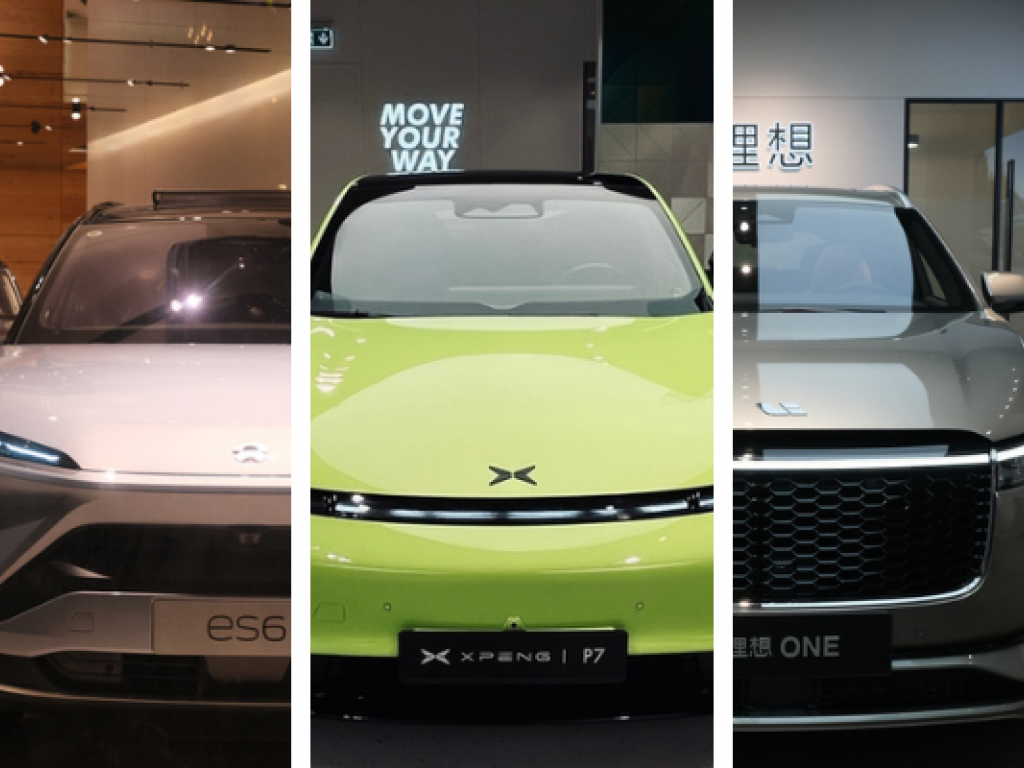

What's Going On With Chinese EV Stocks, Nio, XPeng And Li Auto On Monday?

Author: Anusuya Lahiri | August 19, 2024 09:55am

Chinese electric vehicle stocks NIO Inc (NYSE:NIO), XPeng Inc (NYSE:XPEV), and Li Auto Inc (NASDAQ:LI) are trading higher Monday amid reports indicating China’s cash-for clunkers trade-in program’s potential to boost electric-vehicle demand.

The program could translate into total EV sales to over 10 million in 2024, Bloomberg reports.

In July, China announced plans to launch incentives that would help consumers afford 20,000 yuan ($2,760) to scrap an old, higher-emissions car for an EV or 15,000 yuan for a more fuel-efficient gasoline car.

Many cities followed suit, introducing additional incentives of $140-$1,400 per vehicle.

According to Bloomberg, BNEF analyst Siyi Mi expects the Chinese government’s higher subsidies to spur up to 2 million car sales, including 1.1 million EV sales worth $26 billion in revenue.

Nio delivered 20,498 vehicles in July, flattish year-on-year after the EV companies started offering attractive discounts to boost market share. Li Auto delivered 51,000 vehicles in July, implying a 49.4% growth year-on-year. XPeng delivered 11,145 vehicles, an increase of 1% year-over-year. Reports also indicated China’s plans to ban Chinese software in autonomous and connected vehicles, posing a dampener for the companies.

Nio stock plunged 64%, XPeng 58%, and Li Auto over 48% in the last 12 months as they battled a domestic price war coupled with U.S. and EU protectionist tariffs.

NIO Stock Prediction For 2024

Equity research can be a valuable source of information for learning about a company's fundamentals. Analysts create financial models based on the fundamentals and expected future earnings of a company to arrive at a price target and recommendation for the stock.

Shares of NIO have an average 1-year price target of $6.8, representing an expected upside of 67.9%.

Because of differences in assumptions, analysts can arrive at very different price targets and recommendations. No analysts have bearish recommendations on NIO, while 1 analyst has bullish ratings. The street high price target from Citigroup is $8.5, while the street low from B of A Securities is $5.9.

Price Actions: NIO shares were trading lower by 2.55 % to $4.05 at the last check on Monday. XPEV is up 1.80 at $7.07, and LI is up 3.19% to $21.19.

Photos via Shutterstock

Posted In: LI NIO XPEV