Deep Dive Into Halliburton Stock: Analyst Perspectives (12 Ratings)

Author: Benzinga Insights | August 20, 2025 03:01pm

Analysts' ratings for Halliburton (NYSE:HAL) over the last quarter vary from bullish to bearish, as provided by 12 analysts.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

3 |

3 |

6 |

0 |

0 |

| Last 30D |

1 |

0 |

1 |

0 |

0 |

| 1M Ago |

1 |

2 |

4 |

0 |

0 |

| 2M Ago |

1 |

0 |

1 |

0 |

0 |

| 3M Ago |

0 |

1 |

0 |

0 |

0 |

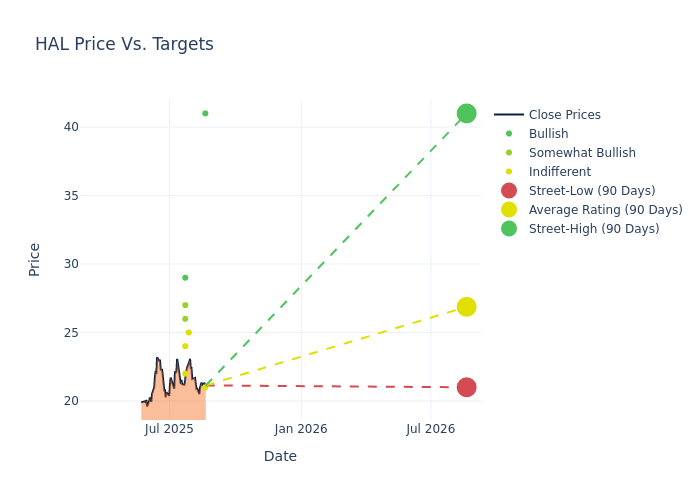

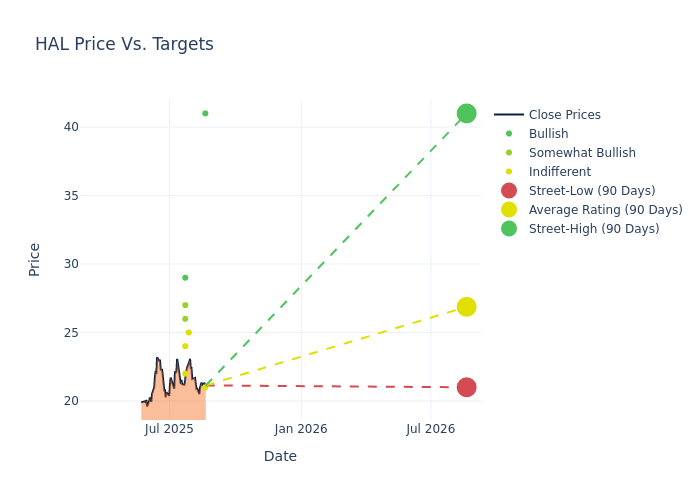

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $26.25, with a high estimate of $41.00 and a low estimate of $20.00. Experiencing a 0.42% decline, the current average is now lower than the previous average price target of $26.36.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive Halliburton is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Josh Silverstein |

UBS |

Raises |

Neutral |

$21.00 |

$20.00 |

| James West |

Melius Research |

Announces |

Buy |

$41.00 |

- |

| Derek Podhaizer |

Piper Sandler |

Maintains |

Neutral |

$25.00 |

$25.00 |

| Josh Silverstein |

UBS |

Lowers |

Neutral |

$20.00 |

$21.00 |

| Stephen Gengaro |

Stifel |

Lowers |

Buy |

$29.00 |

$31.00 |

| Keith Mackey |

RBC Capital |

Lowers |

Sector Perform |

$24.00 |

$28.00 |

| Charles Minervino |

Susquehanna |

Lowers |

Positive |

$27.00 |

$30.00 |

| Roger Read |

Wells Fargo |

Lowers |

Overweight |

$26.00 |

$28.00 |

| David Anderson |

Barclays |

Lowers |

Equal-Weight |

$22.00 |

$26.00 |

| Stephen Gengaro |

Stifel |

Lowers |

Buy |

$31.00 |

$32.00 |

| Josh Silverstein |

UBS |

Lowers |

Neutral |

$21.00 |

$22.00 |

| Roger Read |

Wells Fargo |

Raises |

Overweight |

$28.00 |

$27.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Halliburton. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Halliburton compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Halliburton's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Halliburton's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Halliburton analyst ratings.

Get to Know Halliburton Better

Halliburton is North America's largest oilfield service company as measured by market share. Despite industry fragmentation, it holds a leading position in the hydraulic fracturing and completions market, which makes up nearly half of its revenue. It also holds strong positions in other service offerings like drilling and completions fluids, which leverages its expertise in material science, as well as the directional drilling market. While we consider SLB the global leader in reservoir evaluation, we think Halliburton leads in any activity from the reservoir to the wellbore. The firm's innovations have helped multiple producers lower their development costs per barrel of oil equivalent, with techniques that have been homed in over a century of operations.

Unraveling the Financial Story of Halliburton

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Challenges: Halliburton's revenue growth over 3M faced difficulties. As of 30 June, 2025, the company experienced a decline of approximately -5.54%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Energy sector.

Net Margin: Halliburton's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.57% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.52%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Halliburton's ROA excels beyond industry benchmarks, reaching 1.87%. This signifies efficient management of assets and strong financial health.

Debt Management: With a high debt-to-equity ratio of 0.81, Halliburton faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: HAL