Beyond The Numbers: 7 Analysts Discuss Trex Co Stock

Author: Benzinga Insights | August 05, 2025 02:02pm

Trex Co (NYSE:TREX) underwent analysis by 7 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

1 |

5 |

0 |

0 |

| Last 30D |

0 |

0 |

2 |

0 |

0 |

| 1M Ago |

0 |

1 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

0 |

2 |

0 |

0 |

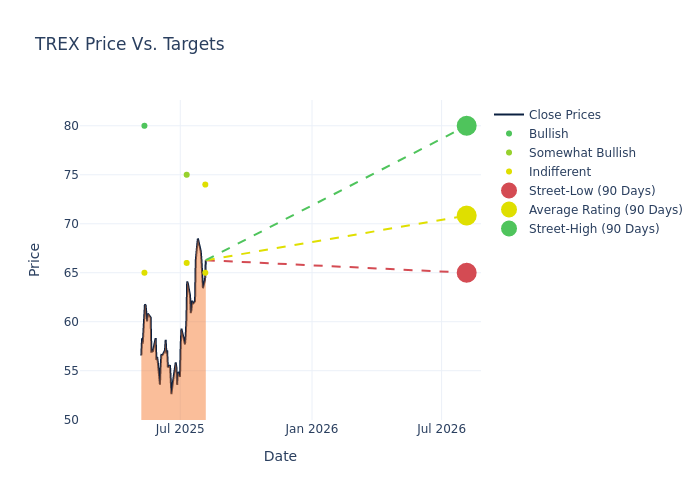

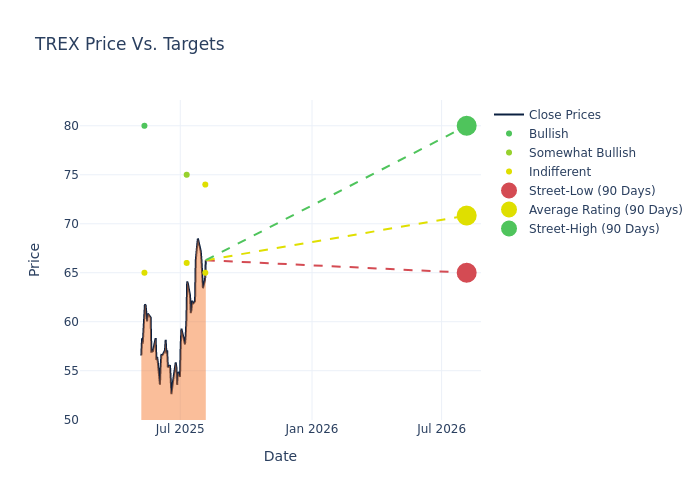

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $71.0, a high estimate of $80.00, and a low estimate of $65.00. This current average reflects an increase of 2.26% from the previous average price target of $69.43.

Interpreting Analyst Ratings: A Closer Look

A clear picture of Trex Co's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Kurt Yinger |

DA Davidson |

Raises |

Neutral |

$65.00 |

$60.00 |

| John Lovallo |

UBS |

Raises |

Neutral |

$74.00 |

$72.00 |

| Jeffrey Stevenson |

Loop Capital |

Raises |

Hold |

$66.00 |

$62.00 |

| Timothy Wojs |

Baird |

Raises |

Outperform |

$75.00 |

$65.00 |

| Reuben Garner |

Benchmark |

Maintains |

Buy |

$80.00 |

$80.00 |

| Trey Grooms |

Stephens & Co. |

Lowers |

Equal-Weight |

$65.00 |

$73.00 |

| John Lovallo |

UBS |

Lowers |

Neutral |

$72.00 |

$74.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Trex Co. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Trex Co compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Trex Co's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Trex Co analyst ratings.

Unveiling the Story Behind Trex Co

Trex Co Inc is a manufacturer of wooden alternative decking products. The company offers outdoor products in the decking, railing, porch, fencing, trim, steel deck framing, and outdoor lighting categories. Its products are sold under the Trex brand and manufactured in the United States. Further, the company licenses its Trex brand to third parties to manufacture and sell products under the Trex trademark. The distribution is focused on wholesale distributors and retail lumber dealers, which in turn sell Trex products to homeowners and contractors, with an emphasis on professional contractors, remodelers, and homebuilders. The company operates in one reportable segment i.e. Trex Residential.

Trex Co's Economic Impact: An Analysis

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, Trex Co faced challenges, resulting in a decline of approximately -9.0% in revenue growth as of 31 March, 2025. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Trex Co's net margin is impressive, surpassing industry averages. With a net margin of 17.78%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Trex Co's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 6.87%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 4.08%, the company showcases effective utilization of assets.

Debt Management: Trex Co's debt-to-equity ratio is below the industry average at 0.54, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: TREX