Nvidia Could Become Taiwan Semi's Third US Plant Customer, But With A Catch

Author: Anusuya Lahiri | December 05, 2024 07:49am

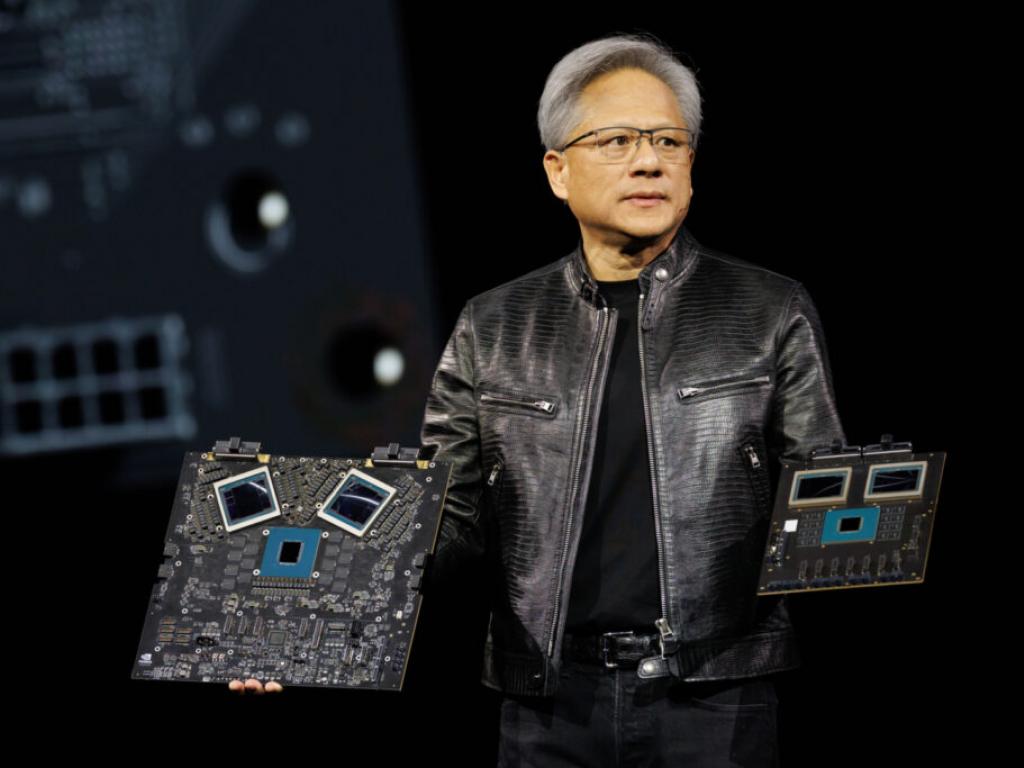

Taiwan Semiconductor Manufacturing Co (NYSE:TSM) and Nvidia Corp (NASDAQ:NVDA) are exploring production of the front-end process of Blackwell artificial intelligence chips at the former Arizona plant, Reuters cites familiar sources.

Taiwan Semiconductor has so far manufactured Nvidia's Blackwell chips in its Taiwan facilities, where its chip-on-wafer-on-substrate (CoWoS) capacity exists.

Also Read: ZJK Industrial Surges On Nvidia Liquid Cooling Collaboration (UPDATED)

Therefore, it must ship the Blackwell chips back to Taiwan for packaging, which renders Nvidia vulnerable to U.S. geopolitical tensions with China.

For context, China continued threats and military exercises around Taiwan. Meanwhile, most of Taiwan Semiconductor's production capacity is based in Taiwan.

The key Nvidia supplier targets mass production of the Blackwell chips in early 2025.

Taiwan Semiconductor's current Arizona plant customers reportedly include Apple (NASDAQ:AAPL) and Advanced Micro Devices Inc (NASDAQ:AMD).

Earlier this week, Amazon.Com Inc's (NASDAQ:AMZN) cloud unit claimed that it could connect more chips than Nvidia and could train some AI models at a 40% discount to Nvidia chips.

Amazon Web Services showcased its data center servers embedded with its AI chips, dubbed Trn2 UltraServers. These servers target Nvidia's flagship server, which is packed with the latest Blackwell chips.

Amazon also disclosed that it is building artificial intelligence supercomputers in collaboration with Anthropic, which will feature Amazon's latest AI training chip, Trainium 2. Previous reports claimed Nvidia's production challenges of Blackwell chips hampered AWS' data center plans.

Despite production challenges, Oppenheimer analyst Rick Schafer projected several billion dollars in revenue from Blackwell for the January quarter. He noted investors are modeling between 5 and 6 million Blackwell GPUs in 2025.

Nvidia stock has surged over 201% year-to-date. Taiwan Semiconductor stock gained 98%.

Investors can gain exposure to Nvidia through ProShares Ultra Semiconductors (NYSE:USD) and EA Series Trust Strive U.S. Semiconductor ETF (NYSE:SHOC).

Price Actions: NVDA stock traded lower by 0.02% at $145.10 premarket at the last check on Thursday. TSM is up 0.37%.

Also Read:

Photo courtesy of Nvidia

Posted In: AAPL AMD AMZN NVDA SHOC TSM USD