Insights Ahead: Maravai LifeSciences's Quarterly Earnings

Author: Benzinga Insights | May 09, 2025 10:02am

Maravai LifeSciences (NASDAQ:MRVI) is set to give its latest quarterly earnings report on Monday, 2025-05-12. Here's what investors need to know before the announcement.

Analysts estimate that Maravai LifeSciences will report an earnings per share (EPS) of $-0.07.

Investors in Maravai LifeSciences are eagerly awaiting the company's announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It's worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

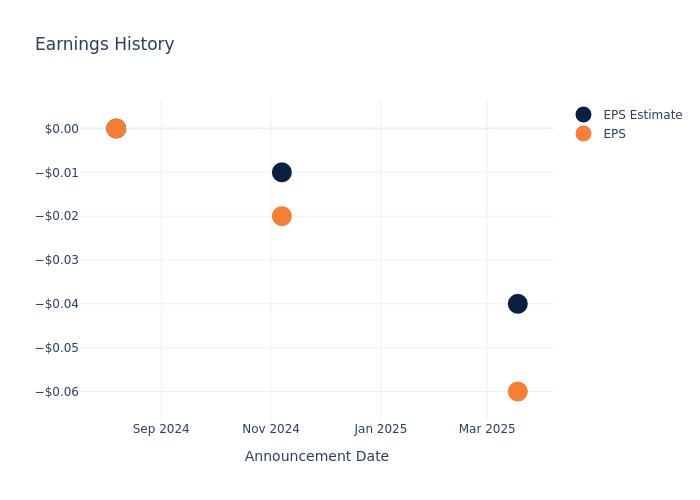

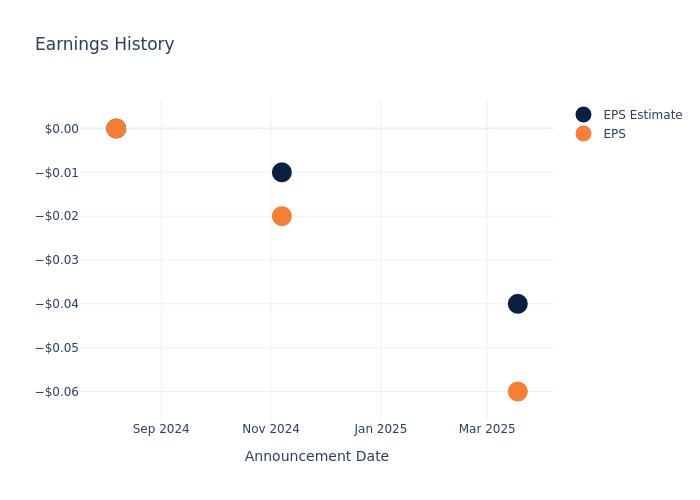

Earnings History Snapshot

Last quarter the company missed EPS by $0.02, which was followed by a 5.81% drop in the share price the next day.

Here's a look at Maravai LifeSciences's past performance and the resulting price change:

| Quarter |

Q4 2024 |

Q3 2024 |

Q2 2024 |

Q1 2024 |

| EPS Estimate |

-0.04 |

-0.01 |

0 |

-0.03 |

| EPS Actual |

-0.06 |

-0.02 |

0 |

-0.02 |

| Price Change % |

-6.0% |

-35.0% |

-7.000000000000001% |

11.0% |

Maravai LifeSciences Share Price Analysis

Shares of Maravai LifeSciences were trading at $2.07 as of May 08. Over the last 52-week period, shares are down 80.58%. Given that these returns are generally negative, long-term shareholders are likely upset going into this earnings release.

Insights Shared by Analysts on Maravai LifeSciences

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Maravai LifeSciences.

Analysts have given Maravai LifeSciences a total of 4 ratings, with the consensus rating being Neutral. The average one-year price target is $4.62, indicating a potential 123.19% upside.

Comparing Ratings with Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of MaxCyte, CryoPort and Pacific Biosciences, three key industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Buy trajectory for MaxCyte, with an average 1-year price target of $9.0, suggesting a potential 334.78% upside.

- Analysts currently favor an Buy trajectory for CryoPort, with an average 1-year price target of $10.82, suggesting a potential 422.71% upside.

- Analysts currently favor an Outperform trajectory for Pacific Biosciences, with an average 1-year price target of $2.25, suggesting a potential 8.7% upside.

Peer Metrics Summary

The peer analysis summary provides a snapshot of key metrics for MaxCyte, CryoPort and Pacific Biosciences, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| Maravai LifeSciences |

Neutral |

-23.92% |

$18.96M |

-7.80% |

| MaxCyte |

Buy |

-44.51% |

$6.41M |

-5.05% |

| CryoPort |

Buy |

-31.06% |

$27.28M |

-3.65% |

| Pacific Biosciences |

Outperform |

-32.79% |

$10.06M |

0.49% |

Key Takeaway:

Maravai LifeSciences ranks at the bottom for Revenue Growth and Gross Profit among its peers. It is also at the bottom for Return on Equity. The consensus rating for Maravai LifeSciences is Neutral, which is better than some peers.

Get to Know Maravai LifeSciences Better

Maravai LifeSciences Holdings Inc is a life sciences company that provides critical products that drive the development of groundbreaking vaccines, drug therapies, cell and gene therapies, and diagnostics. The group's solutions empower research into human diseases and support the entire biopharmaceutical development process from early discovery to commercialization. Its reportable segments are Nucleic acid production and biologics safety testing. It generates a majority of its revenue from Nucleic Acid Production and focuses on the manufacturing and sale of nucleic acid products to support the needs of customers' research, and therapeutic and vaccine programs. In addition, the segment also provides research products for labeling and detecting proteins in cells and tissue samples.

Understanding the Numbers: Maravai LifeSciences's Finances

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Negative Revenue Trend: Examining Maravai LifeSciences's financials over 3 months reveals challenges. As of 31 December, 2024, the company experienced a decline of approximately -23.92% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Maravai LifeSciences's net margin is impressive, surpassing industry averages. With a net margin of -46.35%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Maravai LifeSciences's ROE stands out, surpassing industry averages. With an impressive ROE of -7.8%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Maravai LifeSciences's ROA excels beyond industry benchmarks, reaching -2.29%. This signifies efficient management of assets and strong financial health.

Debt Management: Maravai LifeSciences's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.16.

To track all earnings releases for Maravai LifeSciences visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: MRVI