The Analyst Verdict: Invitation Homes In The Eyes Of 6 Experts

Author: Benzinga Insights | August 06, 2025 10:00am

6 analysts have shared their evaluations of Invitation Homes (NYSE:INVH) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

1 |

2 |

3 |

0 |

0 |

| Last 30D |

0 |

0 |

1 |

0 |

0 |

| 1M Ago |

0 |

0 |

1 |

0 |

0 |

| 2M Ago |

0 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

2 |

1 |

0 |

0 |

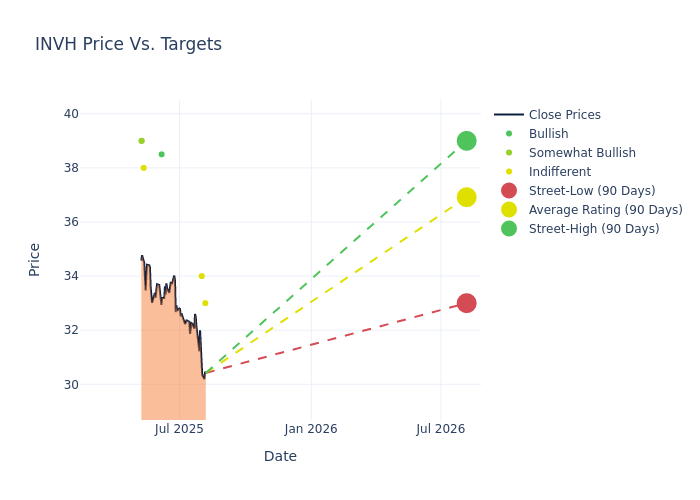

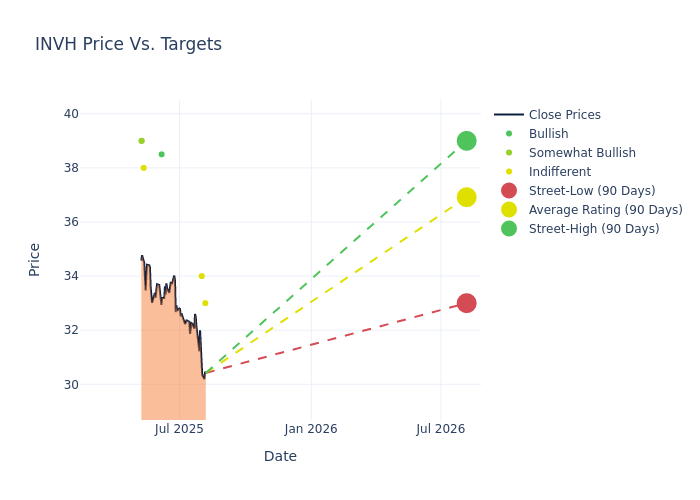

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $36.92, a high estimate of $39.00, and a low estimate of $33.00. This upward trend is apparent, with the current average reflecting a 2.56% increase from the previous average price target of $36.00.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Invitation Homes's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jade Rahmani |

Keefe, Bruyette & Woods |

Lowers |

Market Perform |

$33.00 |

$37.00 |

| Brad Heffern |

RBC Capital |

Lowers |

Sector Perform |

$34.00 |

$35.00 |

| Eric Wolfe |

Citigroup |

Raises |

Buy |

$38.50 |

$35.00 |

| Nicholas Yulico |

Scotiabank |

Raises |

Sector Perform |

$38.00 |

$36.00 |

| Buck Horne |

Raymond James |

Raises |

Outperform |

$39.00 |

$36.00 |

| Richard Hightower |

Barclays |

Raises |

Overweight |

$39.00 |

$37.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Invitation Homes. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Invitation Homes compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Invitation Homes's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Invitation Homes analyst ratings.

About Invitation Homes

Invitation Homes owns a portfolio of over 85,000 single-family rental homes. The company focuses on owning homes in the starter and move-up segments of the housing market with an average sale price around $350,000 and generally less than 1,800 square feet. The portfolio is spread across 17 target markets that feature high employment and household formation growth with almost 70% of the portfolio in the Western U.S. and Florida; 15 of the 17 markets featuring average rents lower than homeownership costs.

Financial Milestones: Invitation Homes's Journey

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Invitation Homes displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 4.28%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Invitation Homes's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 20.64%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 1.45%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Invitation Homes's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.76%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Invitation Homes's debt-to-equity ratio is below the industry average at 0.85, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: INVH