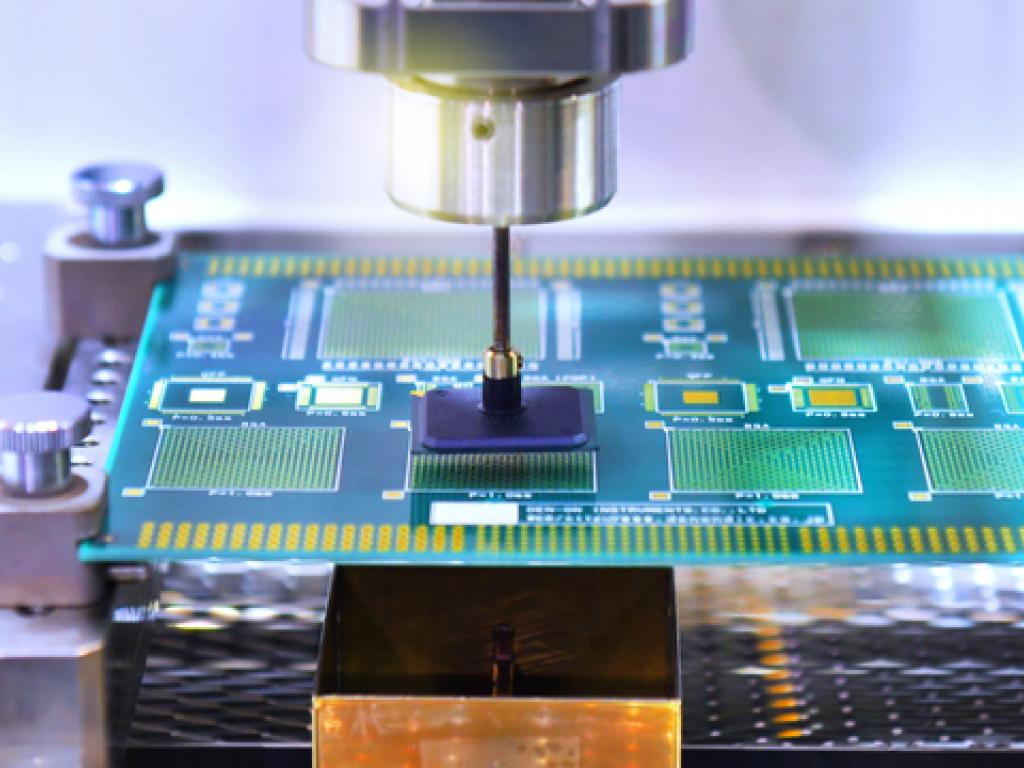

ASML Expected To Beat Estimates With Over $5B In Orders During Q2 Thanks To Rising AI Chip Demand

Author: Benzinga Neuro | July 16, 2024 03:59am

ASML Holding NV (NASDAQ:ASML), the leading supplier of equipment to computer chip manufacturers, is poised to witness a surge in new orders, driven by the escalating demand for AI chips. This development is likely to be announced on Wednesday when the company’s new CEO presents the second-quarter results.

What Happened: The anticipated influx of orders is attributed to the increasing demand for AI chips, a trend that is expected to prompt ASML’s clients to expand their production capacity, reported Reuters.

“We expect ASML’s order received value to reach close to €5 billion (approx. $5.45 billion) in the second quarter, higher than consensus estimates”, Mihuzo analyst Kevin Wang said, with robust orders from TSMC for ASML’s EUV product line.

This surge is largely driven by robust orders from key players in the cutting-edge chip manufacturing sector, such as Taiwan’s Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:TSM), which produces chips for NVIDIA Corp. (NASDAQ:NVDA) and Apple Inc. (NASDAQ:AAPL).

ASML’s new CEO, Christophe Fouquet, is expected to present these results amid the ongoing U.S.-China chip dispute. The company, valued at approximately €400 billion (approx. $436 billion), has projected 2024 as a “transition” year, with a strong rebound in 2025 due to the demand for its most advanced tools.

See Also: No More Getting High On Hemp In America? Multiple States Begin Intoxicating Hemp Crackdown

Why It Matters: The anticipated surge in orders for ASML comes amid a broader context of geopolitical and market dynamics. The U.S. has been pressuring Japan and the Netherlands recently to tighten export controls on chipmaking equipment to China.

This move aims to restrict China’s access to advanced semiconductor technology, which could enhance its military capabilities. This development is part of a broader strategy to maintain technological superiority and national security.

Moreover, ASML has been highlighted as a top pick in the European semiconductor equipment sector. Analysts have pointed out its crucial role in AI infrastructure, which is expected to drive multiple expansions.

The increased demand for EUV tools and higher gross margins have led to optimistic revenue and earnings projections for the coming years.

Price Action: ASML closed at $1,063.63, down 1.99%, on Monday. In after-hours trading, the stock gained 0.46%. Year to date, ASML’s stock has risen by 48.36%, according to the data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Posted In: AAPL ASML NVDA TSM