Gold Moves Higher; Science Applications International Posts Upbeat Earnings

Author: Avi Kapoor | September 05, 2024 02:30pm

U.S. stocks traded mixed toward the end of trading, with the Nasdaq Composite gaining around 0.5% on Thursday.

The Dow traded down 0.36% to 40,828.19 while the NASDAQ rose 0.53% to 17,174.66. The S&P 500 also fell, dropping, 0.08% to 5,515.76.

Check This Out: How To Earn $500 A Month From Smith & Wesson Brands Stock Ahead Of Q1 Earnings Report

Leading and Lagging Sectors

Consumer discretionary shares climbed by 1.4% on Thursday.

In trading on Thursday, health care shares fell by 1.2%.

Top Headline

Science Applications International Corp (NYSE:SAIC) reported upbeat earnings for its second quarter.

The company posted a 2% revenue growth year over year in the fiscal second quarter of 2025 to $1.82 billion, marginally beating the analyst consensus estimate of $1.79 billion. Adjusted EPS of $2.05 beat the analyst consensus of $1.86. The topline growth reflects a ramp-up in volume on existing and new contracts.

Equities Trading UP

- Eastside Distilling, Inc. (NASDAQ:EAST) shares shot up 164% to $1.9980 following the disclosure of a merger agreement with Beeline Financial Holdings, Inc., a private mortgage technology firm.

- Shares of Hoth Therapeutics, Inc. (NASDAQ:HOTH) got a boost, surging 52% to $1.06 after the company announced data from the treatment of epidermal growth factor receptor inhibitor associated papulopustular eruptions with its novel therapeutic HT-001.

- Applied Digital Corporation (NASDAQ:APLD) shares were also up, gaining 70% to $5.50 after the company entered agreements for a $160 million private placement financing priced at market, from a group of institutional and accredited investors including NVIDIA and Related Companies.

Equities Trading DOWN

- Napco Security Technologies, Inc. (NASDAQ:NSSC) shares dropped 19% to $35.01 after Fuzzy Panda Research issued a bearish report on the stock.

- Shares of Qualigen Therapeutics, Inc. (NASDAQ:QLGN) were down 16% to $0.1534 after the company announced a $3.46 million public offering of 14,724,058 shares at $0.13 per share and pre-funded warrants.

- ChargePoint Holdings, Inc. (NYSE:CHPT) was down, falling 17% to $1.3988 after the company reported worse-than-expected second-quarter revenue results.

Commodities

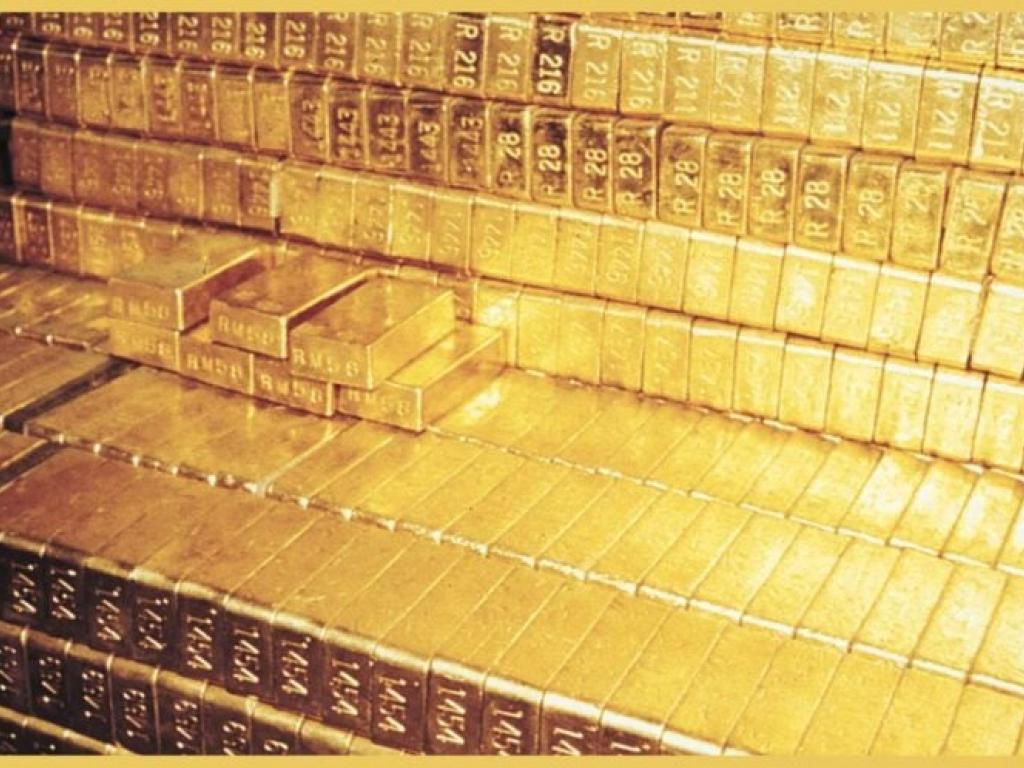

In commodity news, oil traded down 0.5% to $68.89 while gold traded up 0.8% at $2,545.00.

Silver traded up 2% to $29.13 on Thursday, while copper rose 1.4% to $4.1375.

Euro zone

European shares were mostly lower today. The eurozone's STOXX 600 fell 0.54%, Germany's DAX fell 0.08% and France's CAC 40 fell 0.92%. Spain's IBEX 35 Index rose 0.53%, while London's FTSE 100 fell 0.34%.

Retail sales in the Eurozone rose by 0.1% from the previous month in July compared to a revised 0.4% decline in the earlier month. The HCOB Eurozone construction PMI came in unchanged at 41.4 in August. The S&P Global UK construction PMI declined to 53.6 in August compared to 55.3 in July.

Asia Pacific Markets

Asian markets closed mostly lower on Thursday, with Japan's Nikkei 225 falling 1.05%, Hong Kong's Hang Seng Index falling 0.08%, China's Shanghai Composite Index gaining 0.14% and India's BSE Sensex falling 0.18%.

Average cash earnings in Japan rose by 3.6% year-over-year in July versus a 4.5% increase in the prior month.

Economics

- U.S. private businesses added 99,000 workers to their payrolls in August compared to a revised 111,000 gain in July and versus market estimates of 145,000.

- U.S. initial jobless claims fell by 5,000 from the prior week to 227,000 in the week ending August 31, compared to market estimates of 230,000.

- U.S. non-farm business sector labor productivity rose by 2.5% in the second quarter versus the preliminary estimate of 2.3% and compared to the 0.4% gain recorded in the first quarter.

- Unit labor costs in the nonfarm business sector rose by an annualized rate of 0.4% during the second quarter.

- U.S. crude oil inventories fell by 6.9 million barrels during the final week of August, compared to market estimates of a 1.1 million barrel decline.

Now Read This:

Posted In: APLD CHPT EAST HOTH NSSC QLGN SAIC