Chart Of The Week: Cannabis Credit Markets Are Hot Across the Credit Quality Spectrum

Author: Viridian Capital Advisors | September 16, 2024 10:55am

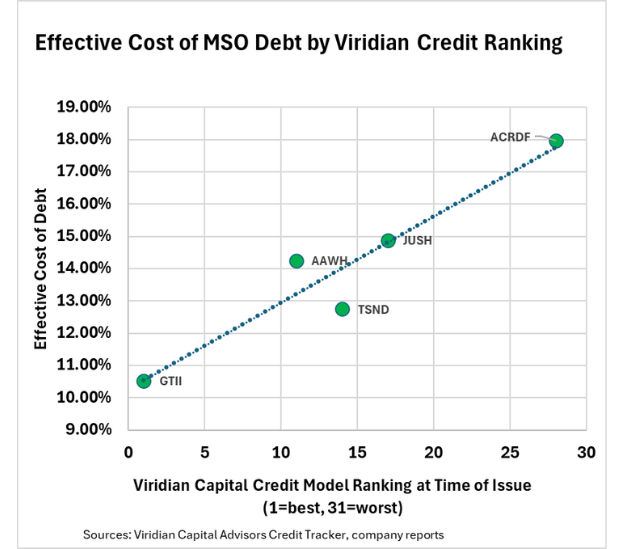

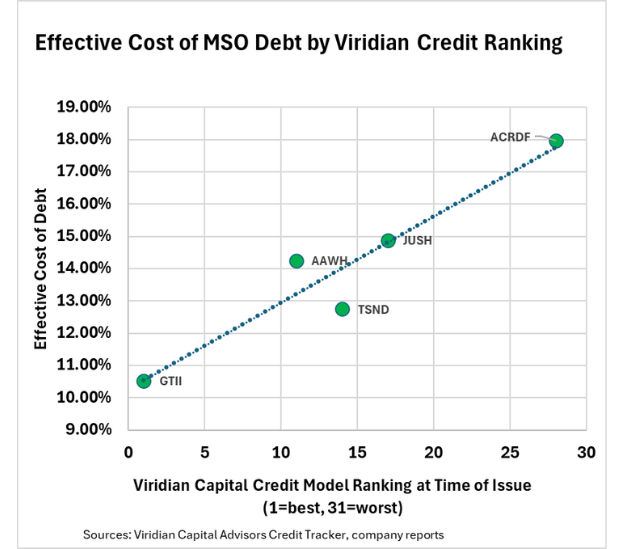

The cannabis debt market is HOT! The five issues shown on the chart were all completed in the third quarter of 2024 (with two weeks remaining) and account for approximately $632M of proceeds, greater than any quarter since the fourth quarter of 2021.

The graph shows the effective cost of the transaction on the vertical axis with the Viridian Credit Ranking at the time of the transaction on the horizontal axis. The close fit of the regression line (R-squared of .91) shows that the market is accurately taking into account the credit risk of the issuers in its pricing of new issues.

The most significant outlier is the 12.75% cost for TerrAscend, which we had expected to carry a higher yield. TSND's less-than-stellar credit ranking was partially attributable to the liquidity pressures that the new financing alleviated. The company is currently ranked three notches better at #11.

The Jushi (OTC:JUSHF) transaction was for first-priority notes, which are now quoted at closer to 17%.

All of the deals on the chart represent refinancings of existing debt. An additional $114M of refinancings occurred earlier in the year for AYR (OTC:AYRWF), PharmaCann (Private), and Cannabist (OTC:CBSTF).

Significant growth capital debt deals have also closed for private companies, including a $40M Sunburn deal and $20M for Nova.

This week's Acreage (OTC:ACRDF) refinancing demonstrates that investor demand exists for companies across the credit quality spectrum. Viridian ranks Acreage at #28/31 due to its extremely high (14.5x) total liabilities to market cap and total liabilities to assets (1.6x). However, we expect the additional liquidity provided by the transaction may improve the company's ranking somewhat in the future.

With cannabis equity markets range-bound and skeptical, awaiting S3 or further developments on SAFE, the debt market is thankfully continuing to be the principal capital source for the cultivation and retail sector for both squeaky clean credits like Green Thumb (GTII: CSE) as well as more challenging underwritings like Jushi and Acreage.

The Viridian Capital Chart of the Week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker.

The Viridian Cannabis Deal Tracker provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy. The Deal Tracker is a proprietary information service that monitors capital raise and M&A activity in the legal cannabis, CBD, and psychedelics industries. Each week the Tracker aggregates and analyzes all closed deals and segments each according to key metrics:

-

Deals by Industry Sector (To track the flow of capital and M&A Deals by one of 12 Sectors - from Cultivation to Brands to Software)

-

Deal Structure (Equity/Debt for Capital Raises, Cash/Stock/Earnout for M&A) Status of the company announcing the transaction (Public vs. Private)

-

Principals to the Transaction (Issuer/Investor/Lender/Acquirer) Key deal terms (Pricing and Valuation)

-

Key Deal Terms (Deal Size, Valuation, Pricing, Warrants, Cost of Capital)

-

Deals by Location of Issuer/Buyer/Seller (To Track the Flow of Capital and M&A Deals by State and Country)

-

Credit Ratings (Leverage and Liquidity Ratios)

Since its inception in 2015, the Viridian Cannabis Deal Tracker has tracked and analyzed more than 2,500 capital raises and 1,000 M&A transactions totaling over $50 billion in aggregate value.

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Posted In: ACRDF AYRWF CBSTF JUSHF