Semiconductor Stocks Historically Outperform Following 5% Selloff In A Day: Bank Of America

Author: Adam Eckert | July 18, 2024 01:48pm

Semiconductor stocks, tracked by the IShares Semiconductor ETF (NASDAQ:SOXX), have taken a beating this week. BofA believes the heavy selling pressure on semis sets the sector up for outperformance into the end of the year.

What To Know: BofA Securities senior analyst Vivek Arya reminded investors to focus on fundamentals when doubt arises in a new note released late Wednesday.

Chip stocks got punished on Wednesday as investors rotated out of the red-hot sector following comments from President Joe Biden and former President Donald Trump.

Biden recently suggested that he’s considering putting tougher trade restrictions on semiconductor equipment and Trump said this week that the U.S. wouldn’t defend Taiwan from Chinese invasion and indicated Taiwan should pay the U.S. for protection from China.

The rising geopolitical uncertainty took a toll on chip stocks causing the semiconductor index to close down approximately 6.8% on Wednesday. Although BofA acknowledged that volatility could remain elevated through earnings season and the upcoming elections, the firm highlighted a reassuring stat suggesting semi stocks could bounce back fast.

Wednesday marked the 26th time the semiconductor sector has closed down more than 5% in a day over the last decade. Historically, the index has “rebounded quickly” and gone on to outperform the S&P 500 over the next three to six months, Arya said.

Based on historical data following a 5% or greater selloff, semiconductors are up 19% on average three months later and 28% on average six months later, well ahead of S&P 500 averages, the BofA analyst said.

See Also: When To Buy Back Into Nvidia–Should You Look At Valuation, Price Movement, Or Both?

To help tune out the noise surrounding geopolitical uncertainty, Arya suggested investors take another look at the fundamentals. AI is still the strongest area that companies are spending in, while global growth looks “murky at best,” he said, adding he believes some of the biggest U.S. cloud companies are planning three to five years out.

“So we understand the rotation away from AI/data-center semis towards industrial/auto/consumer, but it’s not supported by fundamentals and is likely short-term positioning driven,” Arya said.

“We see current volatility as enhanced opportunity in companies with best-profitability in their respective sub-sectors.”

BofA said its best ideas in computing and AI include Nvidia Corp (NASDAQ:NVDA), Broadcom Inc (NASDAQ:AVGO) and Arm Holdings Plc (NASDAQ:ARM). The firm also highlighted “attractive valuations” in ON Semiconductor Corp (NASDAQ:ON) and Micron Technology Inc (NASDAQ:MU).

SOXX Price Action: The IShares Semiconductor ETF was down 0.18% at $242.73 at the time of publication Thursday, per Benzinga Pro.

Read Next:

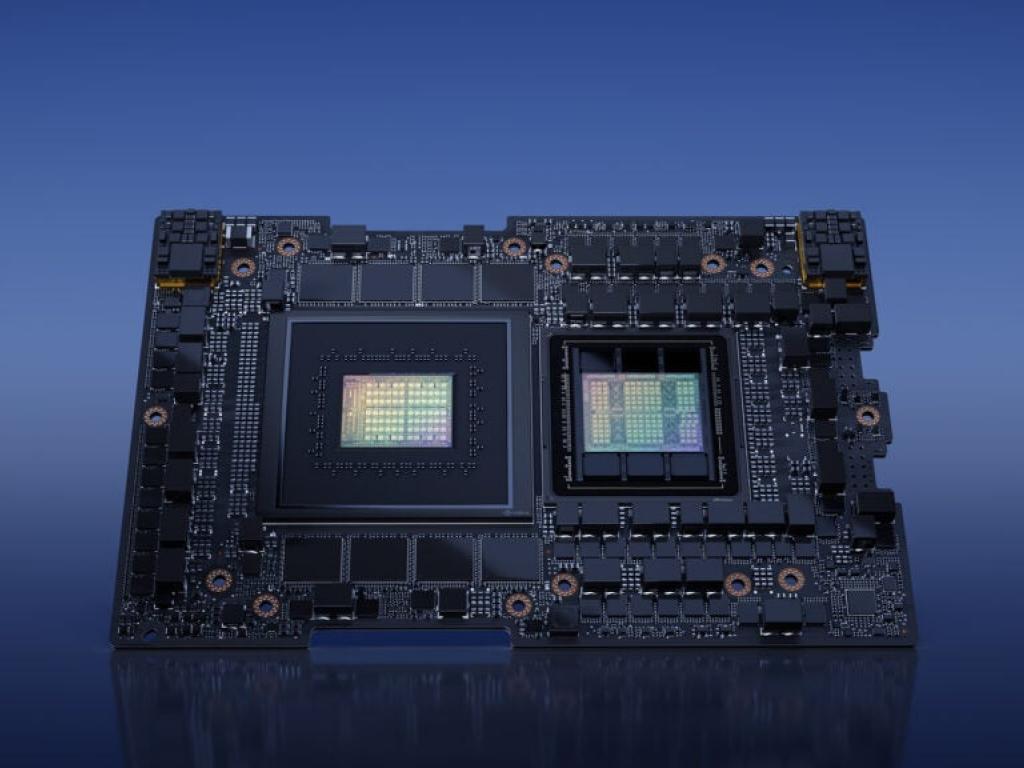

Photo: courtesy of Nvidia.

Posted In: ARM AVGO MU NVDA ON SOXX