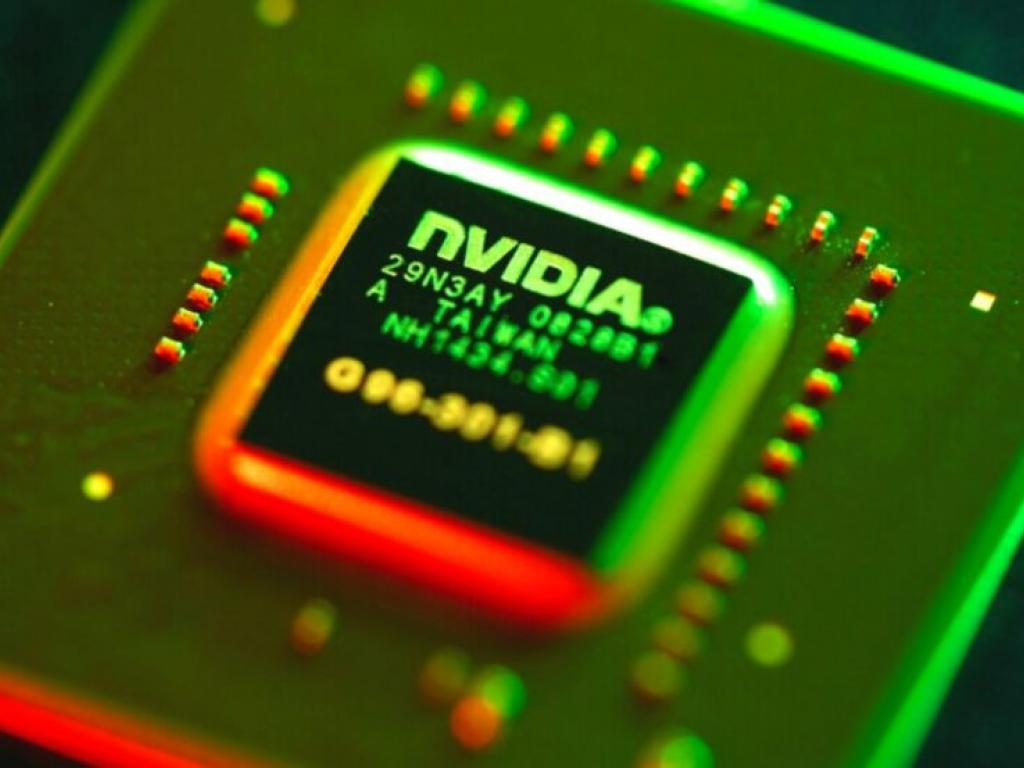

Nvidia Hedge Fund Ownership Shifts, Citadel Cuts Stake While Renaissance Buys In: Report

Author: Anusuya Lahiri | August 19, 2024 07:48am

Nvidia Corp (NASDAQ:NVDA) recently witnessed significant adjustments in its hedge fund ownership, reflecting divergent views on the company’s future amid a volatile market.

While some funds like Citadel and DE Shaw trimmed their stakes in the semiconductor giant, others, including Renaissance Technologies and Marshall Wace, increased their investments, the Financial Times reports.

During the second quarter of 2024, Citadel reduced its Nvidia holdings to $19 million, down from $60 million at the end of March, and DE Shaw slashed its position by more than half, bringing its stake to $1.4 billion.

These moves contrast sharply with Renaissance Technologies, which expanded its stake by 1.5 million, reaching 7 million shares valued at $867 million, and Marshall Wace, which acquired 3.7 million additional shares, boosting its investment to $1.5 billion.

A lot has happened in the semiconductor space, where artificial intelligence has proved to be a raging phenomenon.

SoftBank Group Corp recently pivoted to Taiwan Semiconductor Manufacturing Co (NYSE:TSM), a key Nvidia supplier, for AI chip production after a fallout with Intel Corp (NASDAQ:INTC).

SoftBank, seeking to advance its tens of billions of dollars worth of AI chip ambitions, also explored partnerships with Alphabet Inc (NASDAQ:GOOGL) (NASDAQ:GOOG) and Meta Platforms Inc (NASDAQ:META).

Nvidia stock gained close to 3% in the last 30 days amid a broader industry selloff and is currently trading at a price-to-earnings multiple of 33.1x. Investors can gain exposure to the stock through Vanguard S&P 500 ETF (NYSE:VOO) and SPDR S&P 500 (NYSE:SPY).

Price Action: NVDA shares were trading lower by 0.02% to $124.56 premarket at the last check Monday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

Posted In: GOOG GOOGL INTC META NVDA SPY TSM VOO