A Glimpse of West Pharmaceutical Servs's Earnings Potential

Author: Benzinga Insights | July 23, 2025 12:00pm

West Pharmaceutical Servs (NYSE:WST) will release its quarterly earnings report on Thursday, 2025-07-24. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate West Pharmaceutical Servs to report an earnings per share (EPS) of $1.51.

Anticipation surrounds West Pharmaceutical Servs's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

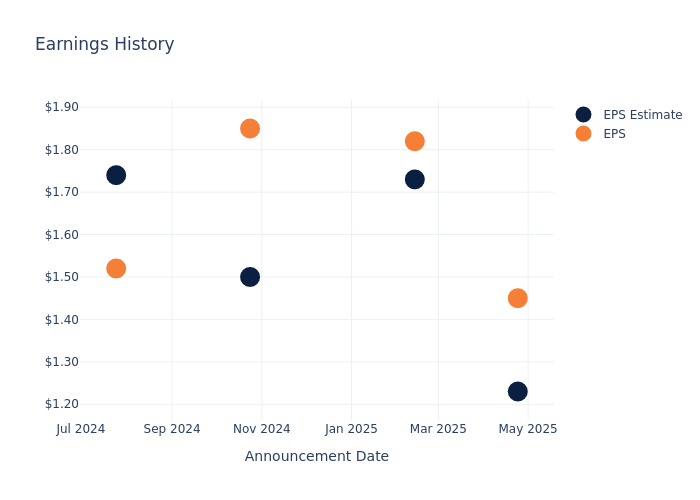

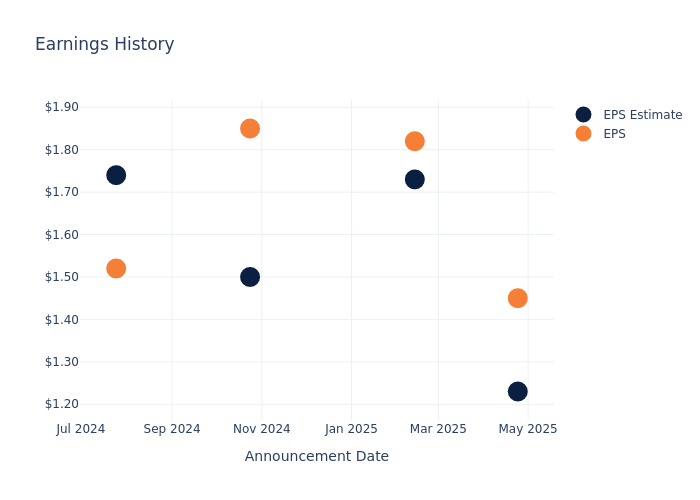

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.22, leading to a 1.88% increase in the share price on the subsequent day.

Here's a look at West Pharmaceutical Servs's past performance and the resulting price change:

| Quarter |

Q1 2025 |

Q4 2024 |

Q3 2024 |

Q2 2024 |

| EPS Estimate |

1.23 |

1.73 |

1.50 |

1.74 |

| EPS Actual |

1.45 |

1.82 |

1.85 |

1.52 |

| Price Change % |

2.0% |

8.0% |

-7.000000000000001% |

3.0% |

Tracking West Pharmaceutical Servs's Stock Performance

Shares of West Pharmaceutical Servs were trading at $218.9 as of July 22. Over the last 52-week period, shares are down 18.96%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Analyst Insights on West Pharmaceutical Servs

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on West Pharmaceutical Servs.

West Pharmaceutical Servs has received a total of 1 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $245.0, the consensus suggests a potential 11.92% upside.

Understanding Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Illumina, Waters and Medpace Hldgs, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- Analysts currently favor an Neutral trajectory for Illumina, with an average 1-year price target of $107.08, suggesting a potential 51.08% downside.

- Analysts currently favor an Neutral trajectory for Waters, with an average 1-year price target of $358.2, suggesting a potential 63.64% upside.

- Analysts currently favor an Neutral trajectory for Medpace Hldgs, with an average 1-year price target of $412.0, suggesting a potential 88.21% upside.

Summary of Peers Analysis

The peer analysis summary offers a detailed examination of key metrics for Illumina, Waters and Medpace Hldgs, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company |

Consensus |

Revenue Growth |

Gross Profit |

Return on Equity |

| West Pharmaceutical Servs |

Neutral |

0.37% |

$231.90M |

3.35% |

| Illumina |

Neutral |

-3.25% |

$683M |

5.53% |

| Waters |

Neutral |

3.90% |

$384.96M |

6.40% |

| Medpace Hldgs |

Neutral |

8.01% |

$178.35M |

23.57% |

Key Takeaway:

West Pharmaceutical Servs ranks in the middle among its peers for consensus rating. It ranks at the bottom for revenue growth. It is at the top for gross profit. It is at the bottom for return on equity.

All You Need to Know About West Pharmaceutical Servs

West Pharmaceutical Services is based in Pennsylvania, US, and is a key supplier to firms in the pharmaceutical, biotechnology, and generic drug industries. West sells elastomer-based packaging components (including stoppers, seals, and plungers), non-glass containment solutions, and auto-injectors for injectable drugs, which include large molecule biologics, peptides such as GLP-1 receptor agonists, and small molecule drugs. The company reports in two segments: proprietary products (about 80% of total revenue) and contract-manufactured products (about 20% of total revenue). It generates approximately 55% of its revenue from international markets and 45% from the United States.

West Pharmaceutical Servs's Financial Performance

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: West Pharmaceutical Servs's remarkable performance in 3 months is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 0.37%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: West Pharmaceutical Servs's net margin excels beyond industry benchmarks, reaching 12.87%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): West Pharmaceutical Servs's ROE excels beyond industry benchmarks, reaching 3.35%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 2.47%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.11.

To track all earnings releases for West Pharmaceutical Servs visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: WST