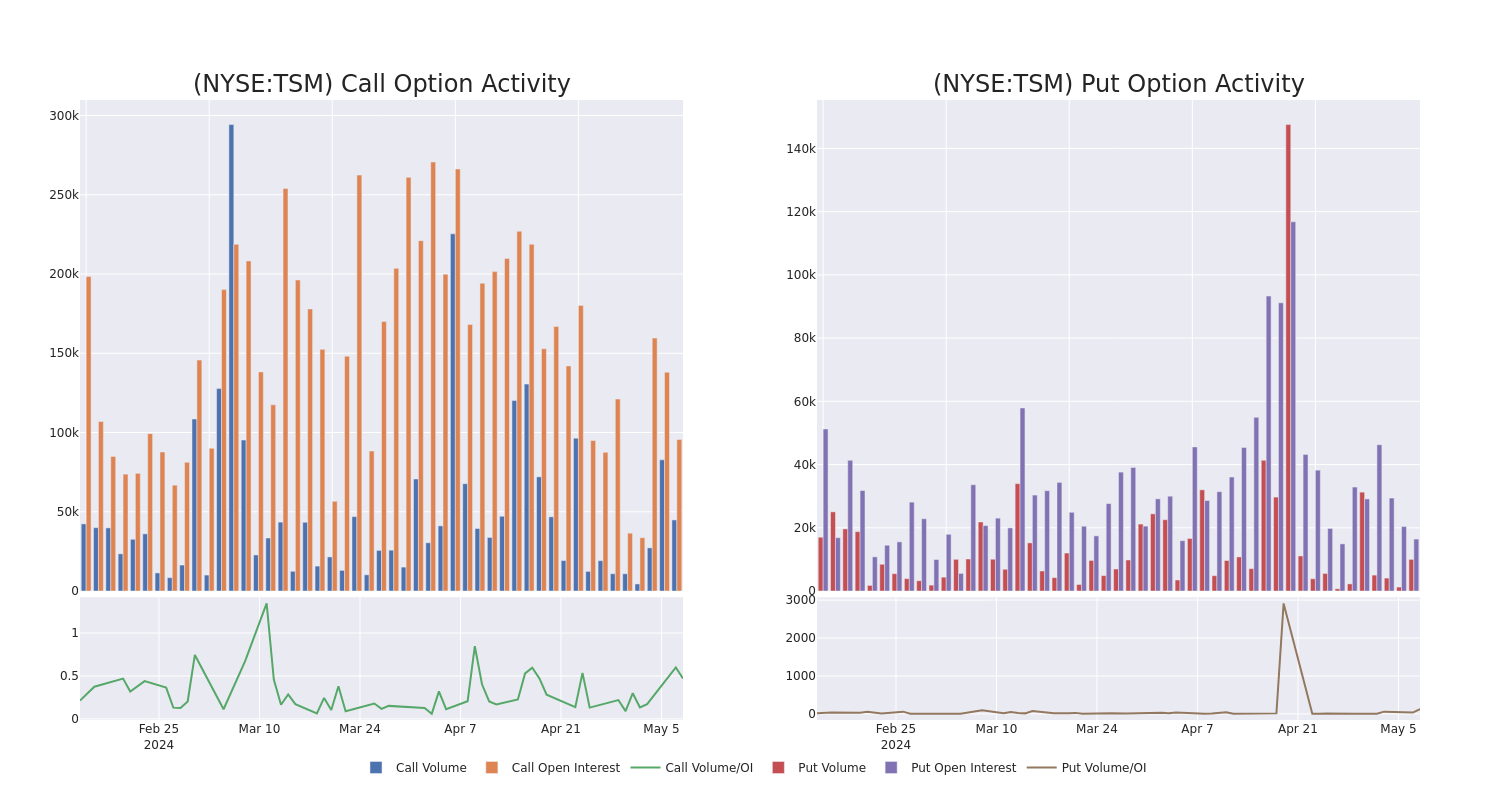

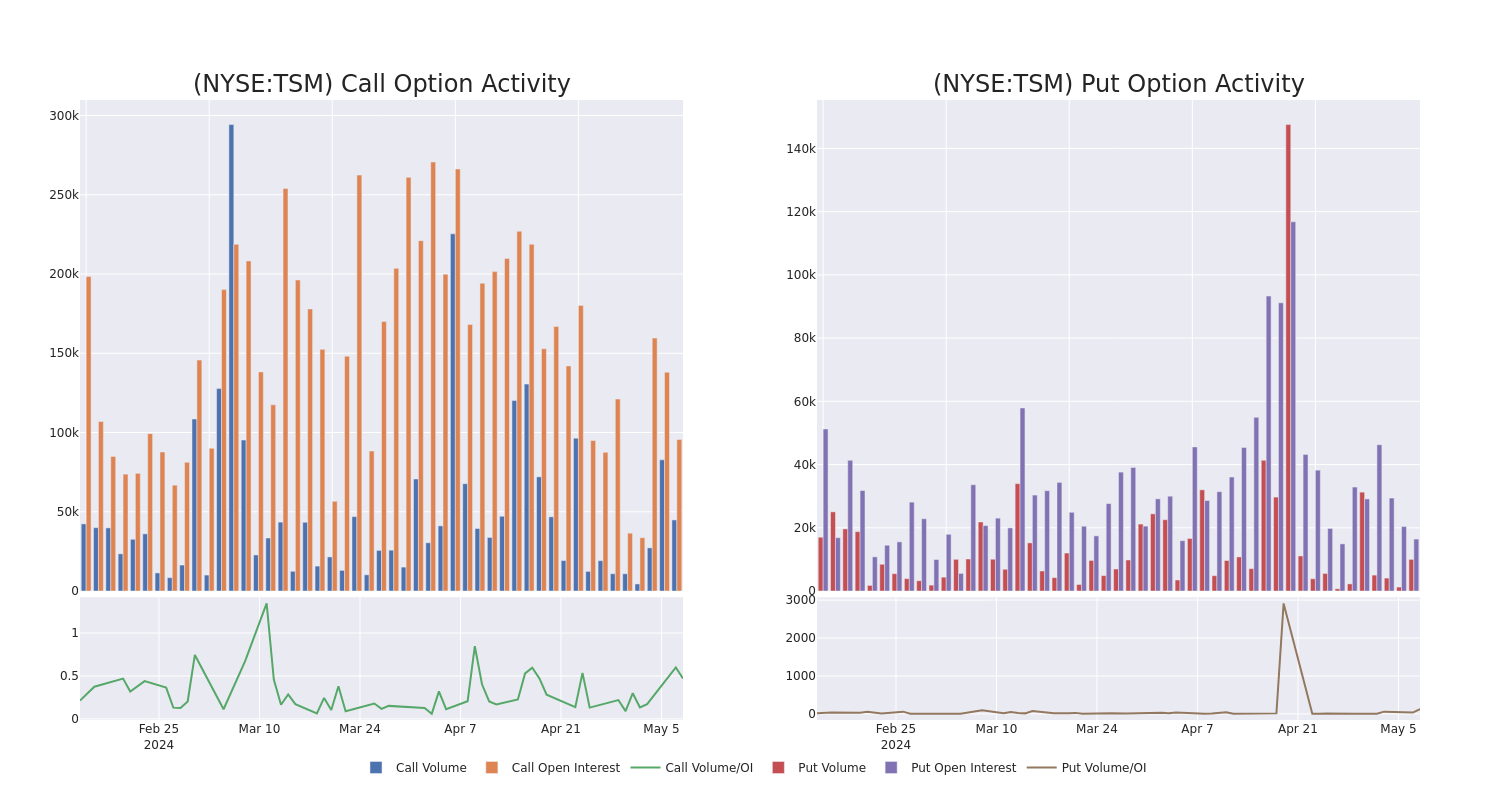

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Taiwan Semiconductor's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Taiwan Semiconductor's substantial trades, within a strike price spectrum from $90.0 to $155.0 over the preceding 30 days.

Taiwan Semiconductor Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

| TSM |

CALL |

TRADE |

BEARISH |

05/17/24 |

$54.4 |

$52.05 |

$52.05 |

$90.00 |

$520.5K |

559 |

0 |

| TSM |

CALL |

TRADE |

BEARISH |

06/21/24 |

$5.1 |

$5.05 |

$5.05 |

$145.00 |

$101.0K |

10.4K |

26 |

| TSM |

PUT |

SWEEP |

BULLISH |

09/20/24 |

$9.5 |

$9.4 |

$9.4 |

$140.00 |

$75.2K |

1.4K |

0 |

| TSM |

CALL |

SWEEP |

BULLISH |

06/21/24 |

$7.3 |

$7.15 |

$7.25 |

$140.00 |

$71.7K |

29.1K |

164 |

| TSM |

CALL |

TRADE |

BULLISH |

05/17/24 |

$5.55 |

$5.4 |

$5.5 |

$138.00 |

$55.0K |

384 |

300 |

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world's largest dedicated chip foundry, with almost 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the U.S. in 1997. TSMC's scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Current Position of Taiwan Semiconductor

- With a volume of 1,865,392, the price of TSM is down -1.5% at $141.45.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 70 days.

What Analysts Are Saying About Taiwan Semiconductor

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $162.0.

- An analyst from Needham has decided to maintain their Buy rating on Taiwan Semiconductor, which currently sits at a price target of $168.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $168.

- An analyst from Barclays has decided to maintain their Overweight rating on Taiwan Semiconductor, which currently sits at a price target of $150.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Taiwan Semiconductor with Benzinga Pro for real-time alerts.

Posted In: TSM