Evertec Stock: A Deep Dive Into Analyst Perspectives (7 Ratings)

Author: Benzinga Insights | July 31, 2025 03:01pm

In the last three months, 7 analysts have published ratings on Evertec (NYSE:EVTC), offering a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

0 |

3 |

4 |

0 |

0 |

| Last 30D |

0 |

1 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

0 |

2 |

2 |

0 |

0 |

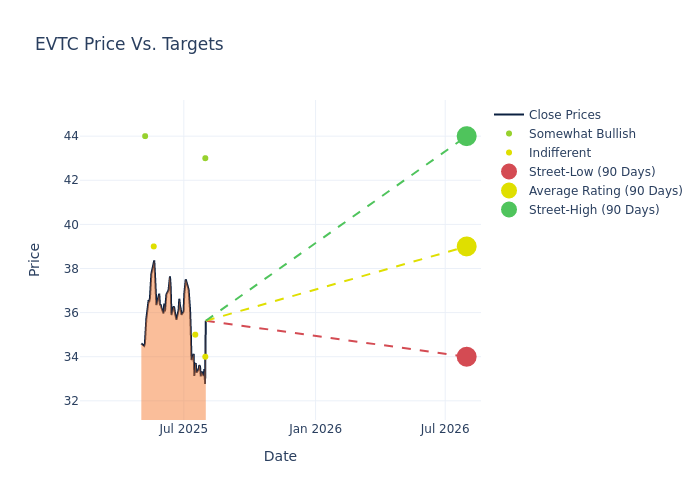

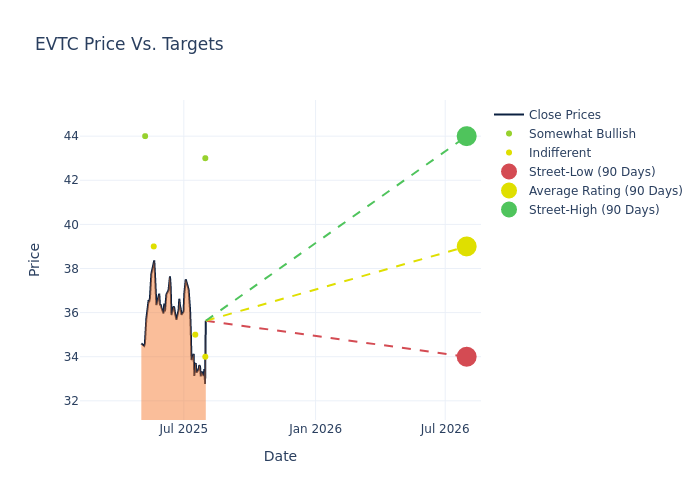

Analysts have set 12-month price targets for Evertec, revealing an average target of $38.86, a high estimate of $44.00, and a low estimate of $34.00. Surpassing the previous average price target of $37.17, the current average has increased by 4.55%.

Interpreting Analyst Ratings: A Closer Look

The standing of Evertec among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| James Faucette |

Morgan Stanley |

Lowers |

Equal-Weight |

$34.00 |

$35.00 |

| John Davis |

Raymond James |

Raises |

Outperform |

$43.00 |

$42.00 |

| Bryan Keane |

Deutsche Bank |

Announces |

Hold |

$35.00 |

- |

| James Friedman |

Susquehanna |

Raises |

Neutral |

$39.00 |

$35.00 |

| James Friedman |

Susquehanna |

Raises |

Neutral |

$35.00 |

$30.00 |

| John Davis |

Raymond James |

Raises |

Outperform |

$42.00 |

$39.00 |

| Sanjay Sakhrani |

Keefe, Bruyette & Woods |

Raises |

Outperform |

$44.00 |

$42.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Evertec. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Evertec compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Evertec's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Evertec's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Evertec analyst ratings.

Get to Know Evertec Better

Evertec Inc is a transaction processing business in Latin America and the Caribbean. Its business segments are Merchant Acquiring, Payment Services - Puerto Rico & Caribbean, Latin America Payments and Solutions, and Business Solutions which derive maximum revenue. The company serves a diversified customer base of financial institutions, merchants, corporations, and government agencies with mission-critical technology solutions that enable them to issue, process, and accept transactions securely. It derives maximum revenue from Latin America Payments and Solutions. Geographically, it operates in Puerto Rico, Caribbean, and Latin America.

Evertec's Economic Impact: An Analysis

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Evertec's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 11.43% as of 31 March, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Evertec's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 14.29% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Evertec's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 6.45%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 1.73%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Evertec's debt-to-equity ratio stands notably higher than the industry average, reaching 1.76. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: EVTC