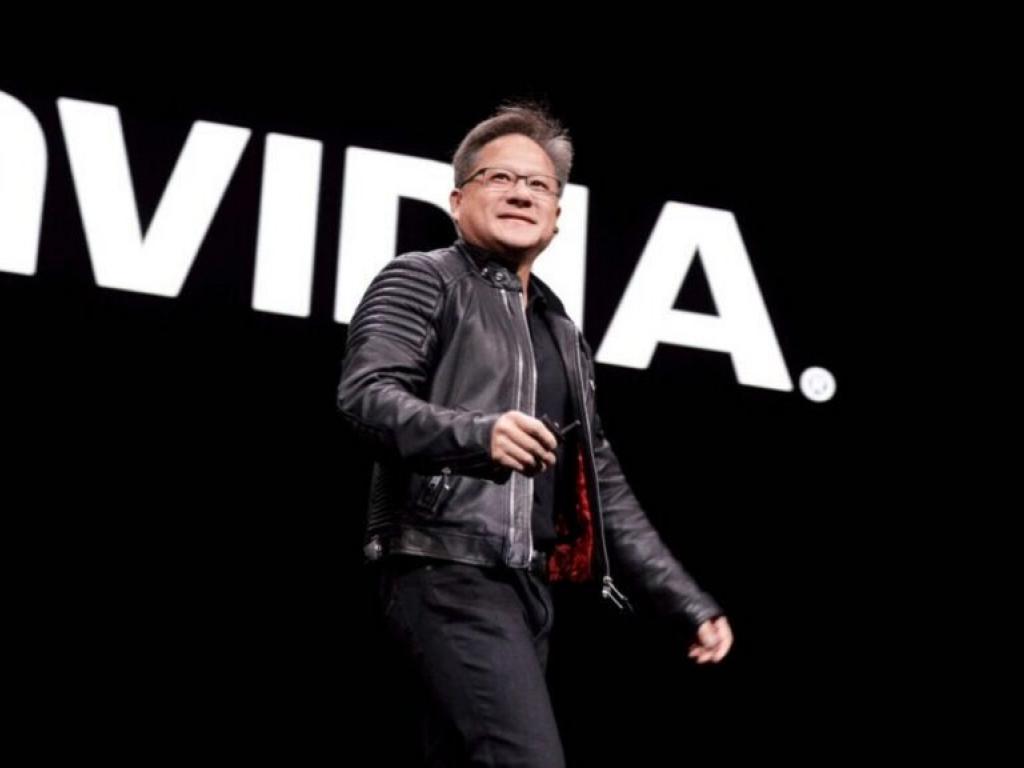

Nvidia Takes A Page From Apple's Playbook: Jensen Huang Wants AI Stalwart To Go Beyond Chips And Be One-Stop Shop For Data Center Clients

Author: Shanthi Rexaline | September 03, 2024 04:30am

Nvidia Corp. (NASDAQ:NVDA) has maintained a competitive edge in artificial intelligence technology by providing full-stack solutions, and a report said on Monday that the Jensen Huang-led company may not merely contend with selling AI accelerators that power data centers but wants to offer a one-stop solution to its data center customers.

What Happened: Along with the AI chips, Nvidia is looking to offer software, data-center services and networking technology, thereby differentiating its offerings from rivals’, said Wall Street Journal in a report. Huang is trying to “build Nvidia into more than a supplier of a valuable hardware component: a one-stop shop for all the key elements in the data centers where tools like OpenAI's ChatGPT are created and deployed, or what he calls ‘AI factories,'” he said.

On the earnings call that followed the release of the second-quarter earnings report, the Nvidia co-founder said, “We have the ability, fairly uniquely, to integrate, to design an AI factory because we have all the parts. It’s not possible to come up with a new AI factory every year unless you have all the parts.”

Nvidia is working on improving the effectiveness of its proprietary software called CUDA, and has been plowing money into its superfast networking protocol called InfiniBand following the acquisition of Mellanox Technologies, the report said. The company is also developing a business that supplies AI-optimized Ethernet, a form of networking widely used in traditional data centers, it added.

See Also: How To Buy Nvidia (NVDA) Stock

Why It’s Important: Nvidia’s frontrunner advantage has given it a near monopoly position in the market for AI accelerators but competition is striving hard to play a catchup.

Advanced Micro Devices, Inc. (NASDAQ:AMD), which has made a splash with its M1300 accelerators, recently agreed to buy data-center design and manufacturing company ZT Systems for $4.9 billion in cash and stock. AMD’s other past acquisitions including Xilinx and data-center networking company Pensando also would help in its AI pursuit.

Nvidia’s strategy to be an integrated provider could insulate it against competition and help maintain its 80% share in the AI accelerator market, the Journal said. “Gobbling up more of the value in AI data centers both adds revenue and makes its offerings stickier for customers,” it added.

This is reminiscent of Apple’s strategy of maintaining a tight grip on the consumer market with its sticky ecosystem. Installed active devices of the company have been on a steady climb and stand at a record, triggering demand for the rest of its products and services.

This approach could cement Nvidia’s competitive positioning, the report said, citing Raymond James analyst Srini Pajjuri. The analyst reportedly said, “Enterprises typically go with the turnkey solution. They don't have the resources, they don't have the technology or know-how to cobble together the equipment themselves.”

That said Pajjuri warned that as technology matures, Nvidia may not be able to capture more of the pie. The analyst also sees regulatory threats on the premise that the company has a monopoly position in the market.

In premarket trading on Tuesday, Nvidia slipped 0.11% to $119.24, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

Posted In: AMD NVDA