Forecasting The Future: 5 Analyst Projections For Renasant

Author: Benzinga Insights | April 02, 2025 02:00pm

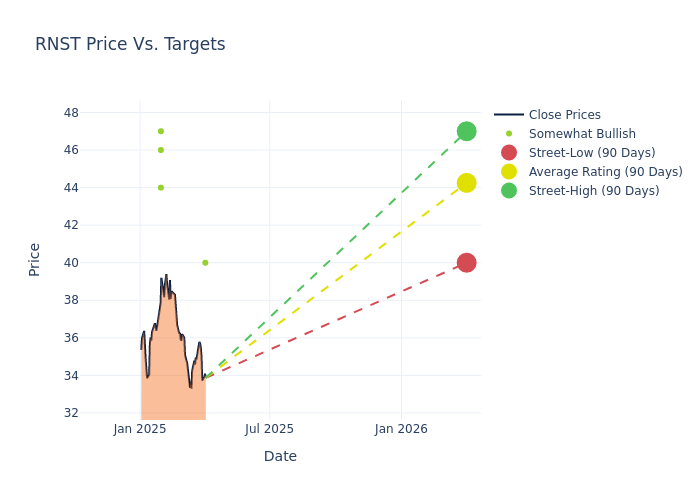

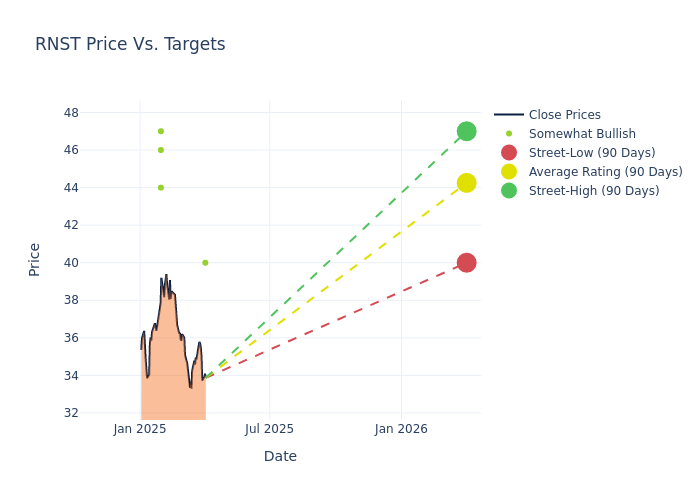

Providing a diverse range of perspectives from bullish to bearish, 5 analysts have published ratings on Renasant (NYSE:RNST) in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

5 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

4 |

0 |

0 |

0 |

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $44.2, with a high estimate of $47.00 and a low estimate of $40.00. Marking an increase of 3.27%, the current average surpasses the previous average price target of $42.80.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Renasant. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Michael Rose |

Raymond James |

Lowers |

Outperform |

$40.00 |

$44.00 |

| Matt Olney |

Stephens & Co. |

Raises |

Overweight |

$47.00 |

$44.00 |

| Catherine Mealor |

Keefe, Bruyette & Woods |

Raises |

Outperform |

$46.00 |

$45.00 |

| Michael Rose |

Raymond James |

Raises |

Outperform |

$44.00 |

$40.00 |

| Stephen Scouten |

Piper Sandler |

Raises |

Overweight |

$44.00 |

$41.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Renasant. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Renasant compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Renasant's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Renasant analyst ratings.

Delving into Renasant's Background

Renasant Corp operates as a holding company for Renasant Bank, a Mississippi banking corporation, and its subsidiary, Renasant Insurance, Inc. It has three reportable segments: Community banks, Insurance, and Wealth management. With its Community banks segment, the company provides a range of financial services to individuals and small businesses. Its Insurance segment is an insurance agency providing commercial and personal insurance through third-party carriers. The Wealth management segment provides a range of services, including money management and retirement planning. The majority of the company's revenue is driven by lending activities in its community banks segment.

Renasant's Financial Performance

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Renasant's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 14.7%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Financials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 26.78%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Renasant's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 1.68%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Renasant's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.25%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Renasant's debt-to-equity ratio is below the industry average. With a ratio of 0.2, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: RNST