Beyond The Numbers: 4 Analysts Discuss Cytek Biosciences Stock

Author: Benzinga Insights | May 28, 2025 03:00pm

In the preceding three months, 4 analysts have released ratings for Cytek Biosciences (NASDAQ:CTKB), presenting a wide array of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

2 |

1 |

0 |

1 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

1 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

2 |

0 |

0 |

0 |

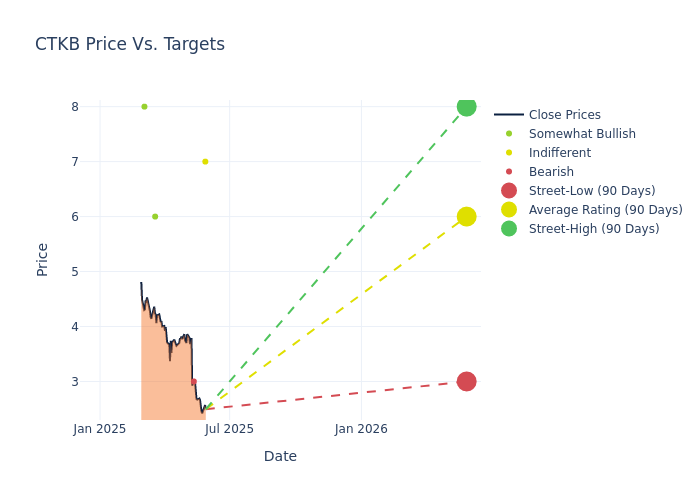

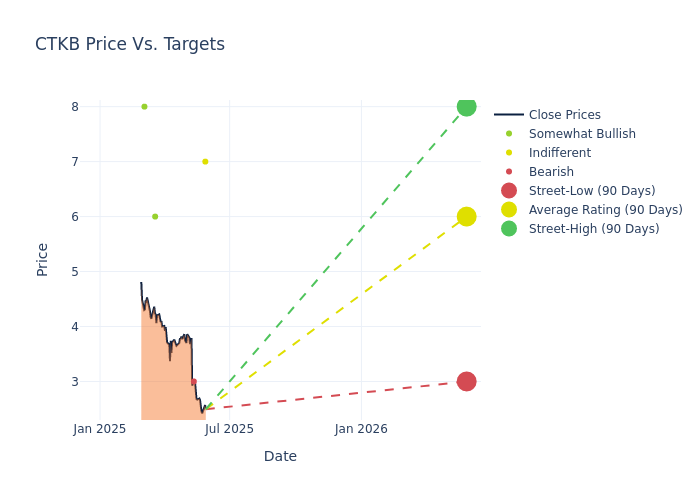

In the assessment of 12-month price targets, analysts unveil insights for Cytek Biosciences, presenting an average target of $6.0, a high estimate of $8.00, and a low estimate of $3.00. Highlighting a 11.11% decrease, the current average has fallen from the previous average price target of $6.75.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Cytek Biosciences by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Tejas Savant |

Morgan Stanley |

Lowers |

Equal-Weight |

$7.00 |

$9.00 |

| Matthew Sykes |

Goldman Sachs |

Lowers |

Sell |

$3.00 |

$3.50 |

| Mason Carrico |

Stephens & Co. |

Maintains |

Overweight |

$6.00 |

$6.00 |

| David Westenberg |

Piper Sandler |

Lowers |

Overweight |

$8.00 |

$8.50 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Cytek Biosciences. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Cytek Biosciences compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Cytek Biosciences's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Cytek Biosciences's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Cytek Biosciences analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Cytek Biosciences Better

Cytek Biosciences Inc is a cell analysis solutions company advancing the next generation of cell analysis tools by leveraging novel technical approaches. Its core instruments, the Cytek Aurora and Northern Lights systems, are the first full-spectrum flow cytometers able to deliver high-resolution, high-content, and high-sensitivity cell analysis by utilizing the full spectrum of fluorescence signatures from multiple lasers to distinguish fluorescent tags on single cells. Its FSP platform addresses the inherent limitations of other technologies by providing a higher density of information with greater sensitivity, more flexibility, and increased efficiency, all at a lower cost for performance. Geographically, the company generates a majority of its revenue from the United States.

Cytek Biosciences's Economic Impact: An Analysis

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Challenges: Cytek Biosciences's revenue growth over 3M faced difficulties. As of 31 March, 2025, the company experienced a decline of approximately -7.59%. This indicates a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Cytek Biosciences's net margin excels beyond industry benchmarks, reaching -27.5%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Cytek Biosciences's ROE stands out, surpassing industry averages. With an impressive ROE of -2.94%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Cytek Biosciences's ROA stands out, surpassing industry averages. With an impressive ROA of -2.32%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.04.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: CTKB