Where Septerna Stands With Analysts

Author: Benzinga Insights | May 16, 2025 02:00pm

Analysts' ratings for Septerna (NASDAQ:SEPN) over the last quarter vary from bullish to bearish, as provided by 4 analysts.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

1 |

3 |

0 |

0 |

| Last 30D |

0 |

1 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

1 |

0 |

0 |

| 3M Ago |

0 |

0 |

1 |

0 |

0 |

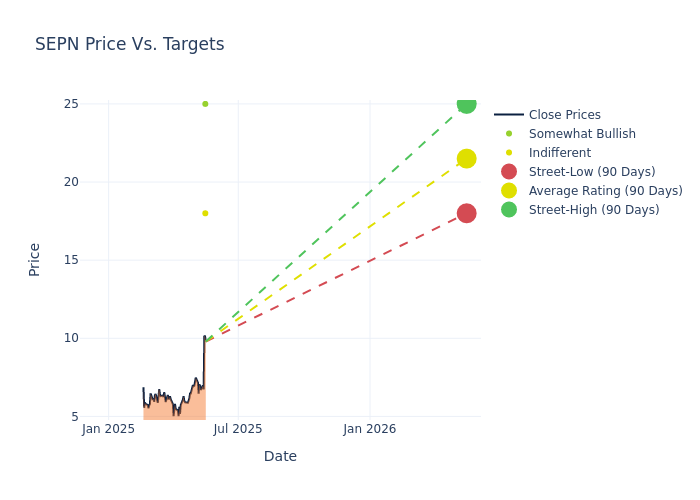

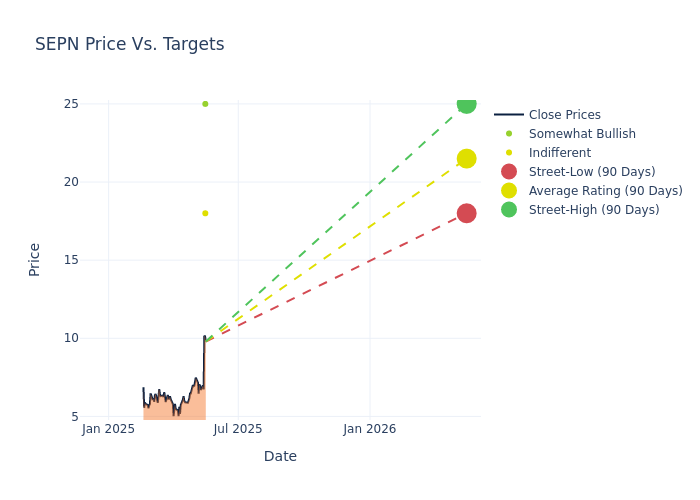

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $17.0, a high estimate of $25.00, and a low estimate of $11.00. Observing a downward trend, the current average is 22.73% lower than the prior average price target of $22.00.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Septerna by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Josh Schimmer |

Cantor Fitzgerald |

Raises |

Overweight |

$25.00 |

$20.00 |

| Derek Archila |

Wells Fargo |

Raises |

Equal-Weight |

$18.00 |

$11.00 |

| Derek Archila |

Wells Fargo |

Lowers |

Equal-Weight |

$11.00 |

$14.00 |

| Derek Archila |

Wells Fargo |

Lowers |

Equal-Weight |

$14.00 |

$43.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Septerna. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Septerna compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Septerna's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Septerna's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Septerna analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Septerna

Septerna Inc is a clinical-stage biotechnology company pioneering a new era of G protein-coupled receptor (GPCR) oral small molecule drug discovery powered by a proprietary Native Complex Platform. Its industrial-scale platform aims to unlock the full potential of GPCR therapies. The group discovery and development of a pipeline of product candidates focused initially on treating patients in three therapeutic areas: endocrinology, immunology and inflammation, and metabolic disease. Its pipeline includes SEP-786 (PTH1R), SEP-631 (MRGPRX2), TSHR, GLP-1R, GIPR, and GCGR.

Breaking Down Septerna's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Septerna's remarkable performance in 3M is evident. As of 31 December, 2024, the company achieved an impressive revenue growth rate of 79.66%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Septerna's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -9749.06%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Septerna's ROE excels beyond industry benchmarks, reaching -12.43%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -6.55%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Septerna's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.06.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: SEPN