DexCom Stock: A Deep Dive Into Analyst Perspectives (11 Ratings)

Author: Benzinga Insights | August 21, 2025 02:00pm

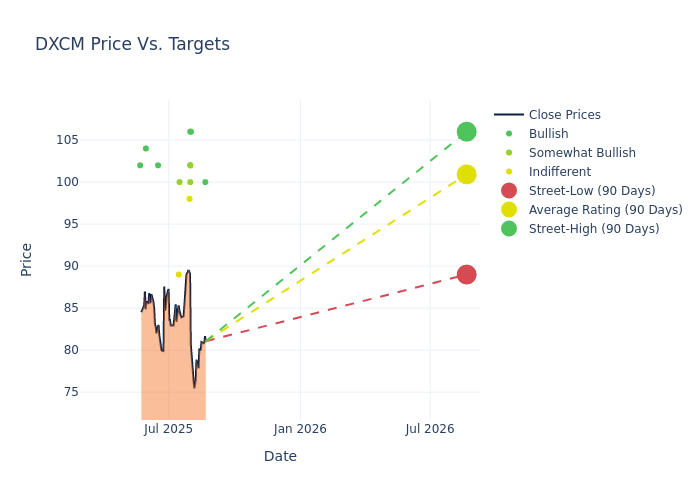

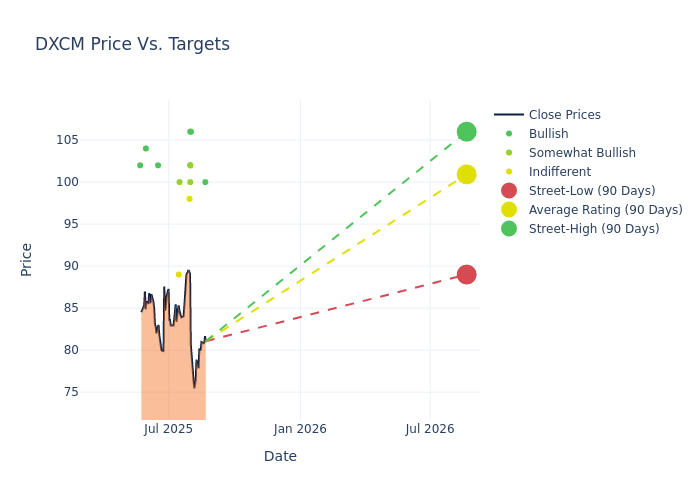

11 analysts have expressed a variety of opinions on DexCom (NASDAQ:DXCM) over the past quarter, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

6 |

3 |

2 |

0 |

0 |

| Last 30D |

1 |

0 |

0 |

0 |

0 |

| 1M Ago |

3 |

2 |

1 |

0 |

0 |

| 2M Ago |

0 |

1 |

1 |

0 |

0 |

| 3M Ago |

2 |

0 |

0 |

0 |

0 |

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $100.82, with a high estimate of $106.00 and a low estimate of $89.00. Observing a 5.44% increase, the current average has risen from the previous average price target of $95.62.

Deciphering Analyst Ratings: An In-Depth Analysis

The standing of DexCom among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Steve Silver |

Argus Research |

Announces |

Buy |

$100.00 |

- |

| William Plovanic |

Canaccord Genuity |

Maintains |

Buy |

$106.00 |

$106.00 |

| Jayson Bedford |

Raymond James |

Raises |

Strong Buy |

$102.00 |

$99.00 |

| Matt O'Brien |

Piper Sandler |

Raises |

Overweight |

$100.00 |

$90.00 |

| Danielle Antalffy |

UBS |

Raises |

Buy |

$106.00 |

$105.00 |

| Steven Lichtman |

Oppenheimer |

Raises |

Outperform |

$102.00 |

$95.00 |

| Matt Miksic |

Barclays |

Raises |

Equal-Weight |

$98.00 |

$93.00 |

| Anthony Petrone |

Mizuho |

Raises |

Outperform |

$100.00 |

$95.00 |

| Patrick Wood |

Morgan Stanley |

Raises |

Equal-Weight |

$89.00 |

$82.00 |

| Richard Newitter |

Truist Securities |

Announces |

Buy |

$102.00 |

- |

| Kate McShane |

Goldman Sachs |

Announces |

Buy |

$104.00 |

- |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to DexCom. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of DexCom compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for DexCom's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Capture valuable insights into DexCom's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on DexCom analyst ratings.

Get to Know DexCom Better

DexCom designs and commercializes continuous glucose monitoring systems for diabetic patients. CGM systems serve as an alternative to the traditional blood glucose meter process, and the company is evolving its CGM systems to provide integration with insulin pumps from Insulet and Tandem for automatic insulin delivery.

DexCom's Economic Impact: An Analysis

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: DexCom's remarkable performance in 3M is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 15.21%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: DexCom's net margin excels beyond industry benchmarks, reaching 15.54%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): DexCom's ROE excels beyond industry benchmarks, reaching 7.43%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): DexCom's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.55% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: DexCom's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.0, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: DXCM