Beyond The Numbers: 6 Analysts Discuss Phreesia Stock

Author: Benzinga Insights | September 05, 2025 08:01am

Phreesia (NYSE:PHR) underwent analysis by 6 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

4 |

0 |

0 |

0 |

| Last 30D |

2 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

2 |

0 |

0 |

0 |

| 2M Ago |

0 |

1 |

0 |

0 |

0 |

| 3M Ago |

0 |

0 |

0 |

0 |

0 |

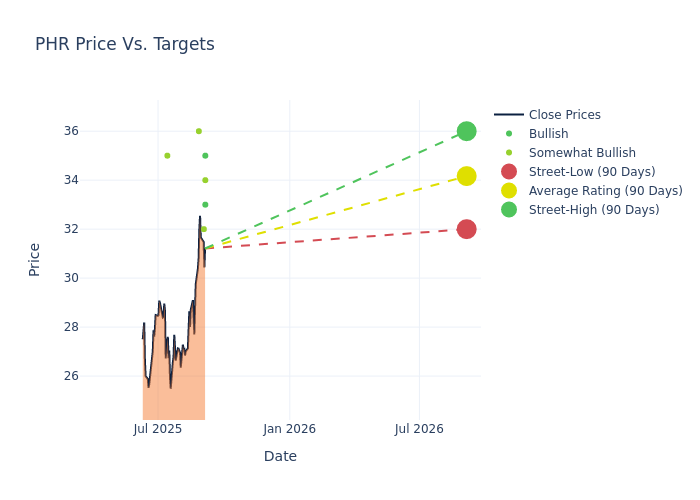

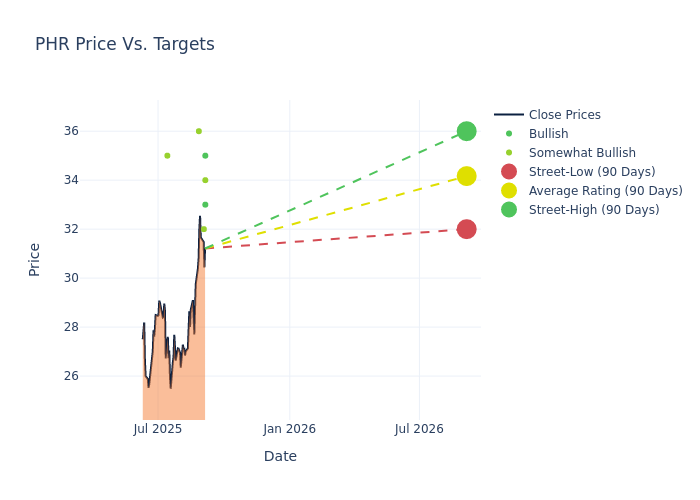

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $34.17, with a high estimate of $36.00 and a low estimate of $32.00. This current average has increased by 12.03% from the previous average price target of $30.50.

Decoding Analyst Ratings: A Detailed Look

The standing of Phreesia among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Jessica Tassan |

Piper Sandler |

Raises |

Overweight |

$34.00 |

$33.00 |

| Lucky Schreiner |

DA Davidson |

Announces |

Buy |

$33.00 |

- |

| Ryan MacDonald |

Needham |

Raises |

Buy |

$35.00 |

$29.00 |

| Jeff Garro |

Stephens & Co. |

Maintains |

Overweight |

$32.00 |

$32.00 |

| Steven Valiquette |

Mizuho |

Announces |

Outperform |

$36.00 |

- |

| Aleksey Yefremov |

Keybanc |

Raises |

Overweight |

$35.00 |

$28.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Phreesia. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Phreesia compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Phreesia's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Phreesia's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Phreesia analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Unveiling the Story Behind Phreesia

Phreesia Inc is a provider of comprehensive software solutions that improve the operational and financial performance of healthcare organizations by activating patients in their care to optimize patient health outcomes. Through its SaaS-based technology platform, it offers healthcare services clients a robust suite of integrated solutions that manage patient access, registration, payments, and clinical support. The Phreesia Platform encompasses a comprehensive range of technologies and services, including, initial patient contact, registration, automated answering services, appointment scheduling, payments, and post-appointment patient surveys.

Financial Insights: Phreesia

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Phreesia's remarkable performance in 3M is evident. As of 30 April, 2025, the company achieved an impressive revenue growth rate of 14.54%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Phreesia's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -3.38% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Phreesia's ROE excels beyond industry benchmarks, reaching -1.43%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Phreesia's ROA stands out, surpassing industry averages. With an impressive ROA of -0.99%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Phreesia's debt-to-equity ratio is below the industry average. With a ratio of 0.06, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: PHR