Beyond The Numbers: 4 Analysts Discuss FTC Solar Stock

Author: Benzinga Insights | May 02, 2025 04:01pm

During the last three months, 4 analysts shared their evaluations of FTC Solar (NASDAQ:FTCI), revealing diverse outlooks from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

0 |

3 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

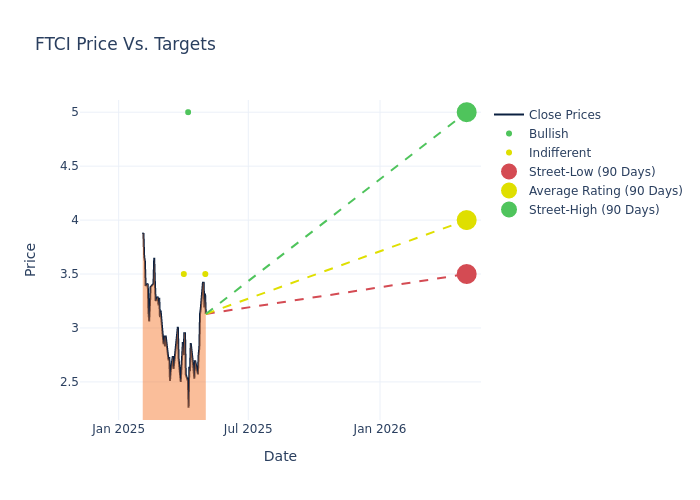

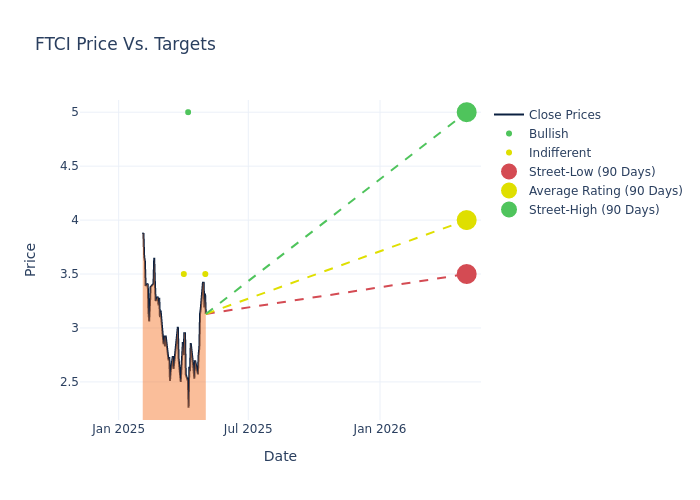

In the assessment of 12-month price targets, analysts unveil insights for FTC Solar, presenting an average target of $3.75, a high estimate of $5.00, and a low estimate of $3.00. Witnessing a positive shift, the current average has risen by 66.67% from the previous average price target of $2.25.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of FTC Solar among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Philip Shen |

Roth MKM |

Raises |

Neutral |

$3.50 |

$3.00 |

| Amit Dayal |

HC Wainwright & Co. |

Raises |

Buy |

$5.00 |

$1.50 |

| Jon Windham |

UBS |

Lowers |

Neutral |

$3.50 |

$4.00 |

| Philip Shen |

Roth MKM |

Raises |

Neutral |

$3.00 |

$0.50 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to FTC Solar. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of FTC Solar compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of FTC Solar's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of FTC Solar's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on FTC Solar analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind FTC Solar

FTC Solar Inc is a provider of solar tracker systems, supported by proprietary software and value-added engineering services. The company's Solar tracker systems move solar panels throughout the day to maintain an optimal orientation relative to the sun, thereby increasing the amount of solar energy produced at a solar installation. It focuses on providing differentiated products, software, and services that maximize energy generation. The company has launched a new mounting solution to support the installation and use of U.S. manufactured thin-film modules by project owners. The only segment the company is engaged in is the Manufacturing and Servicing of Solar tracker systems.

A Deep Dive into FTC Solar's Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Challenges: FTC Solar's revenue growth over 3M faced difficulties. As of 31 December, 2024, the company experienced a decline of approximately -43.1%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -92.68%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): FTC Solar's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -49.49%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): FTC Solar's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -13.47%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.56.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: FTCI