4 Analysts Assess Waystar Holding: What You Need To Know

Author: Benzinga Insights | September 05, 2025 09:01am

During the last three months, 4 analysts shared their evaluations of Waystar Holding (NASDAQ:WAY), revealing diverse outlooks from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

|

Bullish |

Somewhat Bullish |

Indifferent |

Somewhat Bearish |

Bearish |

| Total Ratings |

2 |

2 |

0 |

0 |

0 |

| Last 30D |

0 |

1 |

0 |

0 |

0 |

| 1M Ago |

0 |

0 |

0 |

0 |

0 |

| 2M Ago |

1 |

0 |

0 |

0 |

0 |

| 3M Ago |

1 |

1 |

0 |

0 |

0 |

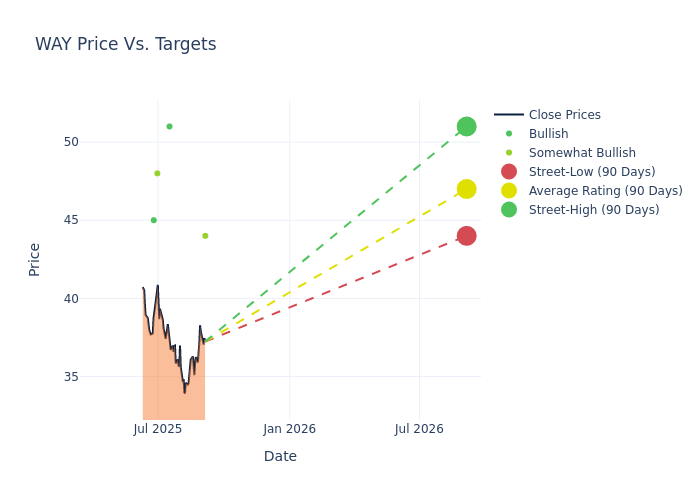

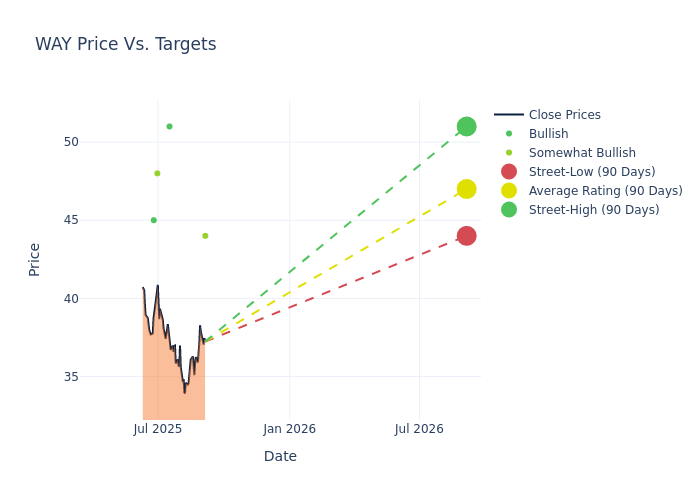

In the assessment of 12-month price targets, analysts unveil insights for Waystar Holding, presenting an average target of $47.0, a high estimate of $51.00, and a low estimate of $44.00. Highlighting a 6.0% decrease, the current average has fallen from the previous average price target of $50.00.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Waystar Holding. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst |

Analyst Firm |

Action Taken |

Rating |

Current Price Target |

Prior Price Target |

| Vikram Kesavabhotla |

Baird |

Announces |

Outperform |

$44.00 |

- |

| Jailendra Singh |

Truist Securities |

Raises |

Buy |

$51.00 |

$50.00 |

| Steven Valiquette |

Mizuho |

Announces |

Outperform |

$48.00 |

- |

| Daniel Grosslight |

Citigroup |

Announces |

Buy |

$45.00 |

- |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Waystar Holding. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Waystar Holding compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Waystar Holding's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Waystar Holding's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Waystar Holding analyst ratings.

Delving into Waystar Holding's Background

Waystar Holding Corp is a provider of mission-critical cloud technology to healthcare organizations. its enterprise-grade platform transforms the complex and disparate processes comprising healthcare payments received by healthcare providers from payers and patients, from pre-service engagement through post-service remittance and reconciliation. its platform enhances data integrity, eliminates manual tasks, and improves claim and billing accuracy, which results in transparency, reduced labor costs, and faster, more accurate reimbursement and cash flow. The market for solutions extends throughout the United States and includes Puerto Rico and other USA Territories.

Understanding the Numbers: Waystar Holding's Finances

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Positive Revenue Trend: Examining Waystar Holding's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 15.4% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 11.89%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Waystar Holding's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.02% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Waystar Holding's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.69%, the company showcases efficient use of assets and strong financial health.

Debt Management: Waystar Holding's debt-to-equity ratio stands notably higher than the industry average, reaching 0.4. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Posted In: WAY