Gold Gains 1%; ISM Services PMI Surges In May

Author: Avi Kapoor | June 05, 2024 12:00pm

U.S. stocks traded higher midway through trading, with the Nasdaq Composite surging over 1% on Wednesday.

The Dow traded up 0.04% to 38,728.39 while the NASDAQ rose 1.21% to 17,060.58. The S&P 500 also rose, gaining, 0.59% to 5,322.59.

Check This Out: Keurig Dr Pepper To Rally Around 18%? Here Are 10 Top Analyst Forecasts For Wednesday

Leading and Lagging Sectors

Information technology shares rose by 1.6% on Wednesday.

In trading on Wednesday, energy shares fell by 0.6%.

Top Headline

The ISM services PMI climbed to 53.8 in May, notching the highest level in nine months, and topping market expectations of 50.8.

Equities Trading UP

- Actelis Networks, Inc. (NASDAQ:ASNS) shares shot up 655% to $3.55 after the company announced orders for cyber-hardened networking technology to be deployed at three US military bases.

- Shares of Moving iMage Technologies, Inc. (NASDAQ:MITQ) got a boost, surging 64% to $1.15 after the company was awarded a multi-million dollar contract.

- WalkMe Ltd. (NASDAQ:WKME) shares were also up, gaining 42% to $13.72 after the company announced it entered into a definitive agreement to be acquired by SAP.

Equities Trading DOWN

- Silo Pharma, Inc. (NASDAQ:SILO) shares dropped 31% to $1.56 after the company announced a $2 million registered direct offering.

- Shares of Volcon, Inc. (NASDAQ:VLCN) were down 19% to $0.1350 after the company announced a 1-for-100 reverse stock split.

- SPAR Group, Inc. (NASDAQ:SGRP) was down, falling 22% to $2.22 after the company announced that it entered into a letter of intent to go private with Highwire Capital.

Also Check This Out: Top 4 Consumer Stocks That May Implode In Q2

Commodities

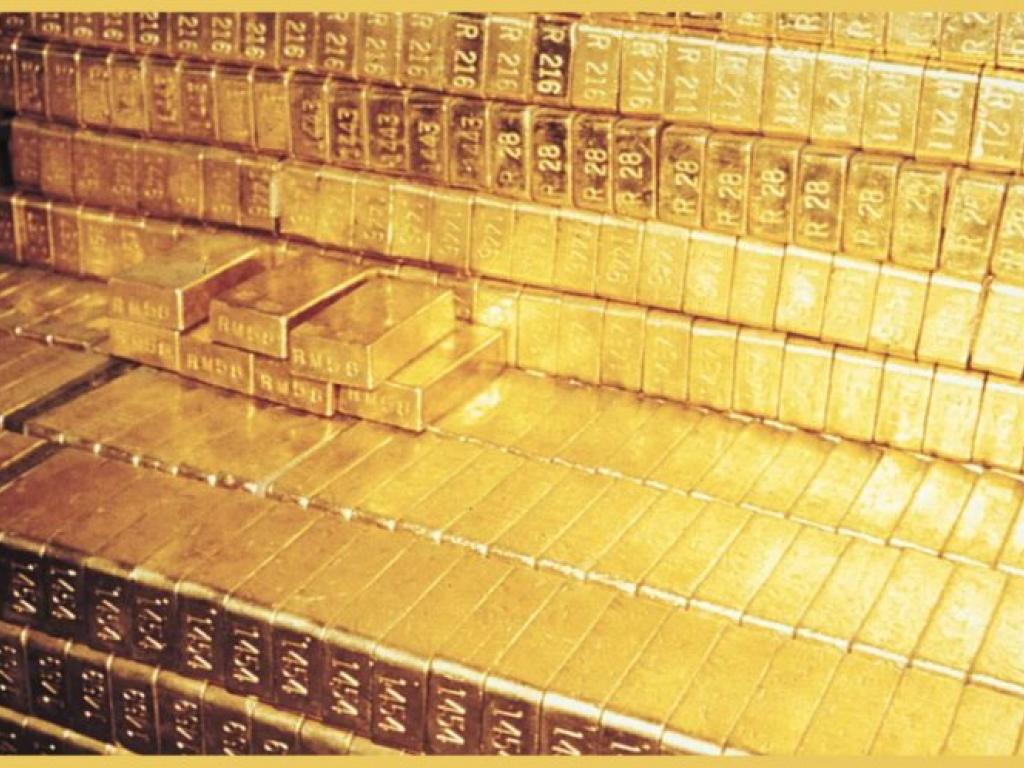

In commodity news, oil traded down 0.2% to $73.09 while gold traded up 1% at $2,370.90.

Silver traded up 0.9% to $29.885 on Wednesday, while copper rose 0.2% to $4.5440.

Euro zone

European shares were higher today. The eurozone's STOXX 600 rose 0.81%, Germany's DAX gained 0.85% and France's CAC 40 rose 0.85%. Spain's IBEX 35 Index jumped 0.52%, while London's FTSE 100 rose 0.30%.

The HCOB Eurozone services PMI fell to 53.2 in May versus a preliminary reading of 53.3. The S&P Global UK services PMI declined to 52.9 in May compared to the one-year high level of 55 in the prior month. The HCOB Germany services PMI rose to 54.2 in May versus a preliminary reading of 53.9. The HCOB France services PMI declined to 49.3 in May versus 51.3 a month ago.

Asia Pacific Markets

Asian markets closed mostly lower on Wednesday, with Japan's Nikkei falling 0.89%, China's Composite Index falling 0.83%, Hong Kong's Hang Seng Index falling 0.10% and India's S&P BSE Sensex jumping 3.20%.

The HSBC India services PMI was revised lower to 60.4 in May versus a preliminary reading of 61.4, while Caixin China general services PMI rose to 54.0 in May from 52.5 a month ago. The au Jibun Bank Japan services PMI rose to 53.8 in May versus a preliminary level of 53.6, while the S&P Global Hong Kong SAR PMI declined to 49.2 in May.

The Australian economy grew by 0.1% quarter-over-quarter in the fourth quarter, while Judo Bank flash Australia services PMI business activity index declined to 52.5 in from 53.6 in the previous month.

Economics

U.S. mortgage applications fell by 5.2% in the final week of May.

U.S. private businesses added 152,000 workers to their payrolls in May, compared to market estimates of 173,000 and down from 192,000 in April.

The S&P Global services PMI came in at 54.8 in May, unrevised versus the preliminary reading.

The ISM services PMI climbed to 53.8 in May, notching the highest level in nine months, and topping market expectations of 50.8.

The EIA said stocks of crude oil in the US increased by 1.233 million barrels in the week ending May 31, versus market estimates of a 2.30 million-barrel decline.

Now Read This: Owens & Minor, O’Reilly Automotive And 2 Other Stocks Insiders Are Selling

Posted In: ASNS MITQ SGRP SILO VLCN WKME