Demystifying Sutro Biopharma: Insights From 4 Analyst Reviews

Author: Benzinga Insights | April 29, 2025 10:00am

Ratings for Sutro Biopharma (NASDAQ:STRO) were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

0 |

3 |

1 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

2 |

1 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

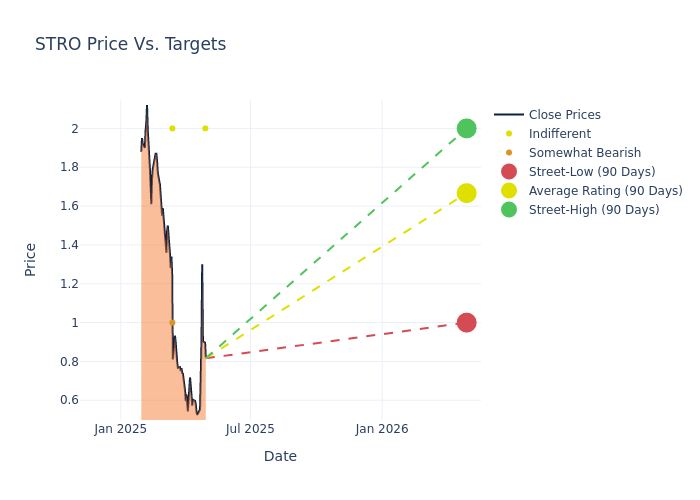

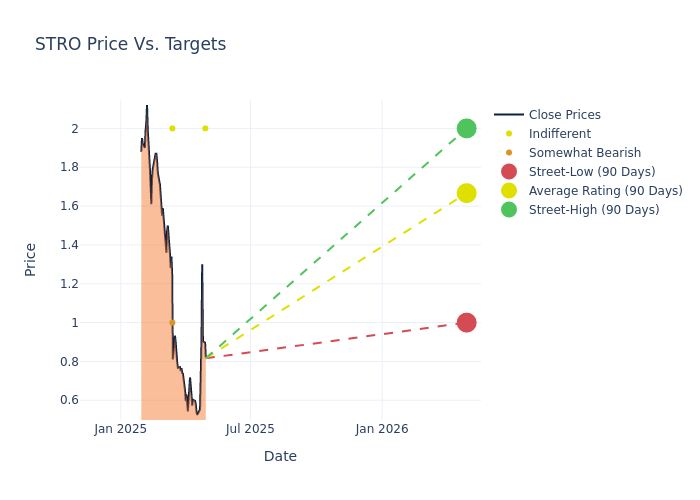

Analysts have set 12-month price targets for Sutro Biopharma, revealing an average target of $1.75, a high estimate of $2.00, and a low estimate of $1.00. This current average has decreased by 78.79% from the previous average price target of $8.25.

Decoding Analyst Ratings: A Detailed Look

The perception of Sutro Biopharma by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target |

|--------------------|--------------------|---------------|---------------|--------------------|--------------------|

|Andres Maldonado |HC Wainwright & Co. |Maintains |Neutral | $2.00|$2.00 |

|Andrew Fein |HC Wainwright & Co. |Lowers |Neutral | $2.00|$12.00 |

|David Nierengarten |Wedbush |Lowers |Neutral | $2.00|$8.00 |

|Tazeen Ahmad |B of A Securities |Lowers |Underperform | $1.00|$11.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Sutro Biopharma. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Sutro Biopharma compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Sutro Biopharma's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Sutro Biopharma's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Sutro Biopharma analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Sutro Biopharma

Sutro Biopharma Inc is a clinical-stage drug discovery, development, and manufacturing company. It is mainly engaged in the development of biopharmaceutical products. The company manufactures next-generation protein therapeutics for cancer and autoimmune disorders through its proprietary integrated cell-free protein synthesis platform, XpressCF. Products offered by the company include STRO-001 for patients with multiple myeloma and non-Hodgkin lymphoma and STRO-002 for the treatment of ovarian and endometrial cancers. The company also pipeline contains STRO-004, STRO-006, STRO-00X, STRO-00Y, STRO-003, VAX24, VAX31, and Others.

Key Indicators: Sutro Biopharma's Financial Health

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Challenges: Sutro Biopharma's revenue growth over 3M faced difficulties. As of 31 December, 2024, the company experienced a decline of approximately -86.98%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -489.18%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -92.98%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -17.27%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Sutro Biopharma's debt-to-equity ratio stands notably higher than the industry average, reaching 0.52. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: STRO