11 Analysts Assess Birkenstock Holding: What You Need To Know

Author: Benzinga Insights | August 05, 2025 03:01pm

11 analysts have shared their evaluations of Birkenstock Holding (NYSE:BIRK) during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

5 |

6 |

0 |

0 |

0 |

| Last 30D |

1 |

1 |

0 |

0 |

0 |

| 1M Ago |

1 |

0 |

0 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

3 |

5 |

0 |

0 |

0 |

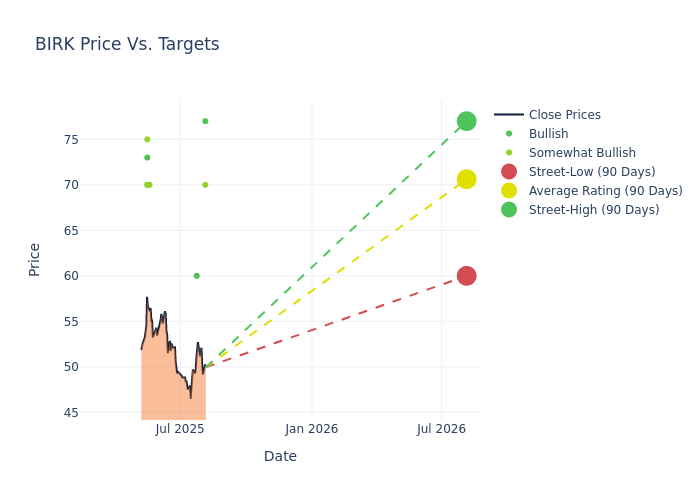

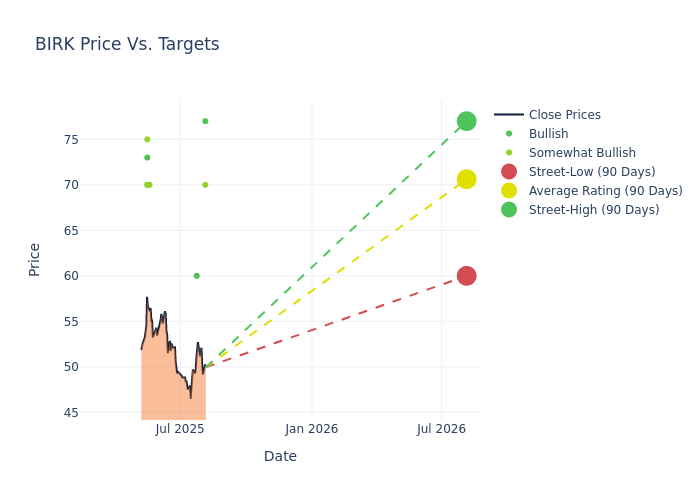

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $71.0, with a high estimate of $77.00 and a low estimate of $60.00. This current average reflects an increase of 4.14% from the previous average price target of $68.18.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Birkenstock Holding's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jay Sole |

UBS |

Raises |

Buy |

$77.00 |

$76.00 |

| Dana Telsey |

Telsey Advisory Group |

Maintains |

Outperform |

$70.00 |

$70.00 |

| Louise Singlehurst |

Goldman Sachs |

Maintains |

Buy |

$60.00 |

$60.00 |

| Michael Binetti |

Evercore ISI Group |

Raises |

Outperform |

$70.00 |

$65.00 |

| Jay Sole |

UBS |

Raises |

Buy |

$76.00 |

$72.00 |

| Jim Duffy |

Stifel |

Raises |

Buy |

$70.00 |

$62.00 |

| Simeon Siegel |

BMO Capital |

Raises |

Outperform |

$75.00 |

$70.00 |

| Lorraine Hutchinson |

B of A Securities |

Raises |

Buy |

$73.00 |

$70.00 |

| Mark Altschwager |

Baird |

Raises |

Outperform |

$70.00 |

$65.00 |

| Dana Telsey |

Telsey Advisory Group |

Maintains |

Outperform |

$70.00 |

$70.00 |

| Dana Telsey |

Telsey Advisory Group |

Maintains |

Outperform |

$70.00 |

$70.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Birkenstock Holding. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Birkenstock Holding compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Birkenstock Holding's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Birkenstock Holding's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Birkenstock Holding analyst ratings.

Delving into Birkenstock Holding's Background

Birkenstock Holding PLC is a company that manufactures and sells footbed-based products, including sandals, closed-toe silhouettes, and other products, such as skincare and accessories, for everyday, leisure, and work. It sells its products through two main channels: business-to-business (B2B) which comprises sales made to established third-party store networks, and direct-to-consumer (DTC) which comprises sales made on globally owned online stores through the Birkenstock.com domain and sales made in Birkenstock retail stores. The company's reportable segments are based on its regional hubs and include: the Americas which is also its key revenue-generating segment; Europe; and Australia, Japan, India, China, and the United Arab Emirates (APMA).

Financial Milestones: Birkenstock Holding's Journey

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Birkenstock Holding's revenue growth over a period of 3M has been noteworthy. As of 31 March, 2025, the company achieved a revenue growth rate of approximately 19.34%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Birkenstock Holding's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 18.3% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Birkenstock Holding's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.79%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Birkenstock Holding's ROA excels beyond industry benchmarks, reaching 2.1%. This signifies efficient management of assets and strong financial health.

Debt Management: Birkenstock Holding's debt-to-equity ratio is below the industry average at 0.49, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: BIRK