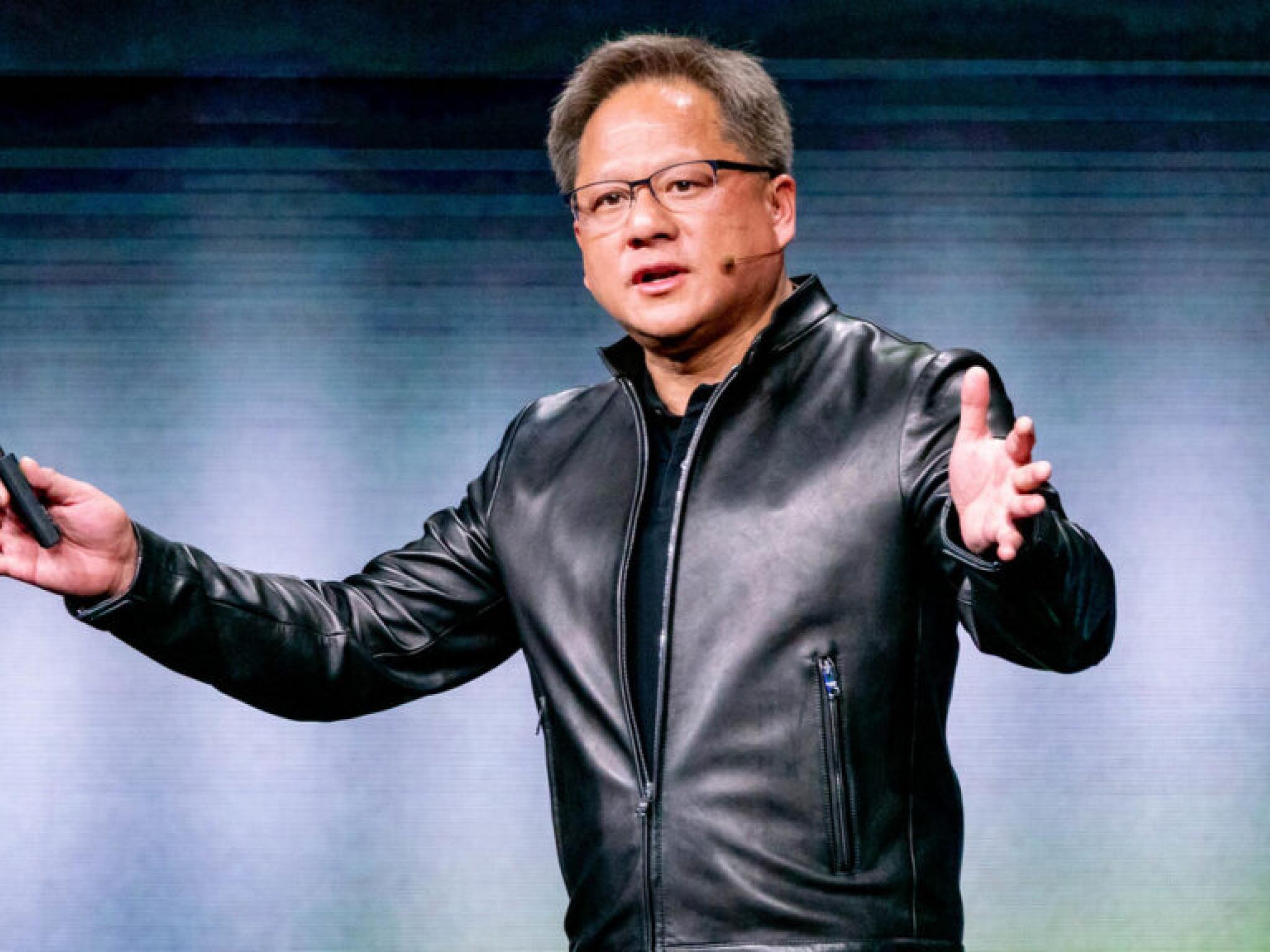

Nvidia CEO Jensen Huang Sells Over $29M Worth Of Shares As Company's Stock Shoots Up 155% In 2024 Amid AI Frenzy

Author: Kaustubh Bagalkote | July 02, 2024 11:34pm

Nvidia Corp (NASDAQ:NVDA) CEO Jensen Huang has sold over $29 million worth of shares amid the company’s remarkable stock market performance.

What Happened: Huang, often referred to as the “Godfather of GPU,” has been offloading his shares as Nvidia’s stock continues to soar. The CEO’s recent sales, disclosed in U.S. Securities and Exchange Commission filings, amount to $29,401,823, bringing his total sales to $184 million over the past three weeks.

Nvidia’s stock reached its peak in June, driving the company’s market value to over $3 trillion. This surge underscored Nvidia’s dominant position in the tech industry, largely due to its focus on developing advanced chips for artificial intelligence applications.

Huang’s leadership has been pivotal in Nvidia’s ascent. His recent share sales coincide with the company’s continued dominance in AI technology and its close competition with tech giants Microsoft and Apple in the race to achieve a $4 trillion market capitalization.

Read Also: GameStop Shares Take A Hit After ‘Roaring Kitty’ Discloses 6.6% Stake In Chewy And Faces A Manipulation Lawsuit

Why It Matters: Huang’s recent share sales are part of a larger trend. In the last week of June, the CEO offloaded shares worth over $90 million, bringing his total sales to $184 million over the past three weeks. This move coincided with Nvidia’s surge in the stock market, briefly making it the largest company by market capitalization.

Not everyone has benefited equally from Nvidia’s rapid rise. At a recent shareholder meeting, Masayoshi Son, founder of SoftBank Group, expressed regret over the decision to sell the company’s stake in Nvidia, which cost SoftBank a potential windfall of $157 billion.

Despite the parallels drawn between Nvidia’s rise and the dot-com era, former Cisco Systems CEO John Chambers emphasized that the dynamics of the AI revolution are distinct from previous tech booms.

Earlier in June, Nvidia’s stock hit a market capitalization of over $3 trillion for the first time, briefly surpassing Apple and Microsoft as the most valuable company in the world. This added to the year-to-date gains for Nvidia CEO Huang’s wealth, which has soared in 2024 due to strong first-quarter earnings and guidance.

Price Action: Nvidia closed at $122.67 on Tuesday, down $1.63 or 1.31% for the day. In after-hours trading, the stock further declined 0.47%. Despite the recent dip, NVDA has shown impressive growth year to date, surging 154.66%, according to data from Benzinga Pro.

Read Next:

Image via Flickr/ Hillel Steinberg

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Posted In: NVDA