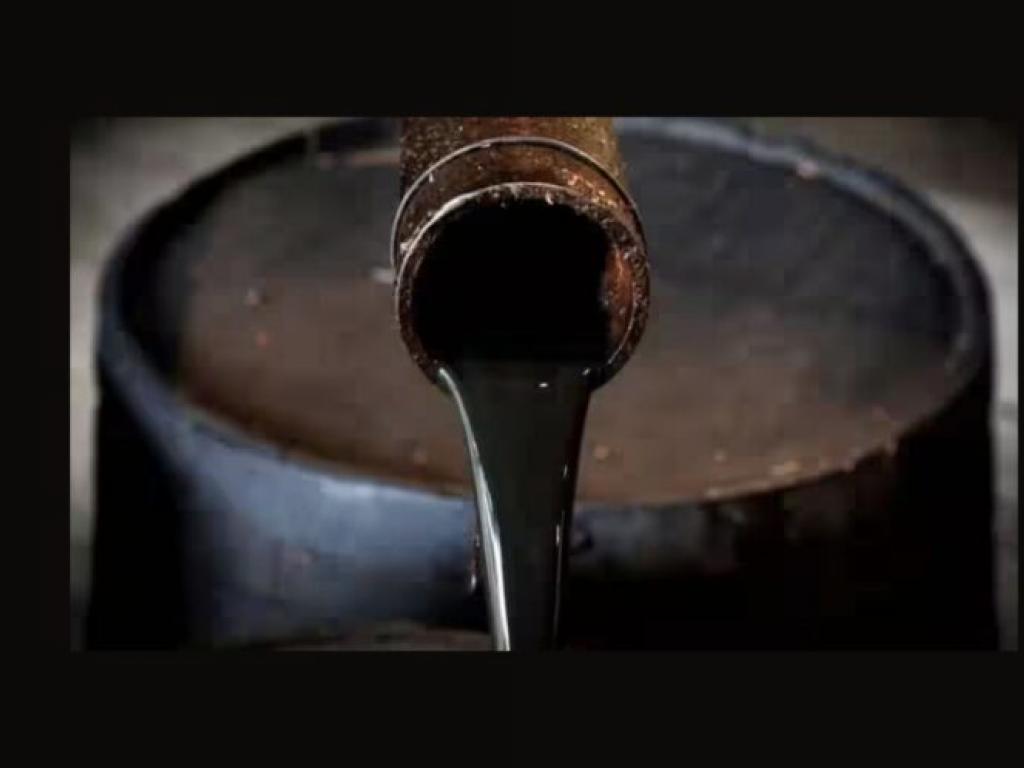

Crude Oil Rises 1%; Dollar Tree Shares Fall After Q1 Results

Author: Avi Kapoor | June 05, 2024 02:37pm

U.S. stocks traded higher toward the end of trading, with the Dow Jones gaining over 100 points on Wednesday.

The Dow traded up 0.33% to 38,840.06 while the NASDAQ rose 1.70% to 17,143.85. The S&P 500 also rose, gaining, 1.03% to 5,345.70.

Check This Out: Keurig Dr Pepper To Rally Around 18%? Here Are 10 Top Analyst Forecasts For Wednesday

Leading and Lagging Sectors

Information technology shares rose by 2.4% on Wednesday.

In trading on Wednesday, consumer staples shares fell by 0.6%.

Top Headline

Dollar Tree Inc (NASDAQ:DLTR) shares fell over 5% on Wednesday after the company reported its first-quarter FY24 earnings and announced a review of strategic alternatives for its Family Dollar business segment.

The company reported first-quarter FY24 sales growth of 4.22% at $7.63 billion, which was in-line with the analyst consensus estimate. Same-store sales increased 1.7% for the Dollar Tree segment, 0.1% for Family Dollar, and 1% for Enterprise. Adjusted EPS of $1.43 beat the consensus estimate of $1.42.

Equities Trading UP

- Actelis Networks, Inc. (NASDAQ:ASNS) shares shot up 704% to $3.78 after the company announced orders for cyber-hardened networking technology to be deployed at three US military bases.

- Shares of Moving iMage Technologies, Inc. (NASDAQ:MITQ) got a boost, surging 50% to $1.0501 after the company was awarded a multi-million dollar contract.

- WalkMe Ltd. (NASDAQ:WKME) shares were also up, gaining 42% to $13.73 after the company announced it entered into a definitive agreement to be acquired by SAP.

Equities Trading DOWN

- Silo Pharma, Inc. (NASDAQ:SILO) shares dropped 36% to $1.4499 after the company announced a $2 million registered direct offering.

- Shares of Volcon, Inc. (NASDAQ:VLCN) were down 21% to $0.1324 after the company announced a 1-for-100 reverse stock split.

- SPAR Group, Inc. (NASDAQ:SGRP) was down, falling 24% to $2.16 after the company announced that it entered into a letter of intent to go private with Highwire Capital.

Also Check This Out: Top 4 Consumer Stocks That May Implode In Q2

Commodities

In commodity news, oil traded up 1% to $74.00 while gold traded up 1.1% at $2,373.90.

Silver traded up 1.6% to $30.095 on Wednesday, while copper rose 1.7% to $4.6130.

Euro zone

European shares were higher today. The eurozone's STOXX 600 rose 0.81%, Germany's DAX gained 0.93% and France's CAC 40 rose 0.87%. Spain's IBEX 35 Index jumped 0.59%, while London's FTSE 100 rose 0.18%.

The HCOB Eurozone services PMI fell to 53.2 in May versus a preliminary reading of 53.3. The S&P Global UK services PMI declined to 52.9 in May compared to the one-year high level of 55 in the prior month. The HCOB Germany services PMI rose to 54.2 in May versus a preliminary reading of 53.9. The HCOB France services PMI declined to 49.3 in May versus 51.3 a month ago.

Asia Pacific Markets

Asian markets closed mostly lower on Wednesday, with Japan's Nikkei falling 0.89%, China's Composite Index falling 0.83%, Hong Kong's Hang Seng Index falling 0.10% and India's S&P BSE Sensex jumping 3.20%.

The HSBC India services PMI was revised lower to 60.4 in May versus a preliminary reading of 61.4, while Caixin China general services PMI rose to 54.0 in May from 52.5 a month ago. The au Jibun Bank Japan services PMI rose to 53.8 in May versus a preliminary level of 53.6, while the S&P Global Hong Kong SAR PMI declined to 49.2 in May.

The Australian economy grew by 0.1% quarter-over-quarter in the fourth quarter, while Judo Bank flash Australia services PMI business activity index declined to 52.5 in from 53.6 in the previous month.

Economics

- U.S. mortgage applications fell by 5.2% in the final week of May.

- U.S. private businesses added 152,000 workers to their payrolls in May, compared to market estimates of 173,000 and down from 192,000 in April.

- The S&P Global services PMI came in at 54.8 in May, unrevised versus the preliminary reading.

- The ISM services PMI climbed to 53.8 in May, notching the highest level in nine months, and topping market expectations of 50.8.

- The EIA said stocks of crude oil in the US increased by 1.233 million barrels in the week ending May 31, versus market estimates of a 2.30 million-barrel decline.

Now Read This: Owens & Minor, O’Reilly Automotive And 2 Other Stocks Insiders Are Selling

Posted In: ASNS DLTR MITQ SGRP SILO VLCN WKME