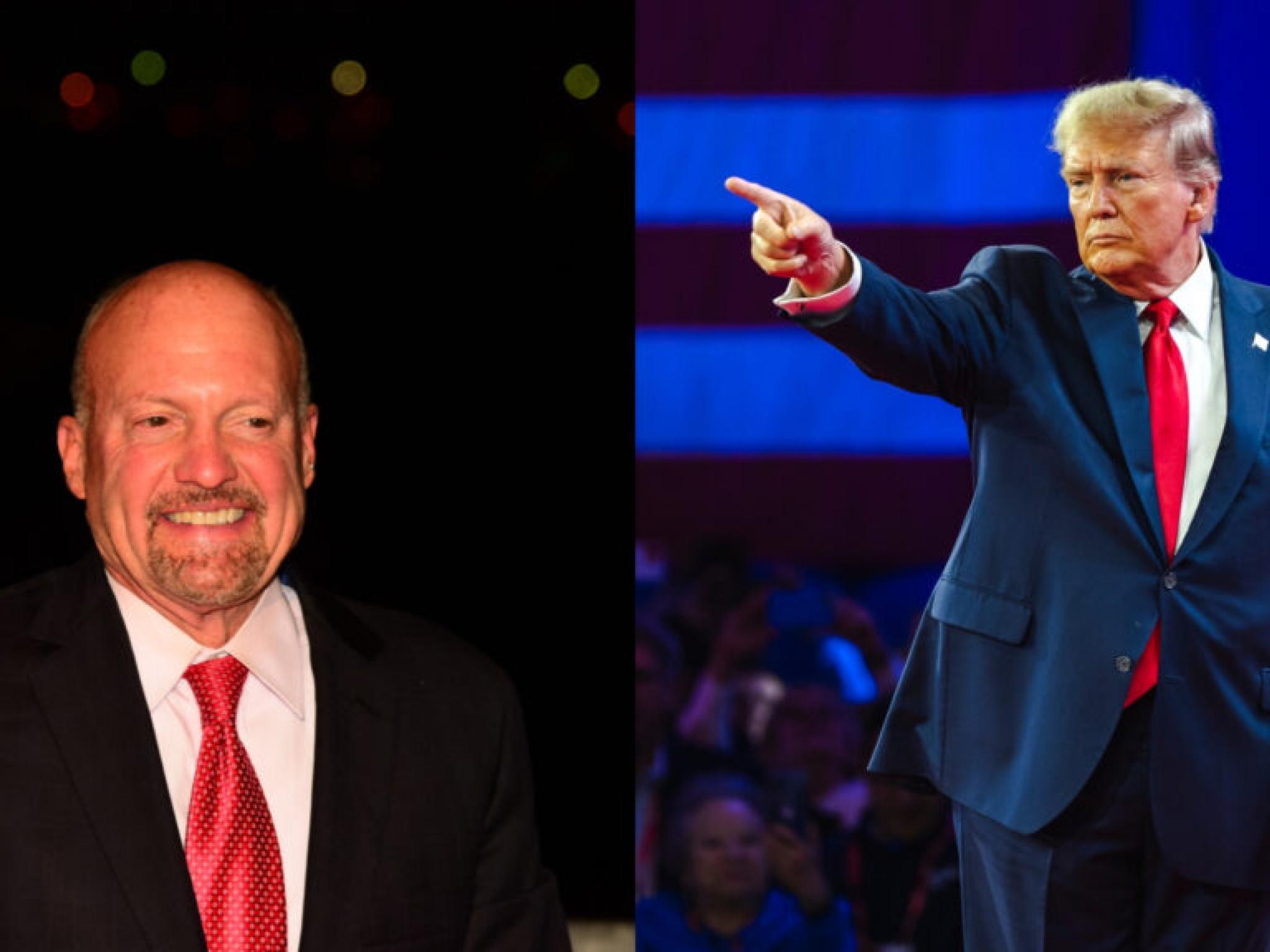

Jim Cramer Says These Stocks Could Soar Or Sink If Trump Wins 2024 Election

Author: Benzinga Neuro | July 16, 2024 12:49am

Jim Cramer has identified a list of stocks that could experience significant gains or losses if Donald Trump secures the 2024 presidential election.

What Happened: Cramer, the host of “Mad Money,” highlighted the potential stock market impacts of a Trump re-election on his show. He noted that the recent assassination attempt on Trump has led to increased speculation about his chances of winning against President Joe Biden in the upcoming election, reported CNBC.

"After this weekend, it sure seems like the Trump stocks are back," Cramer said. "Just keep in mind that plenty of companies are great enough to transcend politics, and sometimes what counts as a Trump stock can change on a dime."

Cramer suggested that Trump’s administration would likely be more amenable to mergers and acquisitions, which could benefit major investment banks such as JPMorgan Chase & Co (NYSE:JPM), Goldman Sachs Group Inc (NYSE:GS), Morgan Stanley (NYSE:MS), and Bank of America Corp (NYSE:BAC).

He also predicted that environmental policy changes under a Trump administration could negatively impact companies like Enphase Energy Inc (NASDAQ:ENPH), Solaredge Technologies Inc (NASDAQ:SEDG), Sunrun Inc (NASDAQ:RUN), and Sunnova Energy International Inc (NYSE:NOVA).

"Eight years ago, in a moment gripped by political fever, I put a button on my sound board that said ‘Trump stock, Trump stock,' Cramer said. "After this weekend's events, it looks like I have to bring it back."

See Also: Nvidia’s Stock Surge Raises Concentration Risks For Investors, Warns Analyst: Not ‘Smart…To Have That Many Eggs In One Basket‘

Why It Matters: Cramer has previously emphasized the potential benefits of a Trump presidency for the stock market. Cramer in July suggested that Trump’s return to the White House could be “good for your portfolio,” citing Trump’s focus on stock market performance as a key factor.

Moreover, Cramer has highlighted JPMorgan as a significant beneficiary of the AI boom. He predicted that the company would reap substantial benefits from advancements in AI technology, which could be further amplified under a Trump administration.

Recent events have also influenced market sentiment. An assassination attempt on Trump on Jul. 13, has led to increased optimism about his chances of winning the 2024 election. This has resulted in a rally for Trump-linked stocks.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Posted In: BAC ENPH GS JPM MS NOVA RUN SEDG